It’s no secret that Brazil is the largest producer of soybeans in the world. Their rate of soybean production expansion over the past decade has been remarkable.

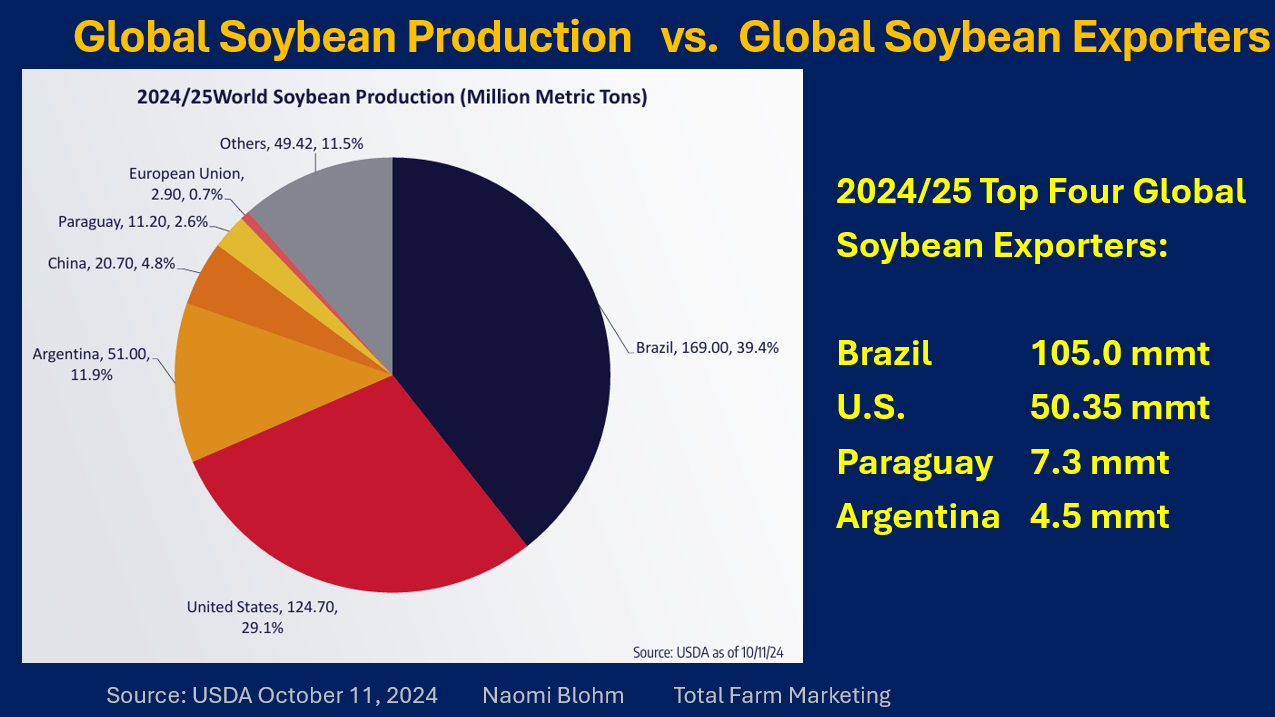

Brazil grows 39% of the world’s soybeans, according to USDA.

What’s happened

The Brazilian soybean production number for the 2024-25 growing season is expected to be at 169 million metric tons. The U.S. by comparison is expected to grow 124.7 MMT of soybeans, with Argentina coming in third at 51.0 million metric tons.

Brazil is also the largest exporter of soybeans with export destinations primarily to China and Southeast Asia. Below is a map which shows the major global producers of soybeans, along with the major global exporters of soybeans.

Brazil is pegged to export 105 MMT of soybeans in 2024-25. Notice this is double the amount that the United States is expected to export.

From a marketing perspective

The potential for a behemoth Brazilian soybean crop is likely to keep the price of soybean futures in check for now. The perception is that global supply will be large, and that could potentially weigh on prices in the short term.

