No news may be a nightmare for headline writers, but “steady as she goes” meant mostly sweet dreams for markets from stocks to soybeans last week. Both the Federal Reserve and USDA left benchmark measures unchanged for interest rates and 2024 crop stocks, helping insulate prices from downside pressure.

Markets made it through a swamp of conflicting data without getting stuck in the muck. Stock markets around the world set new all-time highs despite another Consumer Price Index print showing falling but persistent inflation and a tick higher in unemployment as more workers file unemployment compensation claims.

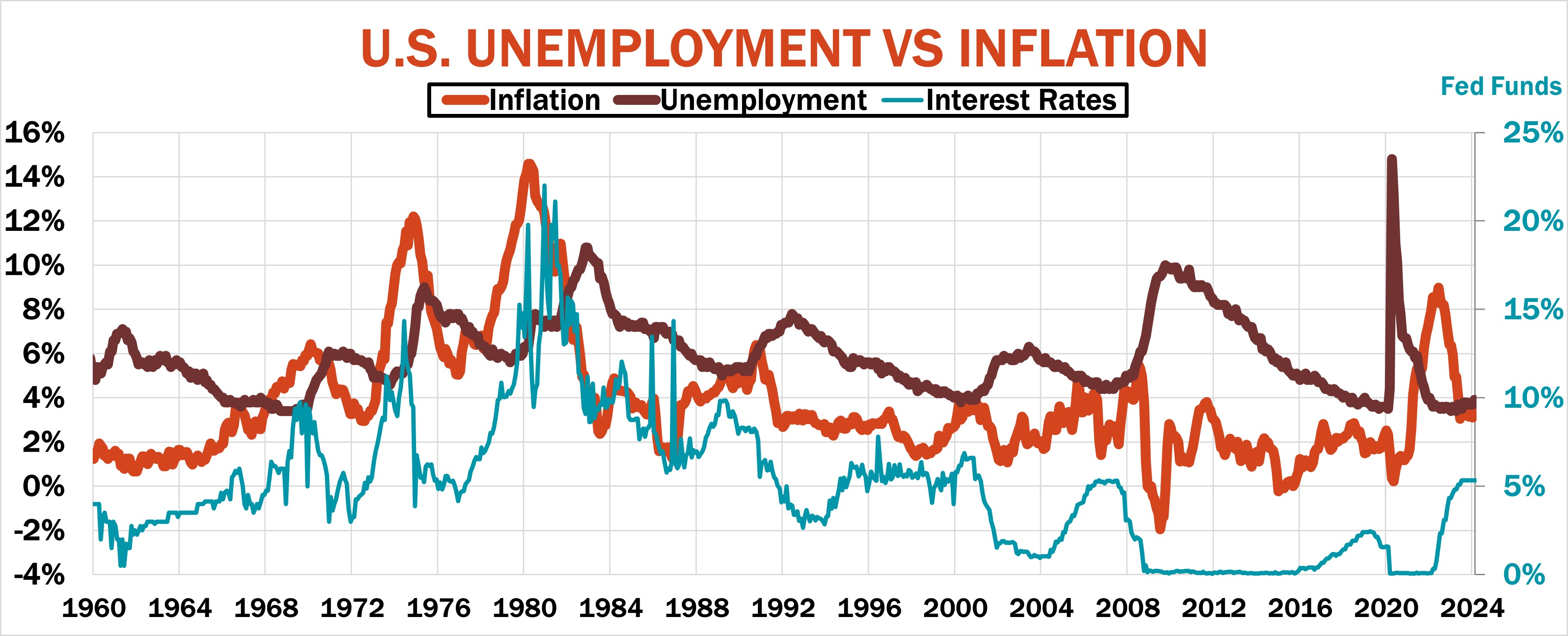

Still, Fed officials appear to believe the current tightening cycle has peaked. While the “dots” from their Summary of Economic projections indicated slightly higher unemployment and interest rates will persist into 2026, when 2.8% short-term interest rates and 4.2% unemployment would still be relatively benign. That’s a far cry from the “stagflation” suffered in the 1970s and 1980s.

WASDE answers lingering questions

Economic data undergoes a relentless series of adjustments, so investors normally try not to sweat “the small stuff.” But small stuff is the lifeblood of traders, and that’s where the grain market can be difficult. USDA, of course, revises its World Agricultural Supply and Demand Estimates every month. Most months these revisions are minor or nonexistent, but any differences from market expectation can trigger moves – or not.

Two questions lingered ahead of the June 12 WASDE.

- The first was estimates for supplies left over at the end of the 2023-2024 marketing year on Aug. 31.

- New Crop. New crop production, the other question in the market, along with projected imports form total supplies available for the 2024-2025 marketing year – new crop.

The average of trade guesses into the WASDE showed small increases in old crop soybean stocks and that’s what happened, a little. Slightly weaker crush flowed through to the new crop bottom line, which rose to 350 million bushels, while the bets for old and new crop corn both leaned toward modest reductions in carryout.

Forecasted yield trend

The dice roll for traders was whether late corn planting would convince the agency to lower its projection for a weather-adjusted “trend” yield. Last fall USDA begin plugging a 181-bushel-per-acre yield into its new crop forecasts, and that didn’t change in the June 12 WASDE. Planting was later than normal in key states, perhaps taking the top end off a bumper harvest. But delays weren’t bad enough to have a significant impact – yet.

