Fuel tanks are tapped and fertilizer bunkers emptied – and it’s time for refills. From propane for drying crops this fall to supplies for 2025 production, buying season is here.

Summer months that begin with “J” are typically good times for purchasing these essential inputs, for a reason better than alliteration: Your neighbors aren’t in the market. Indeed, the last thing a business’s cash flow needs after spending hundreds per acre to put the crop in the ground is laying out even more – especially when growing fields won’t generate any income until harvest at the earliest.

To be sure, most wholesale costs are down 15% to 25% or more from year-ago levels. But they aren’t exactly cheap, either. Agriculture like everyone else still feels the effect of inflation that’s been “sticky” to say the least. While costs have stabilized, that doesn’t mean they have to stay that way. An old adage says the longer the trading range, the more violent the move when prices do break out – but that could be either higher or lower.

So, should you hold off on buying and wait for the fog to clear? Here’s a look at where markets are, and where they could be going.

Check supply chain

If your dealers have yet to post summer fill prices, local spot prices – if listed at all – may be well out of date. That alone makes action on international markets significant. Where you sit on the supply chain can determine how most costs increase over those wholesale levels. And because that supply chain can break down without warning, what you see may not be what you actually get at delivery.

Costs for moving inputs into position on barges, rail and trucks is one consideration. High or low water can cause sudden changes in barge freight rates, but early June water levels on the Mississippi are fairly normal. Many segments are above flood stage, but not seriously so, though some restrictions force shippers to modestly reduce the number of barges on tows, which raises costs. Repairs will close some locks longer, but work-arounds usually limit impacts. The same holds true for areas with dredging activity.

Export demand is another prime factor influencing transportation costs. The shipping season is winding down, but recent activity is decent, elevating barge rates a little. But rates for September slots are well below 2023 and the few offers for rail forwards are also down. Fuel prices are part of this equation and diesel is also cheaper.

