As we head into 2025, many producers may be considering cash sales for soybeans sitting in the bin, or potentially starting to think about locking in cash sales for new crop soybeans that will be planted in the spring.

What’s happened

Last week I wrote about a fundamental update for soybean futures and how current reality is that a large global supply of soybeans is keeping a lid on any upward price movement.

In addition to what I wrote about in last week’s blog, here are three additional things to be mindful of in January.

From a marketing perspective

The upcoming Jan. 10 USDA report is indeed “the big one.”

All categories on the spreadsheet can be tweaked: yield, total supply, old crop carryout, new crop demand and global supplies.

Production increases. Will USDA increase the size of the Brazil soybean crop (currently pegged at 169 million metric tons) or the Argentina crop, currently marked at 52 mmt? Will USDA change the size of the U.S. soybean yield from the fall harvest (currently set at 51.7 bushels per acre)? Will there be changes to U.S. ending stocks for the 2024-25 crop year (currently estimated at 470 million bushels)?

The report by itself will have traders and computer algorithms on edge, creating a likely volatile trading day.

Three-day holiday weekend. Shortly after the USDA report is released, occurs a three-day holiday weekend. The markets close to honor and observe Martin Luther King Jr. Day.

This year, that holiday is Jan. 20. That day also happens to be Inauguration Day this year. Between the uncertainty of a new administration and potential trade wars, along with the position squaring into and coming out of a three-day holiday weekend, trade volatility could be extreme! Be ready for anything!

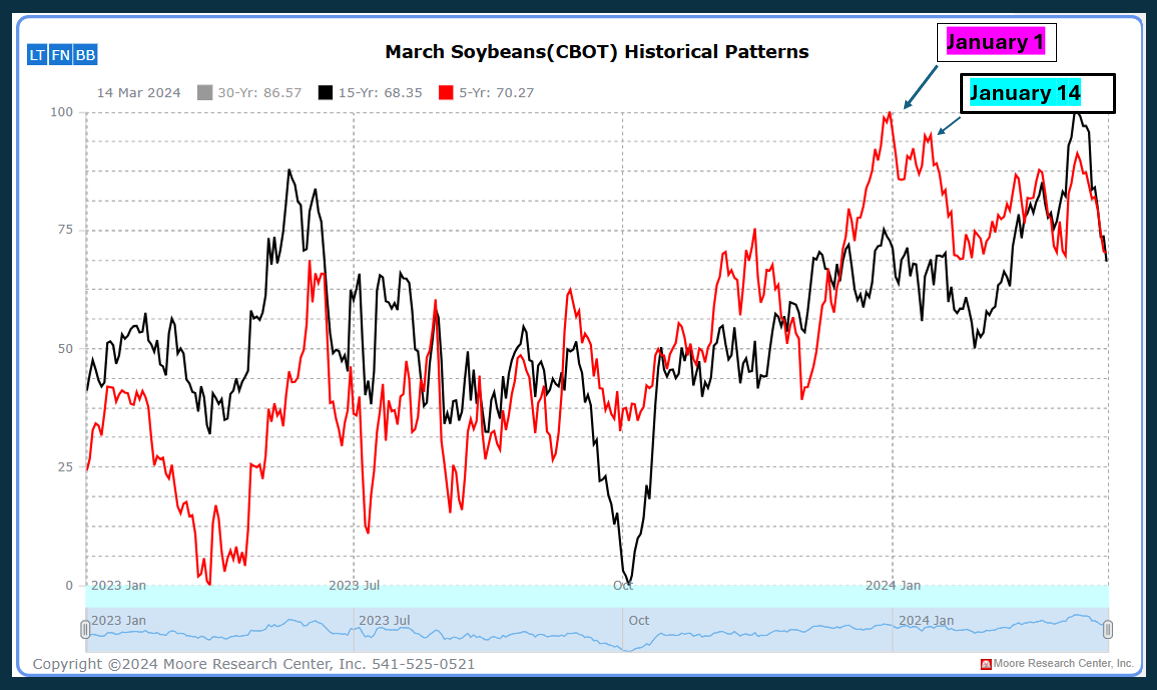

Seasonal charts and seasonal chart patterns. Incredibly strong five-year price and 15-year price patterns suggest the March soybean futures will hit a price peak in early January, and then again in min-January. Prices then have a strong tendency to slide lower until month end.

