Harvest has wrapped up for most of the Midwest. Grain that needed to be sold off the combine at harvest time has come to town to be sold. The remaining harvested bushels are now secure in on-farm bins.

What’s happened

With year-end bills likely due soon, such as land rent, fertilizer costs or seed purchases, farmers may be considering whether to sell some of that binned up grain in the near future.

In a recent conversation, a client was deciding if he should make some cash sales soon, and potentially re-own it with a call option strategy, or potentially, “do nothing” and wait to see if the price of corn and soybeans might rally into year end.

“Well, you know what they say, Naomi,” this client quipped: “The bears get Thanksgiving and the bulls get Christmas.” Meaning, might grain prices trade lower in early November to then see a price rebound after Thanksgiving and into year end?

The comment got my attention, and I was eager to see if there was any truth to this saying. And, while past performance is not indicative of future results, the results were quite compelling.

From a marketing perspective

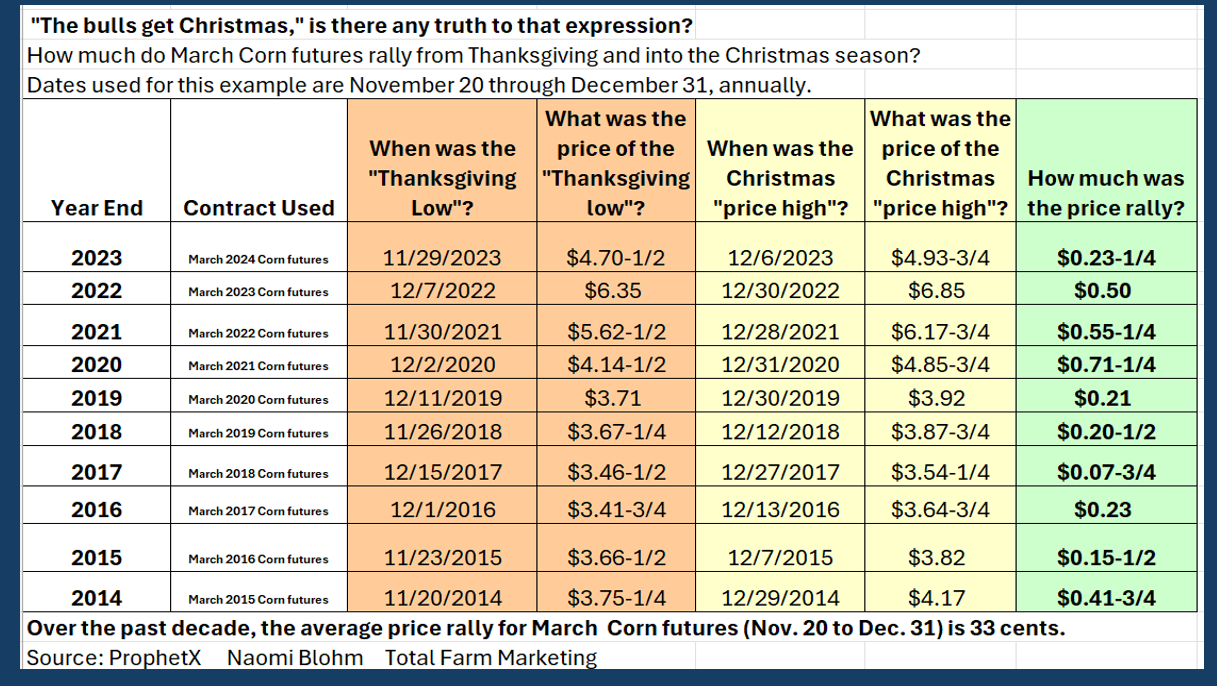

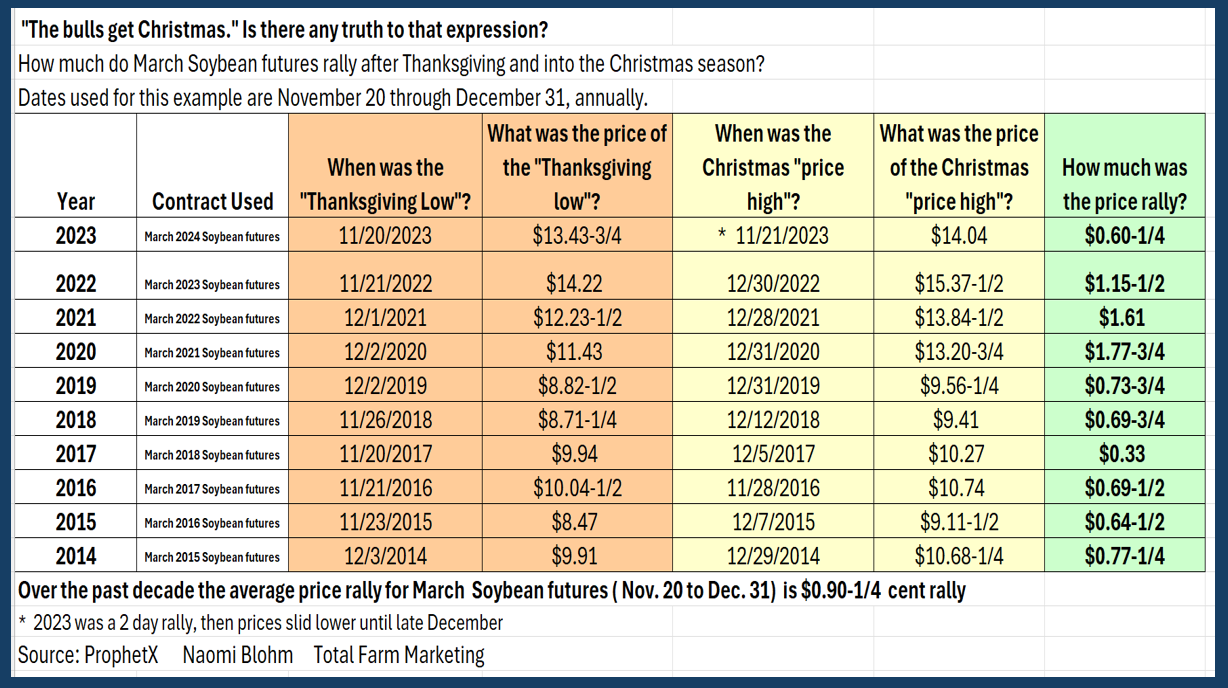

For the purpose of my simple research project. I looked over the past decade for any type of rally for corn and soybean futures from Thanksgiving until the end of the year.

I used the March corn and March soybean futures contracts the. (The January soybean contract and December corn futures contracts would be tangled in their delivery periods during this timeframe.)

Also, since the date of Thanksgiving changes annually, I used November 20 as my “start date” annually.

While each year over the past decade has provided unique fundamental supply and demand perspectives, in each year over the past decade March corn and March soybean futures has some sort of rally between Nov. 20 and the end of the calendar year! Each year.

The average soybean rally was 90 cents, and the average corn rally was 33 cents!

In some instances, the Thanksgiving to year-end rally lasted only days. Other times, it lasted for weeks. Be prepared for anything.

My resounding takeaway was that a farmer who pays attention to the markets during that time frame – rather than being lulled by holiday cheer – likely has an opportunity to take part in some sort of pricing rally opportunity between late November and the end of December.

Again, I only looked at the past decade, and these results may not necessarily repeat this year, but the information is eye opening.

Prepare yourself

Things to be aware of:

- The rally can come and go quickly.

- Sometimes the rally seemed to peak in conjunction with the December USDA WASDE report timeframe.

- Sometimes the rally continued into year end.

Much of a potential rally depends on weather in South America, fund trader activity, export demand, an upcoming USDA report, and geo-politics.

A Christmas miracle? An early gift from Santa? If the rally should occur, consider using it to enhance your cash sales.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.