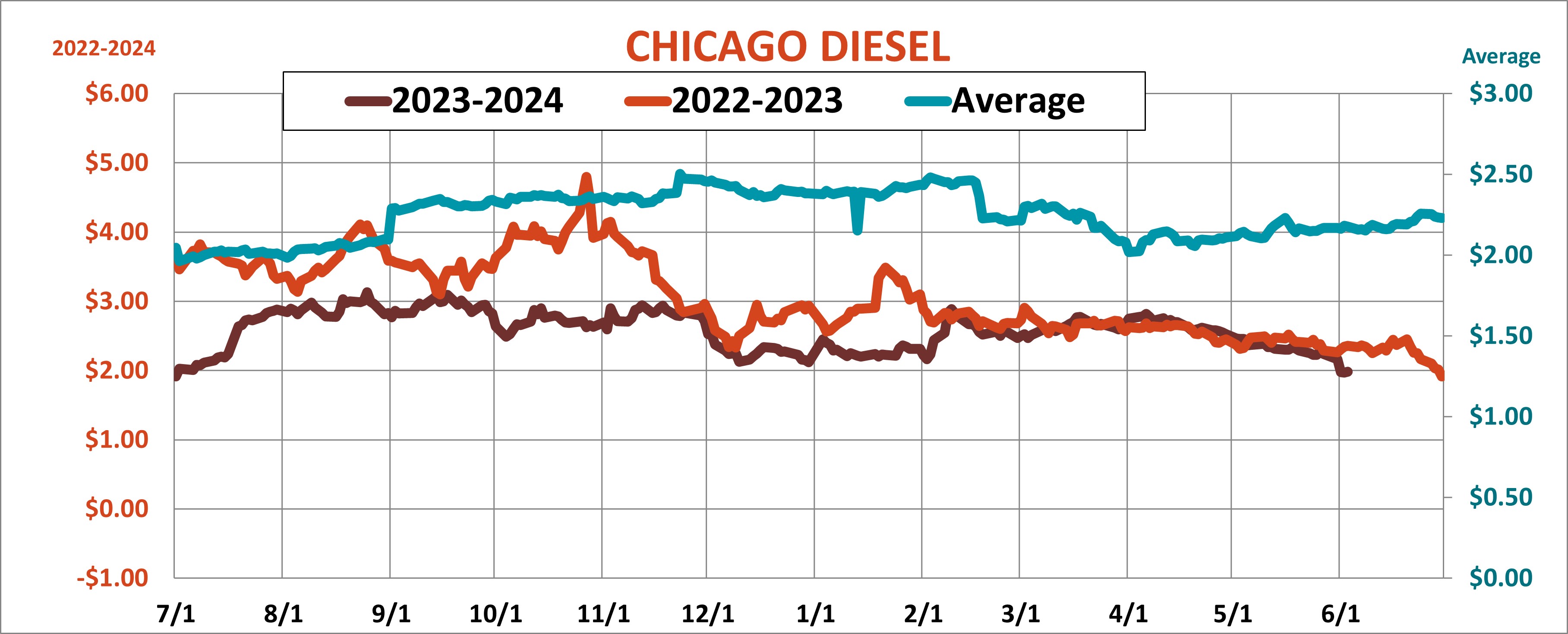

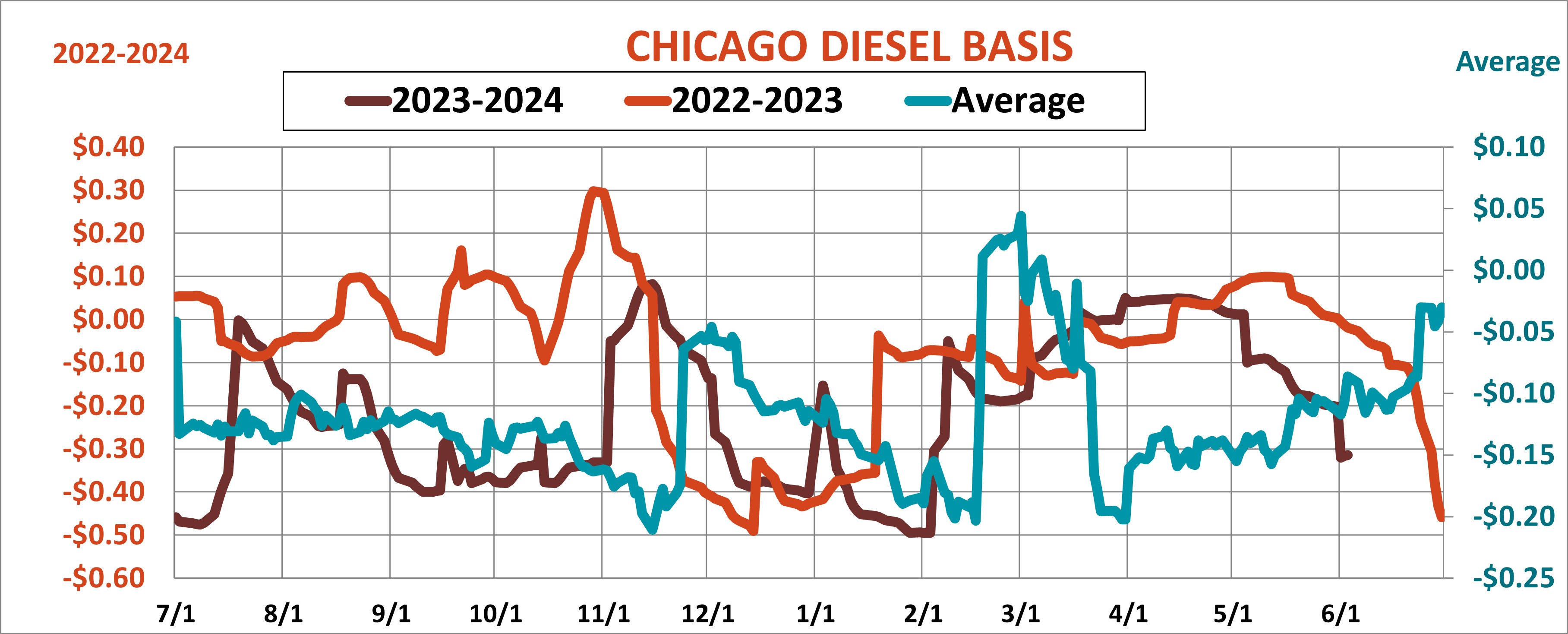

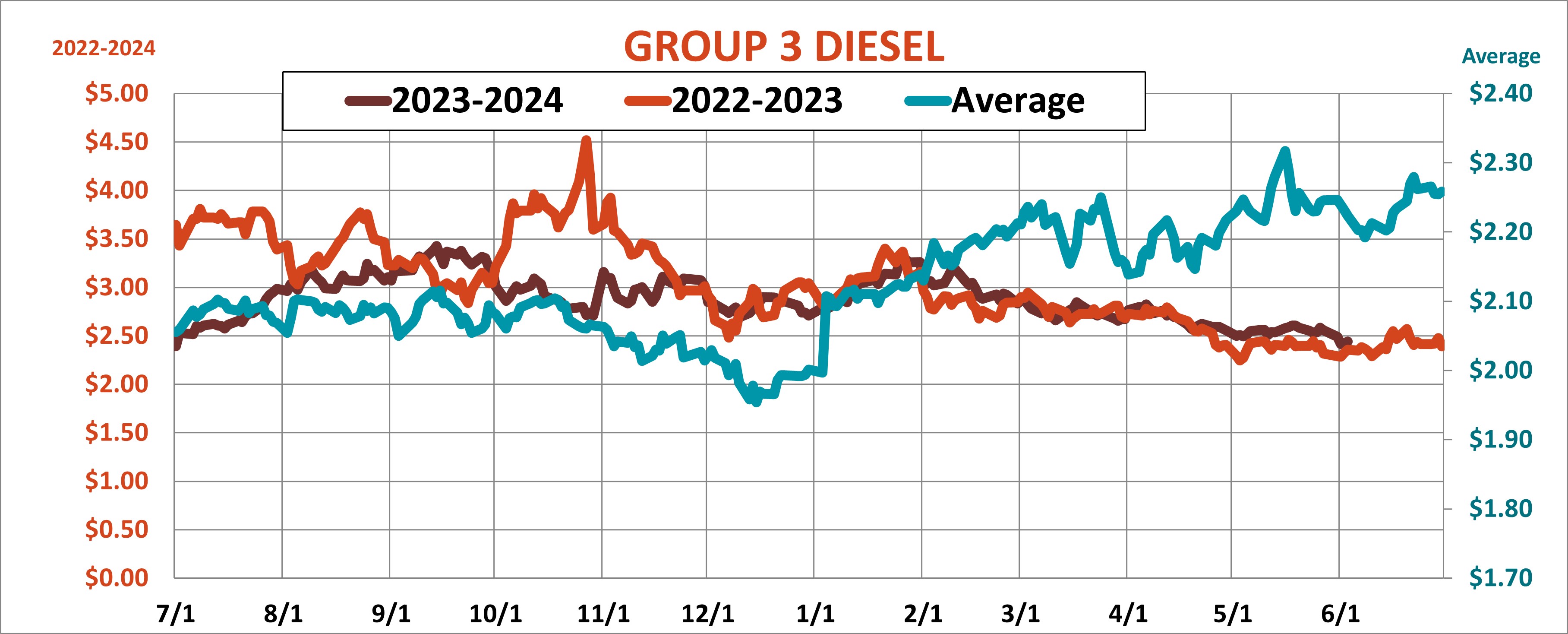

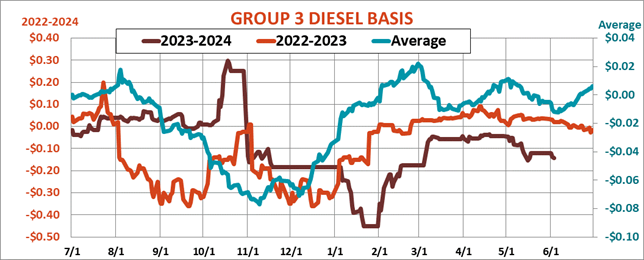

Declining diesel prices are the norm for this time of season because agricultural use is the swing factor in demand. Farmers burn more during the spring planting and fall harvest months. But when equipment is parked, the difference between ULSD futures delivered in New York Harbor and rural cash prices tends to widen out, weakening basis.

Where your fuel originates also matters, though the two Midwest benchmarks are steady to a little lower than last year. Supplies off the Chicago price are a little cheaper than last year, trends between the two years are similar, and basis is weak, another buying signal.

In addition to agriculture, the cost of crude used to refine diesel also matters. West Texas Intermediate traded around $75 a barrel at the end of last week. After softening to the lowest since February on potential for OPEC and its allies to begin increasing production next year, prices turned around a few bucks. Those gains held despite a surprising monthly employment report that showed more new jobs created in May than expected and a tick higher on the jobless rate.

Watch Fed meeting fireworks

Still, news the economy wasn’t falling apart dashed hopes the Federal Reserve will cut the benchmark Federal Funds rate on June 12, the end of its next two-day meeting, when it releases an updated statement on monetary policy. Hours before that print another Consumer Price Index comes out, and participants in the Fed meeting also release their own forecasts for rates, inflation, economic growth and unemployment. These “Dots” provide clues about whether the Fed’s first cut will come in September and be followed by another, after the election, in December.

No break in the ag rate cloud

In either case, farmers should expect ag rates to stay mostly where they are until the dam breaks one way or the other, keeping financing costs high. The CCC rate for June is 6.125%, just three quarters of 1% above Federal Funds.

The outlook for interest rates helped stem selling in the U.S. dollar. Higher rates in a country tend to support its currency, luring investors to earn a higher return for their cash. Currency values can also filter into the fertilizer market. A country with a weaker currency against the greenback may be less able to afford imports.

Foreign buyers face other obstacles, from uncertain supplies out of Ukraine and the rest of the Former Soviet Union to questions about China’s role in the trade and whether some plants in Europe may stop production due to shortages of natural gas, the primary feedstock for nitrogen-based fertilizers.

Exporters face resistance from their own governments, which may restrict sales abroad to keep supplies at home. Nitrogen is in the crosshairs for these currents. Urea out of the Middle East rose 20% in May as searing heat in Egypt decreased production prospects just as China appeared ready to limit exports this summer after its own planting time sales restrictions end. Production cuts in the Caribbean are also supporting nitrogen prices, along with demand news. India is starting to buy again while corn prices, which are below break-even in the U.S., will influence what growers here do.