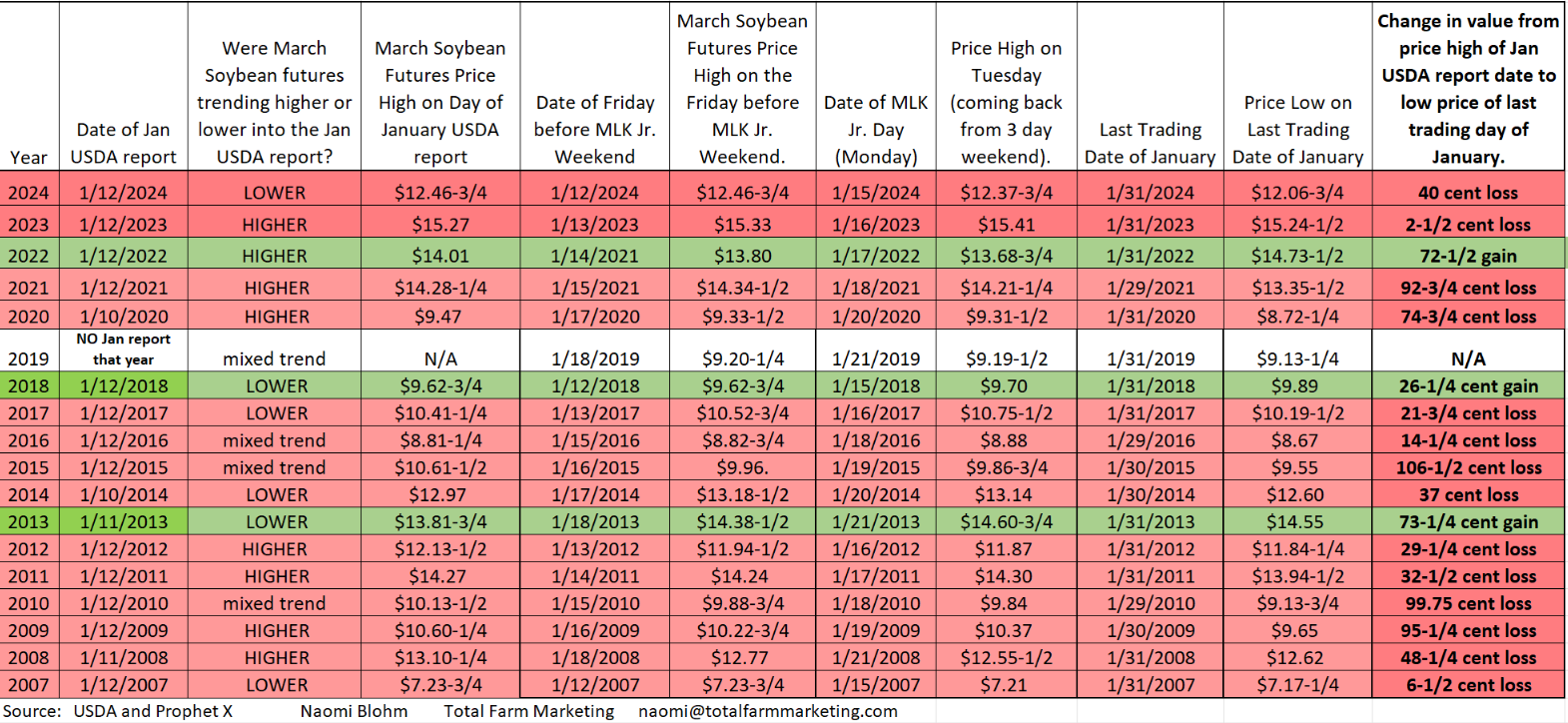

Even though there are no guarantees this will happen every year, curiosity got the best of me, and I looked back at nearly two decades worth of USDA reports, dates and price information.

I put together this chart which shows the date of the January USDA report for each specific year, the date of the Martin Luther King Jr. three-day holiday weekend, and how March soybean futures performed during those two to three weeks.

The bottom line, even with one year not having a January USDA report (2019), in 14 out of 17 years, March soybean futures prices traded lower during the last two weeks of January.

Prepare yourself

While past performance is not indicative of future results, this strong soybean price seasonal definitely suggests March soybean futures have a tendency to fall lower into the end of January.

Does a seasonal price high in January mean that the soybean rally is forever done for that year? Of course not.

- Mother Nature can always have a trick up her sleeve.

- We might receive wonderful demand news on the biofuels front.

- Or trade wars may be averted.

But it is important to be aware of the potential for a January drop.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.