We are quickly approaching the holiday season, which means the grain markets have fewer fundamental data to trade with than we typically receive during the rest of the year.

Because the December WASDE report is almost always similar to the November report that was released a couple weeks ago, we likely won’t have any fresh supply and demand numbers until Jan. 10.

Until then, what does that mean for the corn market? Typically, markets without fresh fundamental information will trade largely based on technicals and money flow. Toward that end, a comparison to last year’s fundamentals may shed a bit of light on what to watch for over the next couple of months.

Let’s take a look at two of those fundamentals, exports and corn spreads.

- Export data is released weekly. So, we can pay attention to how export pace is trending between WASDE reports. As of the most recent corn export data, we are 42% ahead of last year’s export sales and 29% ahead of last year’s export shipments at this time in the marketing year. That strong export pace is a large part of the reason that we have seen basis improvements and corn spreads moving stronger.

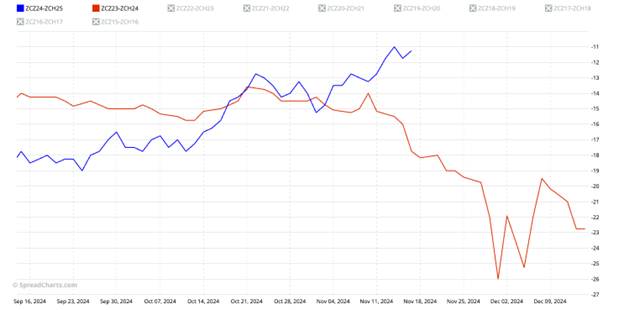

- One corn spread I have been watching closely is the December to March spread. Often times, spread price action can foreshadow flat price action. On November 1 of both last year and this year, the Dec/March spread closed at a 14.75 cent carry, meaning March was trading 14.75 cents higher than December.

But fast forward two weeks to Nov. 15, and the two years look quite different. Last year, the spread had widened out to 17.75 cents – suggesting bearish flat price, while this year it had narrowed to 11.25, which suggests bullish flat price.

Will the bulls take over?

So where does that leave us over the next two “dead” months?

In my opinion, how this spread trades over the last half of November will be a good indicator. Last year, by the end of November, the Dec/March spread continued to widen to a 26-cent carry at its maximum. In hindsight, that should have been a signal to us that corn was going to have a hard time rallying (and that’s exactly what we saw over the rest of the winter and spring months).

So far this year, the spread is acting the opposite and pushing higher. Does that mean we have a better chance to see a corn rally this winter? If we can see the spread continue to have strength into December expiration, I would argue that the potential is there.

However, let me throw out one caution. If the spread is working higher simply due to strong export demand and that demand dries up over the next couple of months, it’s going to be difficult for the board to rally. This is especially true if the crop is still as large as the latest WASDE suggests. We would likely see basis falter in that scenario as well.

For this reason, I have been encouraging my clients to consider locking in strong basis opportunities and have target orders in place to set the futures price on those basis contracts as well.

I think it makes good sense to reward a market as it moves higher. This is especially the case when options are trading cheaply enough to make it easy to buy back those bushels on paper in a limited risk fashion.

In conclusion, over the upcoming holiday trade, watch the Dec/March corn spread as it goes into expiration and watch our export pace. Look for opportunities to reward the market with sales and consider reownership on paper if you still want upside potential.

If you need help with any of the above, you can reach me at 815-691-2672 or ksweeney@agmarket.net.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net® is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.