In late May, November 2024 soybean futures peaked at a price point of $12.28. Two days later the daily November 2024 Soybean Futures chart flashed a bearish key reversal, signaling a potential short-term top was at hand.

What’s happened

Coming back from the Memorial Day Holiday weekend, while weather forecasts for spring planting were not perfect, windows of opportunity opened to get the soybean crop planted in many portions of the Midwest over the weekend. Planting wasn’t perfect, and much of it was “mudded in.”

The weekly crop progress report showed that soybean planting progress was mostly on track with the five-year average. Traders took that news and then assumed that the entire U.S. crop would be planted on time, and the adage of “rain makes grain” fueled a price sell off.

Soybean futures then lost 75 cents in a matter of six business days as traders took heed to the technical price warning and exited long positions. As prices fell lower, sell stops were triggered under the market, exasperating the quick price sell off.

There’s just one problem. The last of the beans in Minnesota and North Dakota are struggling to get planted, and the world does not understand how significant a potential problem this may be.

From a marketing perspective

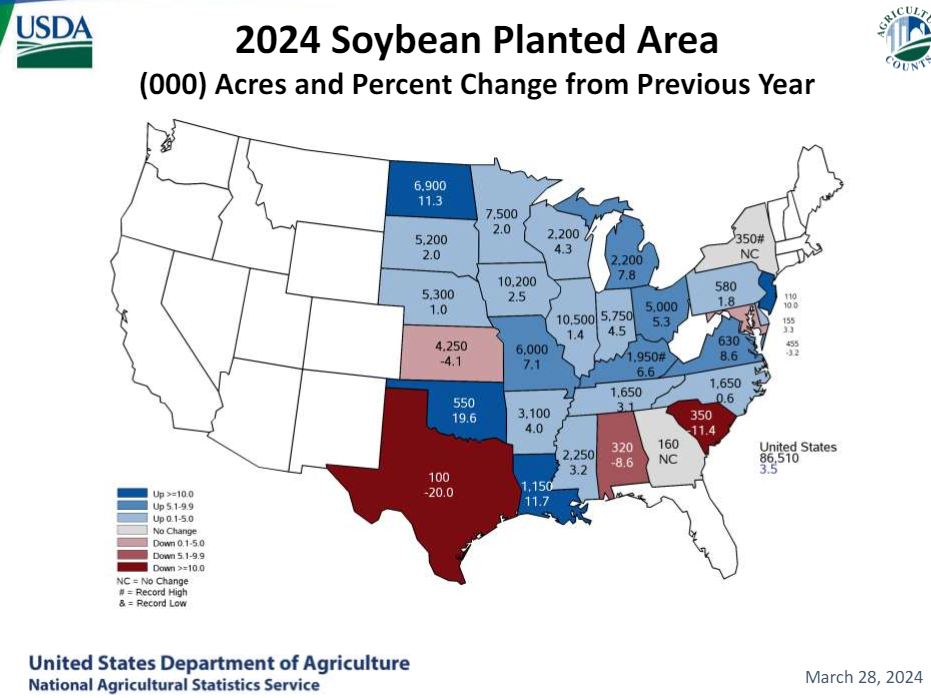

According to the March 28 Prospective planting report, Illinois is expected to plant the most soybeans in the United States this spring with 10.5 million acres expected to go into the ground. Iowa is next with 10.2 million acres of soybeans expected to be planted this spring. Minnesota is the third largest, with 7.5 million acres expected to be planted this spring with North Dakota coming in fourth with 6.9 million acres of soybeans expected to be planted.

The June 3, 2024, weekly crop progress report from the USDA, based on June 2 estimates, said 20% of the soybeans in Minnesota were not yet planted and 34% of the soybeans in North Dakota were not yet planted.

Twenty percent of 7.5 million acres planned for Minnesota means that 1.5 million acres of soybeans still need to be planted. Thirty-four percent of 6.9 million acres in North Dakota means that 2.3 million acres of soybeans still need to be planted.

Combined, that is nearly 4 million acres of soybeans that need to be planted.

Now you may think, “Oh, those farmers will mud it in, and that crop will get planted.” But will they? Already saturated field conditions in those two states with more rain in the forecast will likely keep the planting progression on the slow side for the June 10 crop progress report.

With the final planting deadline for crop insurance coming up next week, plenty of producers are contemplating taking prevent plant, and NOT planting those final soybean acres.

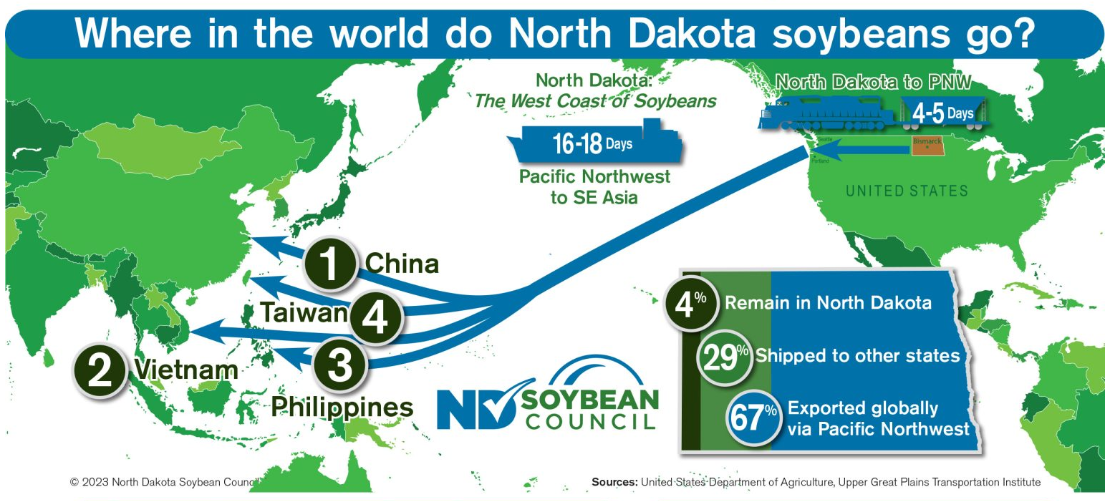

Why does it matter? These are the soybeans that get exported to Asia via the Pacific Northwest. According to the North Dakota Soybean Council website, a whopping 67% of the soybeans grown in North Dakota get exported out the Pacific Northwest to China, Taiwan, Vietnam and the Philippines.

According to the Minnesota Soybean Council website, 30% of soybeans grown in Minnesota are exported to the world. The majority of those exported move via the Pacific Northwest, with some sent by barge down the Mississippi River to the Gulf of Mexico.

Prepare yourself

Right now, traders seem to feel that those near 4 million acres of soybeans in Minnesota and North Dakota will get planted, and there seems to be little-to-no weather premium in the November 2024 soybean futures price.

The May 2024 USDA WASDE report said that for the 2024-‘25 crop year, an estimated 86.5 million acres of soybeans will be planted this spring (up from 83.6 million last year).

According to the May 2024 USDA report, if those 86.5 million acres of soybean do get planted, and if weather is decent this summer, then U.S. soybean ending stocks will increase to 445 million bushels, up from 340 million bushels this past year. That likely will weigh on soybean prices.

However, if those 4 million or so acres in Minnesota and North Dakota do not get planted, then U.S. ending stocks will likely go back below 300 million bushels for the 2024- ‘25 crop year, which would be supportive for prices.

All eyes are on you, Minnesota and North Dakota farmers. The ball is in your court and Mother Nature is your opponent.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.