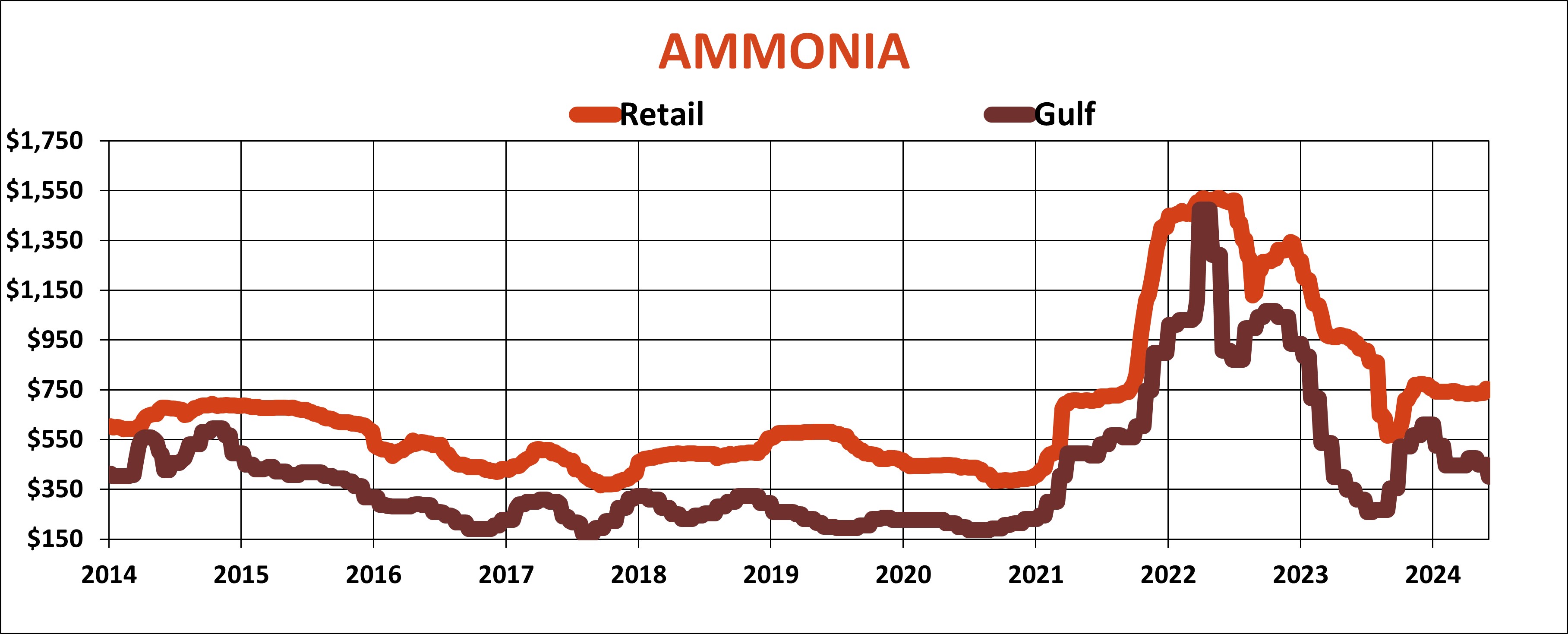

While that debate rages, the market is speaking a little about chances for bargains. Ammonia swaps for June at the Gulf settled lower around $365 a short ton. Given historical margins that translates to $650 at retail, or around $65 to $100 higher than prices ended the application season this year.

