As we move toward incoming President Donald Trump’s second term, two questions top a long list for agriculture:

- Will the president’s policies impact corn demand?

- Will there be a trade war?

The underlying concern in both questions is: Will corn demand suffer?

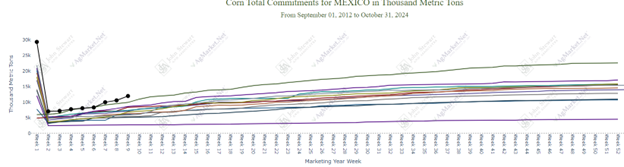

Let’s look at Mexico. Mexico is the largest consumer of U.S. corn, buying over 40% of our annual exports. So far, year-to-date, Mexico has purchased about 20.7% more corn this year through the end of October when compared to a year-ago level.

Over a five-year average of corn purchases, Mexico has increased U.S. corn purchases by 59.2%. Many are suggesting Mexico is “front loading” corn purchases in anticipation of a potential trade war with the U.S.

Mexico has a new president as well and there is a push for Mexico to make its food production and distribution look more like it did in the 1980s, when they consumed more tortillas, beans, instant coffee and hot chocolate.

However, the front loading of U.S. corn this year could be more to do with Mexico’s policies and not a Trump presidency. With a potential new agricultural plan in Mexico, one concern is that Mexico could put a ban on GMO corn from the U.S.

Last year, we saw Mexico buy the most corn ever from the U.S. They started buying early on and that trend never changed. They started out the year strong and the country kept buying U.S. corn all year. In my mind, it is more of a value play for Mexico in securing cheap food for their people.

Is Mexico just buying cheap?

With December corn futures trading around $4.20-$4.25 – the cheapest in four years – they see good value. However, if Mexico enacts a GMO ban on U.S. corn, that could cause demand from Mexico to slow.

I like to tell everyone to watch what foreign countries do versus what they say they might do. For now, until probably late January 2025, we could see U.S. corn demand stay pretty strong.

Have questions? Feel free to contact me directly at 605-657-1978 or anyone on the AgMarket.Net team at 844-4AG-MRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago, IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.