USDA’s month-over-month adjustments in the November 8 WASDE report reflected a continuation of modest tightening of the 2024/25 world cotton balance sheet, particularly and consistently on the supply side. World beginning stocks were cut by 610,000 bales, mostly in India (-400,000) and Central Asia (-110,000). World production was likewise 460,000 million bales fewer than the previous month, mostly in the Pakistan (-200,000), the EU (-60,000), Bangladesh (-10,000), Central Asia (-10,000) and the U.S. (10,000). Similarly, the world imports categories saw 330,000 fewer bales compared to last month, mostly in Turkey (-400,000), partially offset by Central Asia (+70,000).

On the demand side, world exports were reduced by 290,000 bales month-over-month, mostly in the U.S. (-200,000) and the EU (-20,000), and partially offset by 30,000 in other exporting countries. World domestic use was a net 520,000 bales fewer, month-over-month, mostly in Turkey (-400,000), Pakistan (-100,000), and Central Asia (-10,000). The supply side cuts dominated those on the demand side, so the bottom line of all these adjustments was a modest 580,000 bale decrease in world ending stocks. This adjustment would be historically neutral to price supportive.

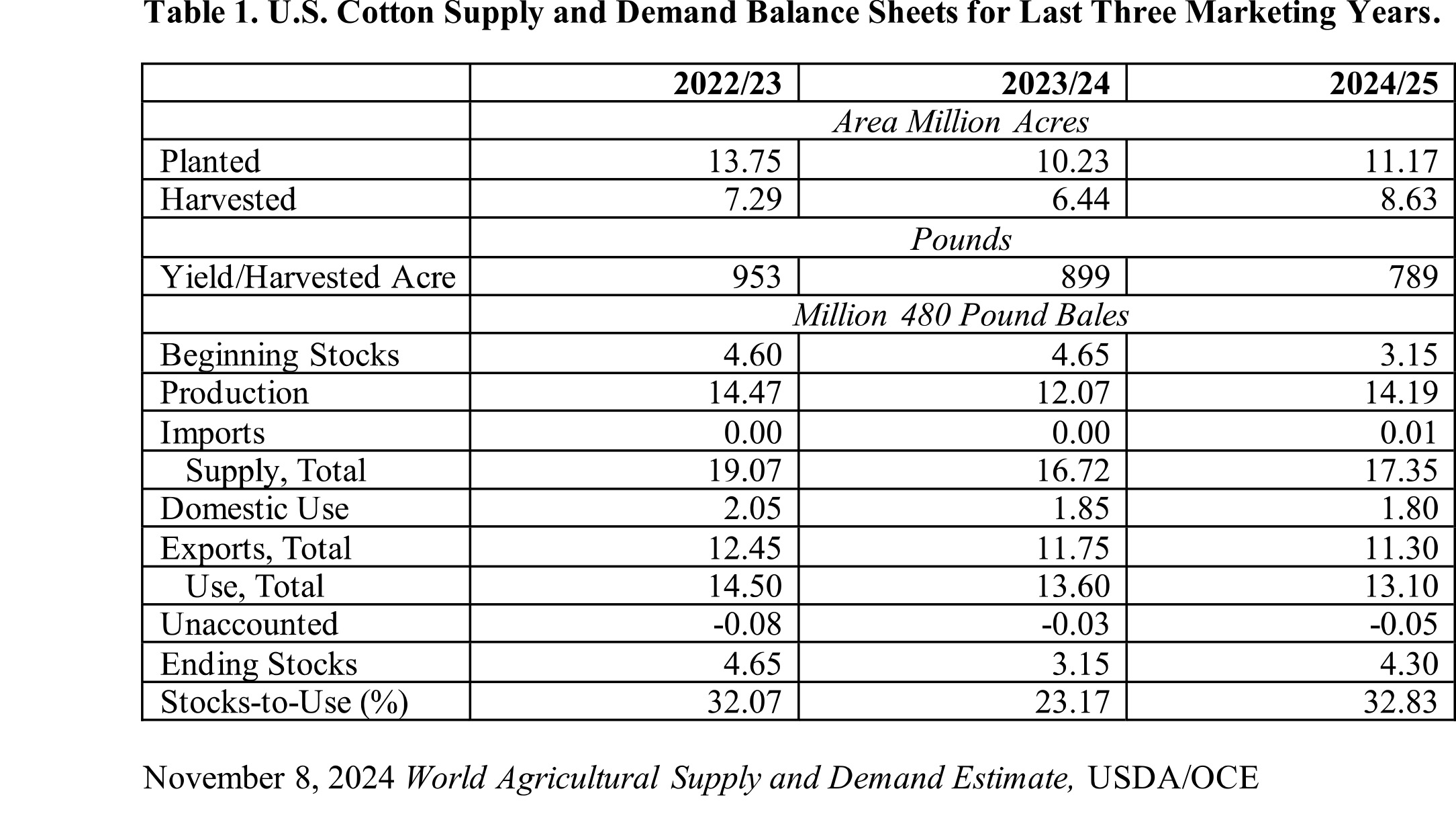

The November WASDE saw minor month-over-month adjustments to the U.S. balance sheet (last column of numbers in Table 1). On the supply side, beginning stocks and imports were unchanged, as was yield per harvested acre. For that matter planted and harvested acres were also unchanged from last month, thus implying the same 22% abandonment rate. Still, somehow USDA carved a miniscule 10,000 bales off last month’s production estimate, attributed to additions in Georgia that were offset by cuts in Texas and other minor adjustments.

On the demand side, U.S. domestic use and import categories were unchanged, while U.S. exports were trimmed by 200,000 bales, month-over-month. The bottom line of all these adjustments, plus some minor tinkering with the “Loss” fudge factor was a net 200,000 increase in U.S. ending stocks, to 4.3 million. The monthly adjustment would historically be price neutral to slightly bearish, both in the adjustment and the resulting level of U.S. ending stocks.

So, what does all this mean? I think that it basically explains the price weakness that we’ve been seeing since March. The Mar’25 futures might get a little bounce if the hedge funds cover more of their longstanding short speculative position. But over time, I think there are fewer and fewer fundamental reasons for the old crop market to get surprised into a rally.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at https://cottonmarketing.tamu.edu.