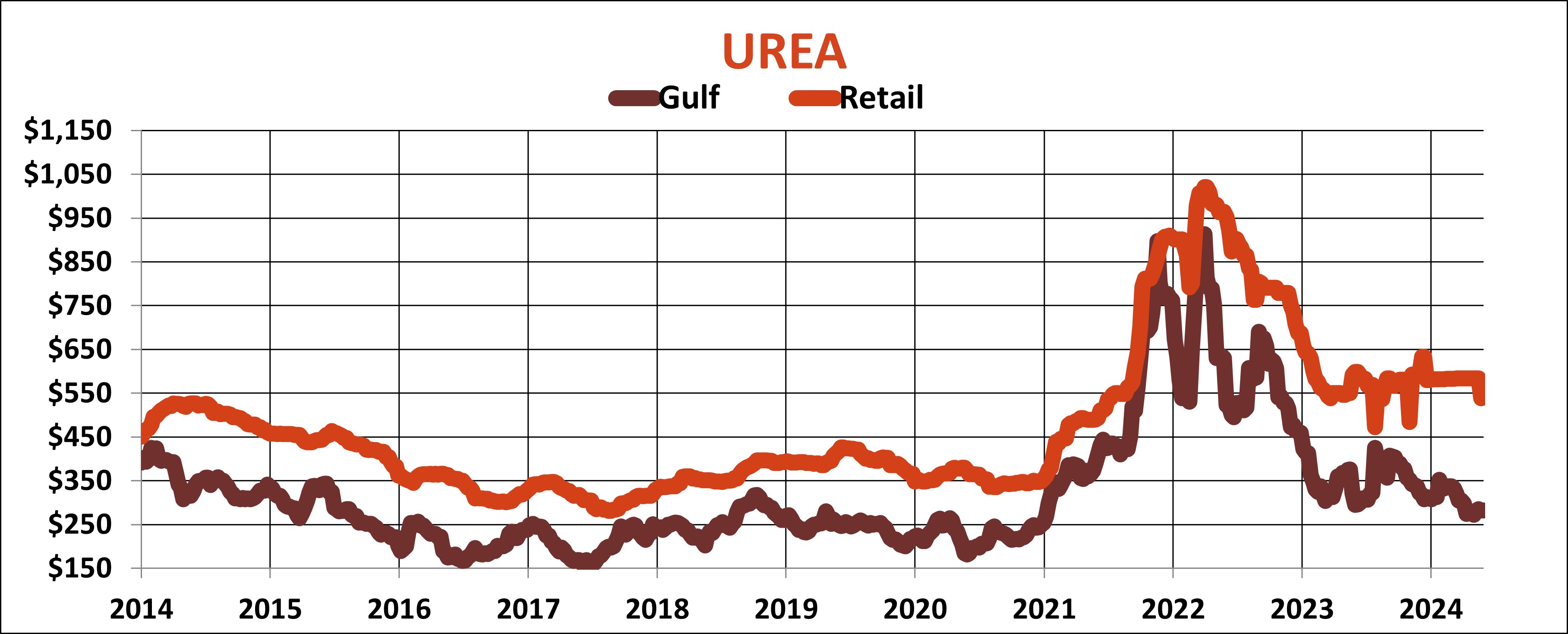

Urea swaps for summer and fall-winter are $25 to $30 higher than the spot market, which could be another target for those seeking to calibrate local offers and lock in a price for 2025 application.