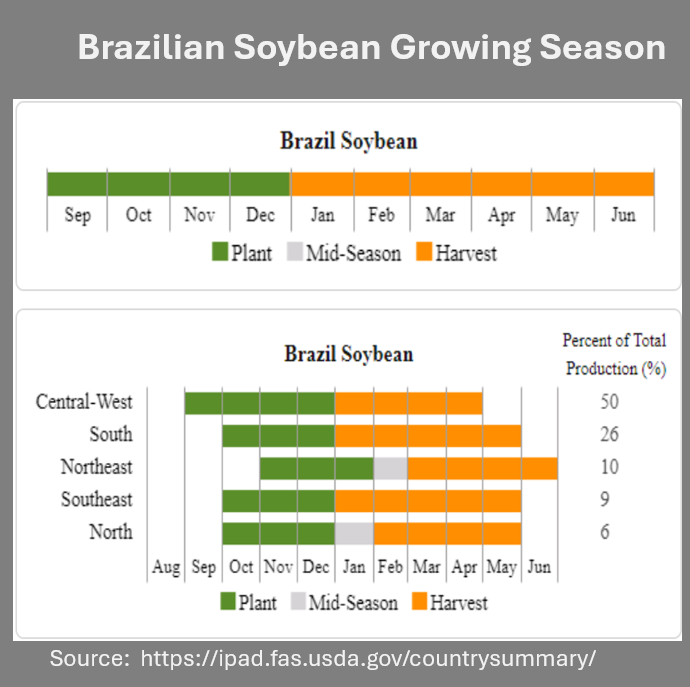

Yet, it is still early in Brazil’s growing season. Brazil is approximately just over the halfway mark with planting their soybean crop as of this writing. Plenty of growing season and potential weather worries are still to come.

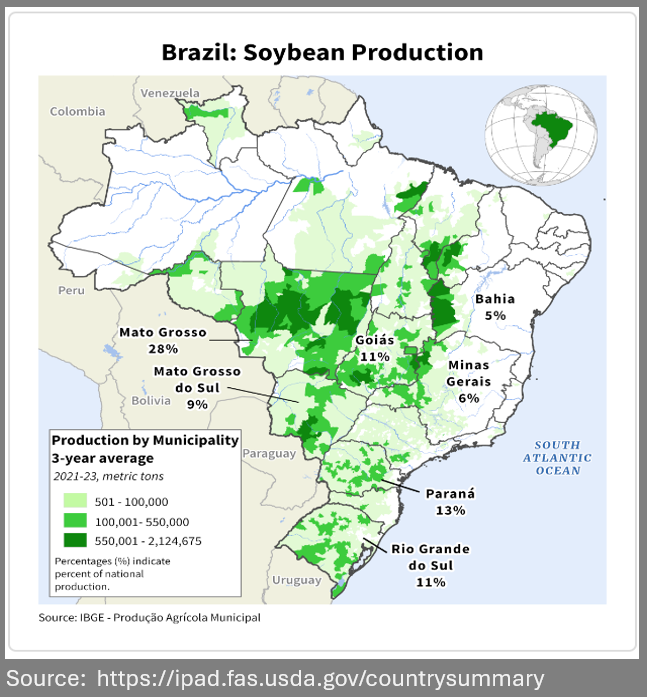

Below is a production map of the major soybean growing areas within Brazil. This is helpful to visualize where to “weather watch” in the upcoming months as the soybean crop starts to grow in Brazil.

Brazil’s largest soybean growing area is Mato Grosso. It is said that Mato Grosso is nearly the equivalent size of Illinois, Indiana and Iowa combined. According to USDA’s Foreign Agriculture Service, Mato Grosso is expected to account for 28% of Brazil soybean production. Parana is expected to grow 13% of total production. Goias and Rio Grande do Sul follow, each with 11% total production. Mato Grosso do Sul accounts for 9% of total production for Brazil soybeans.

With ample supplies expected globally, and the soybean crop for the most part being planted in a timely manner, the soybean market currently offers little weather risk premium regarding the Brazil crop.

That could change. Well, the perception of a potential weather threat in South America can sometimes lift soybean futures prices during late December and January. So late December and January is the time to watch weather in Brazil.

Why should you care?

Should this price rally occur, due to a weather scare in Brazil, it is often a wonderful opportunity for U.S. farmers to focus on cash sales for any soybean supplies in bins at home, or a potential opportunity to begin forward contracting new crop sales.

Prepare yourself

While the perception is for a large supply of Brazilian soybeans to be grown for the 2024-25 crop year, one never knows when Mother Nature has a trick up her sleeve. Weather watching in the coming weeks and months for the Brazil soybean crop will be important.

Market volatility can come and go quickly. Grain marketing opportunities can also come and go quickly. Be ready to act.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.