Market-moving fundamental data are typically scarce during the traditional holiday season. While the USDA Monthly Supply and Demand report on Dec. 10 is a notable event, it rarely produces significant market shifts. However, other factors, such as the presidential transition and escalating geopolitical tensions in Europe, may create underlying uncertainty.

Let’s focus on three quantifiable factors that could potentially shape market direction this holiday season.

One: A strong U.S. dollar

The U.S. dollar last week reached its highest level since November 2022. A strengthening dollar could slow the pace of grain exports, which have been robust this marketing year. Combined with growing South American supplies, a strong U.S. dollar might prompt global grain buyers to delay purchases, and instead wait to buy cheaper South American bushels when they come on the market.

Two: Exports ride on supplies

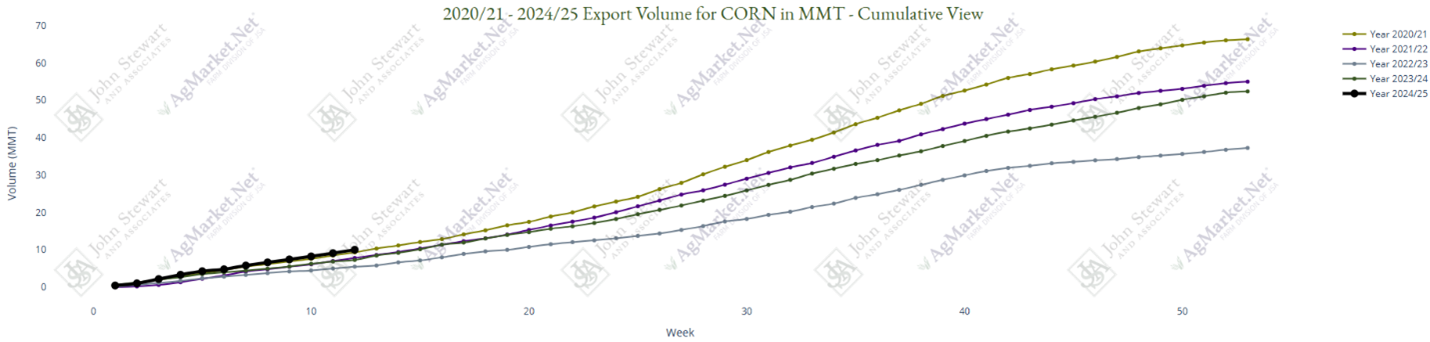

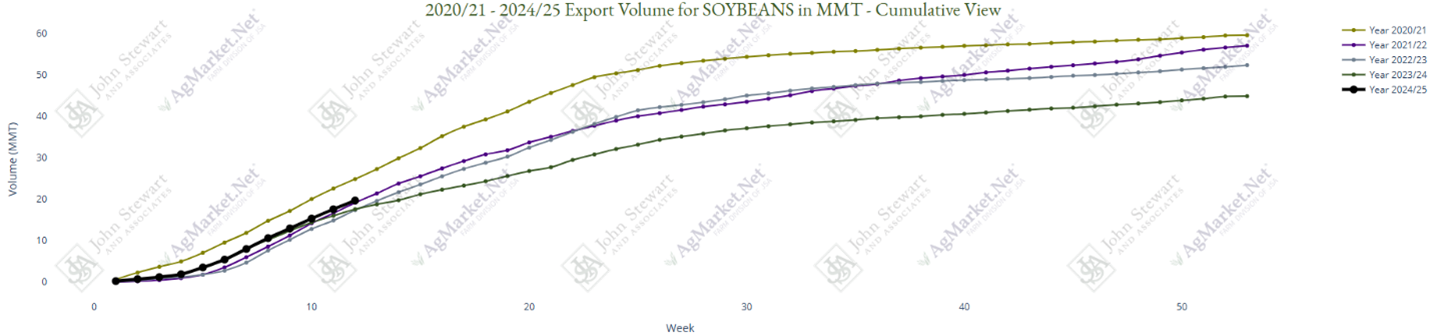

Exports are another critical factor. With large U.S. corn and soybean crops, ample supplies are available to the marketplace.

Corn. Year-to-date corn sales have reached 53.1% of the USDA's export estimate, the largest since the 2012-13 crop year and 39% ahead of last year’s pace. This rapid export growth is driven by:

- Mexico’s aggressive buying, influenced by potential policy shifts regarding GMOs.

- Uncertainty in Black Sea grain supplies.

- A smaller South American corn crop.

Soybeans: Year-to-date soybean inspections are 39.6%, 11% ahead of last year. Sales are at 63.5% of the USDA’s export estimate, consistent with last year. Increased global demand for animal protein and strong vegetable oil consumption are fueling this trend.

Three: Managed money pivots

The managed money crowd has played a pivotal role in supporting the corn market this year. After setting a record short position in July, managed money reversed course, particularly in corn. As of the Nov. 22 Commitment of Traders report:

- Managed Money has shifted from a record short position to being long over 107,000 contracts—a dramatic change of 463,500 contracts, equivalent to 2.3 billion bushels or 15.5% of the total U.S. corn crop. This aggressive buying during harvest provided strong market support for corn.

- In contrast, managed money activity in soybeans has been less pronounced, with about 135,000 contracts covered, representing 673 million bushels.

Watch the dollar and managed money

- The direction of the U.S. dollar likely will significantly influence export trends.

- Managed money, with its large positions, tends to drive market movements in tandem with its buying or selling patterns.

Together, these factors will influence grain market direction this holiday season.

If you have questions about these insights or need assistance with marketing strategies, feel free to contact me directly at 314-626-4019 or contact the AgMarket.Net team at 844-4AG-MRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net® is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.