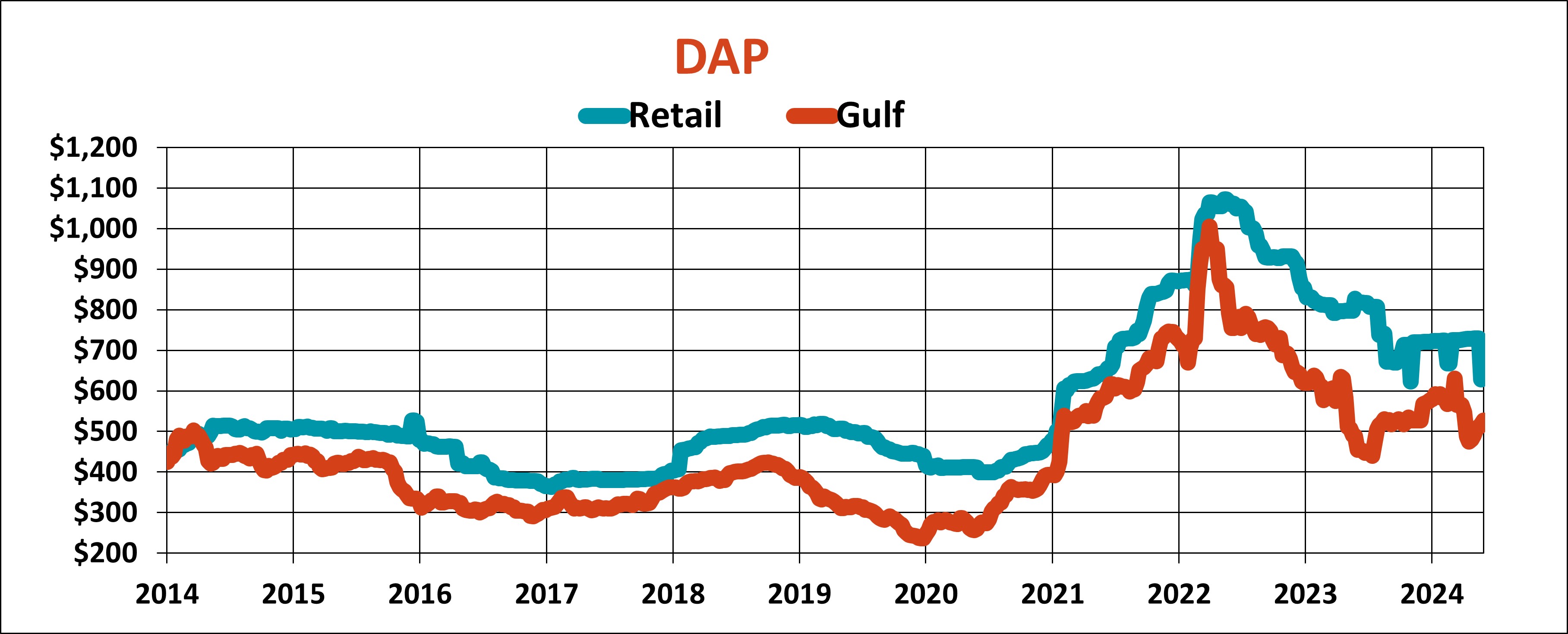

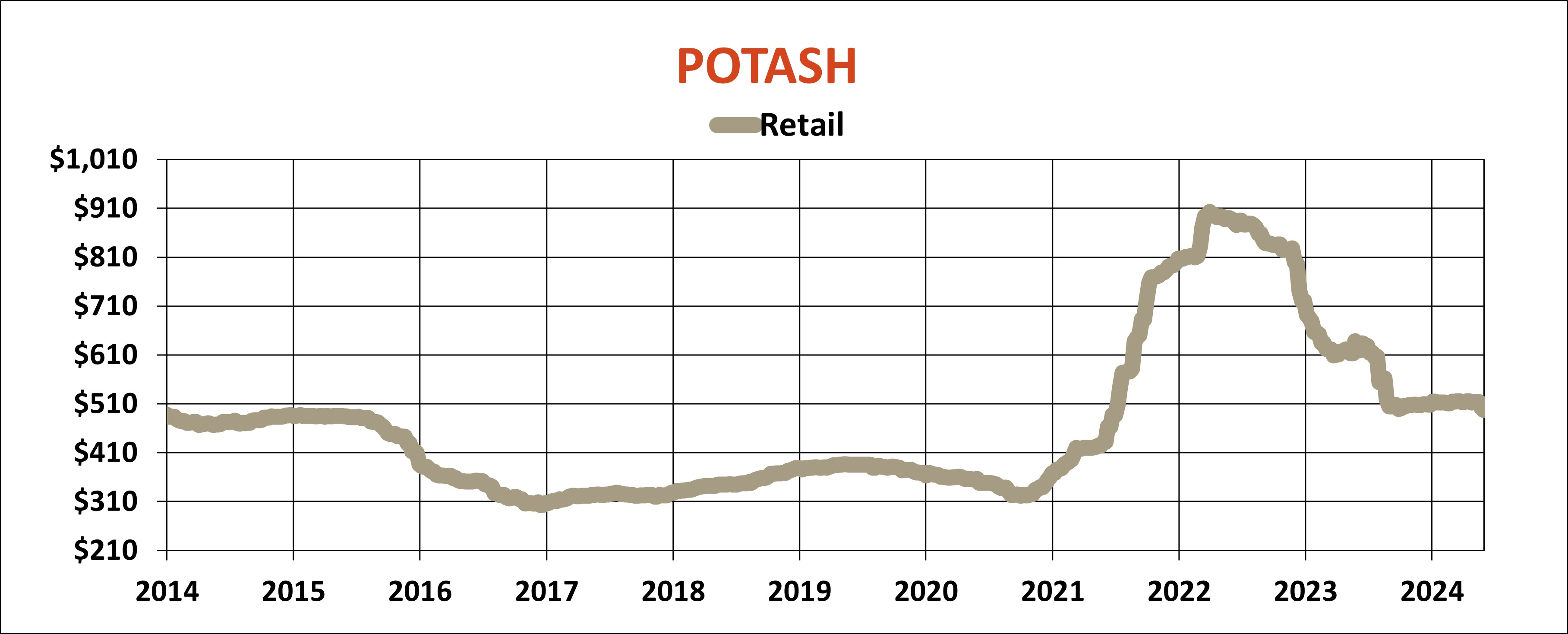

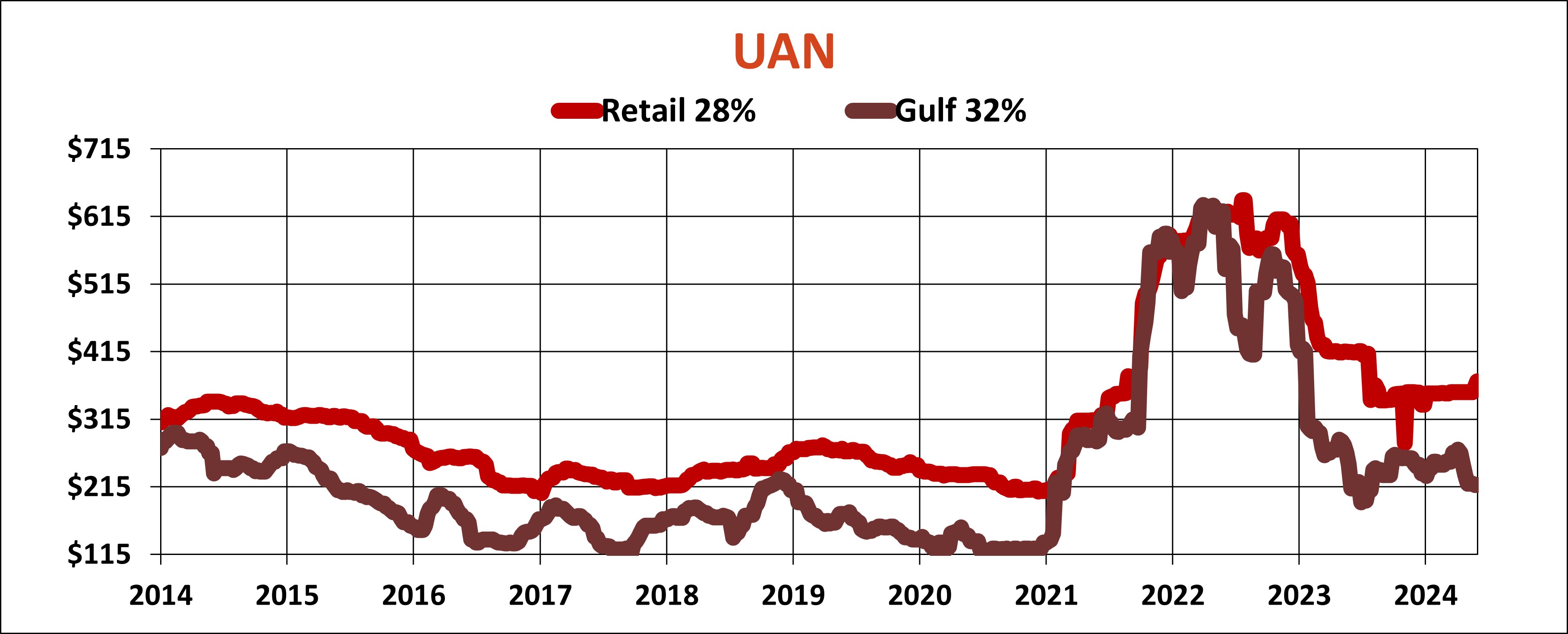

Phosphate is also starting to firm, with summer costs out of the Gulf for DAP running around $30 higher than the $500 spot level. But like the rest of the complex, a holding pattern prevails thanks in part to questions about tariffs on Russian exports and sales out of the Black Sea. This certainly is true for potash, which flatlined at retail after the 27% drop from last June.