Goodbye, El Nino

Corn and soybeans didn’t follow the S&P to new highs, but futures did maintain recent ranges, a moral victory considering a bearish break lower might have triggered more liquidation. That sets the stage for potential weather rallies if the market starts to fret about the impact of hot, dry weather on crops.

Corn yields presumably would feel the brunt of weather first. June stress, Mid-May planting progress and July rainfall and precipitation are a good guide to corn production, and this helps explain why updated forecast maps out Friday afternoons can be important.

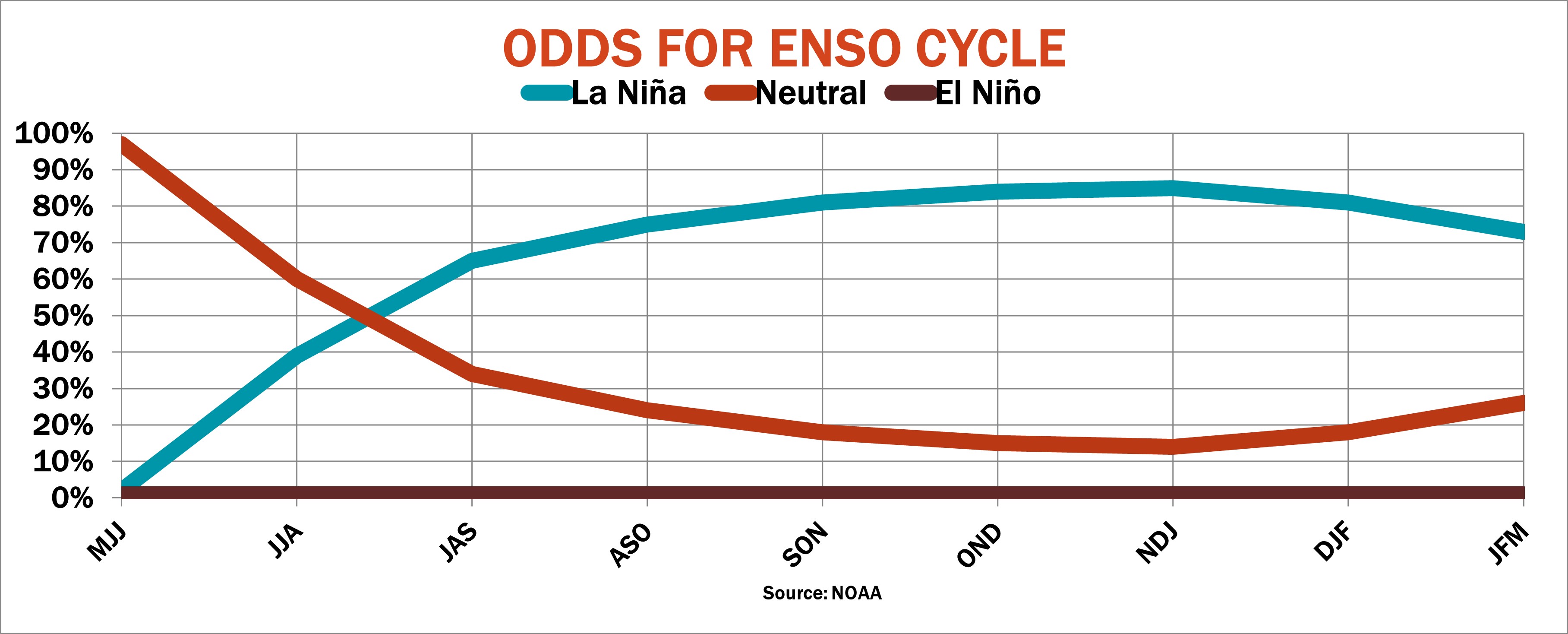

Planting progress isn’t a major factor for soybean yields, which rise and fall according to July and August weather. And that’s where more news out last week becomes significant. The latest El Nino update from the U.S. called an end to the El Nino warming of the equatorial Pacific, with a shift to La Nina cooling from July to September.

La Nina is correlated with U.S. corn and soybean yields. This association is enough to be statistically significant – that is, it’s not the result of mere chance. But it’s by no means a slam-dunk indicator.

So, weather risks are up, and this affects selling ranges projected by my pricing model. Yield is only one variable in total production. USDA updates the other, acreage, on June 28, just in time for whatever July 4 fireworks pop up.

Knorr’s price projections

Currently my model projects a small drop from the June WASDE, but a mere 25 million bushels. In other words, “Move along folks, there’s nothing to see here.”

Still, markets will be markets, overdoing it to both the up- and down-sides. The top third of my selling ranges for December 2024 range from $5.05 to $5.50 and $5.55 to $6.15. FYI, the bottom of those ranges matches the top of the market from back in January.

A similar process for soybeans puts November 2024 selling targets from $12.85 to $13.80 and $11.40 to $12.25. Last week’s low matched the bottom of those ranges, while new crop futures haven’ traded above $13 since Thanksgiving.

So the pump is primed for whatever rallies emerge. But with only 2% of corn acres and a mere 1% of soybean fields suffering from drought last week, get ready for a lot of pumping.

Will 2024 be a dream or nightmare? Me, I sleep with a battery back-up nightlight, just to be sure.