Propane lacks heat

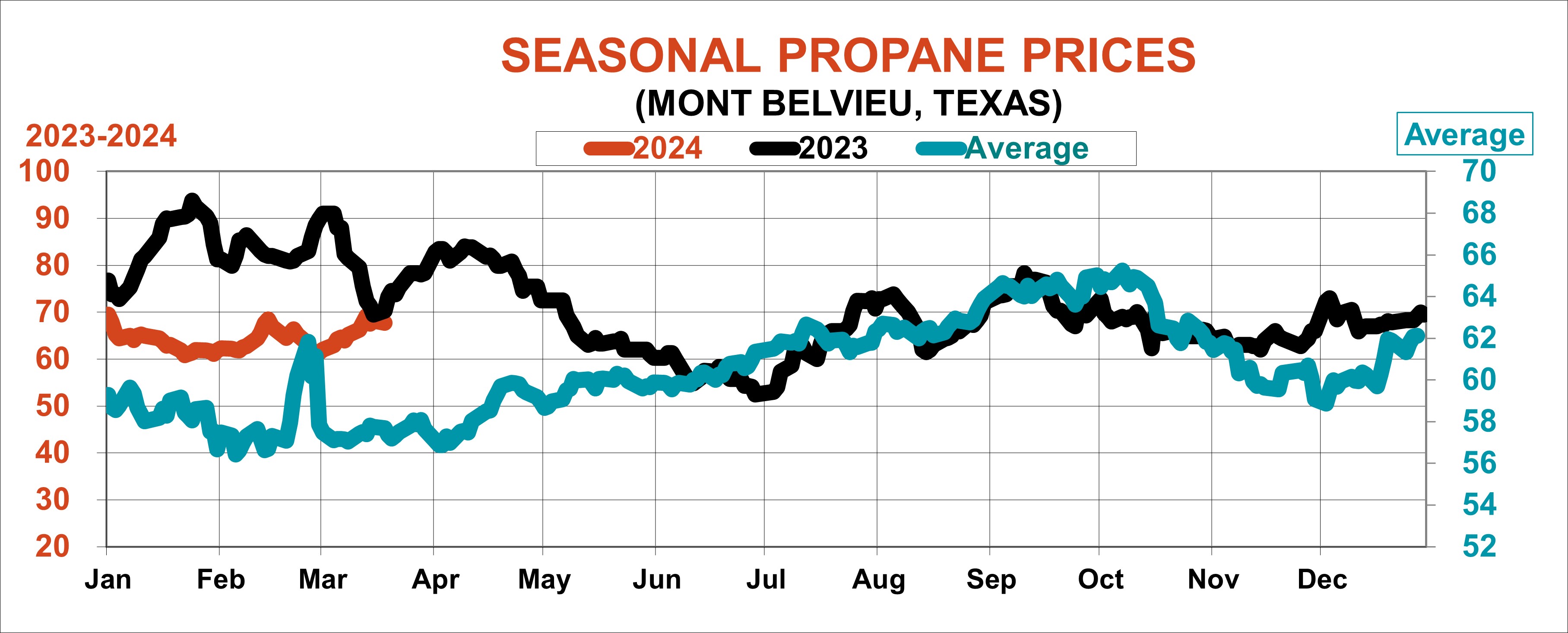

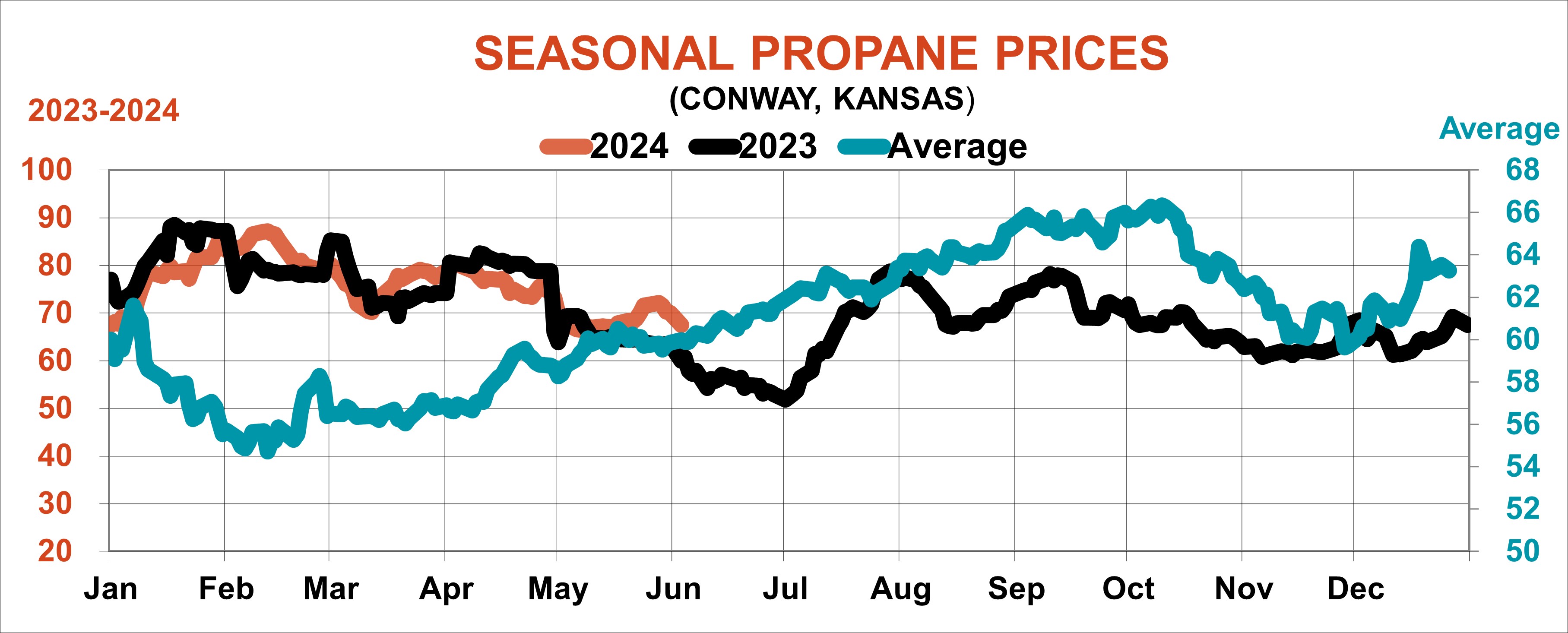

While growers may not be ready to spend on nutrients yet, time is more of the essence for fall drying fuel. Over the long-haul, propane tracks crude oil due to heating demand. But this relationship breaks down in spring. Crude oil starts to firm into the summer driving season on gasoline usage while the end of the heating season begins to increase fuel oil supply as propane demand dries up.

On average, this means the end of winter and beginning of spring can be the best time to book fall needs, though the market can stay weak into summer if broader financial markets drag commodities lower along with Wall Street indexes. Propane weakened last year into July, taking wholesale benchmarks to three-year lows. Whether that happens this year depends on the Fed, Ukraine, election jitters and any new black swans that come out of the woodwork. Midwest benchmarks traded below 70 cents a gallon last week with on-farm delivered costs some 85 cents to $1.50 higher.