The January 2025 USDA WASDE report had a bullish surprise for soybeans with a lower-than-expected drop in U.S. soybean yield. This yield drop triggered a larger-than-expected drop in 2024-25 ending stocks. The combination of surprises allowed for a near 70-cent rally in nearby soybean futures prices.

What’s happened

With the report now fully digested into marketplace news and prices, traders are shifting their focus onto South American weather, and policy uncertainties of a new U.S. presidential administration.

The stage is now set for a bullish and bearish fundamental clash for soybean prices in the weeks and months ahead. Here are four things to closely monitor.

From a marketing perspective

Three-day holiday weekend. On Monday, Jan. 20, the markets will be closed to honor and observe Martin Luther King Jr. Day. That day also happens to be Inauguration Day this year.

Between the uncertainty of a new administration and potential trade wars, along with the position squaring into and coming out of a three-day holiday weekend, trade volatility could be extreme! Be ready for anything!

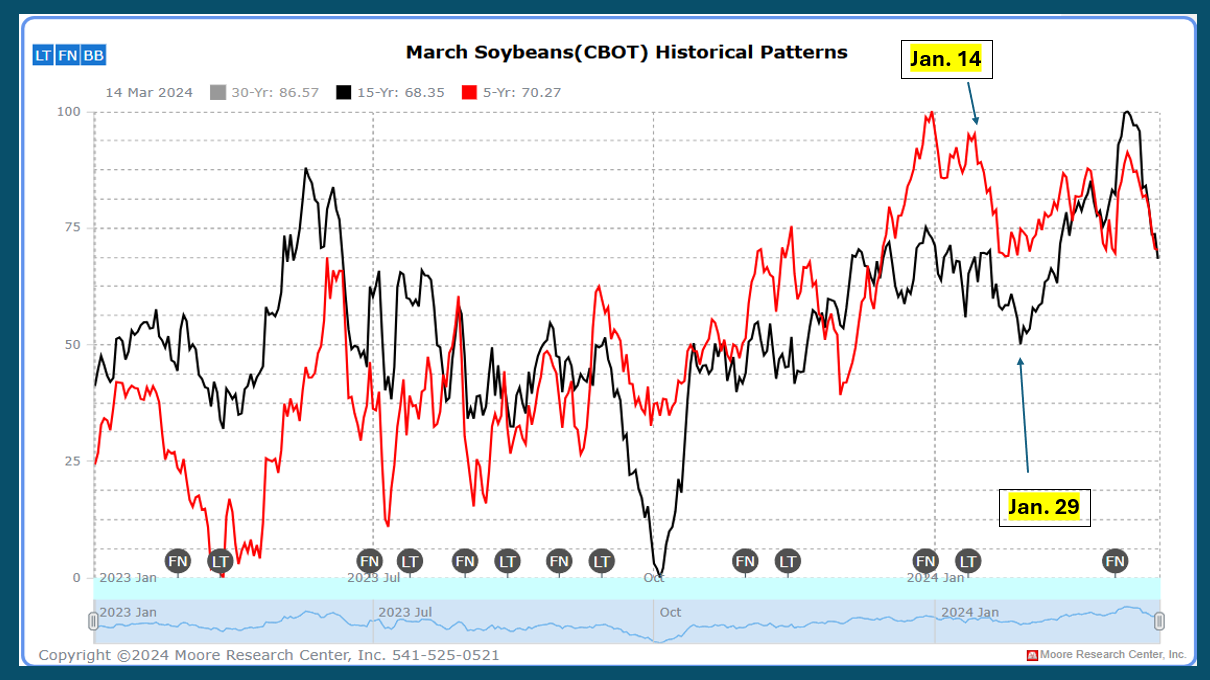

Looking at seasonal charts and seasonal chart patterns, there is a significantly strong 5-year price pattern and 15-year price pattern that suggests the March soybean futures achieve a price peak in early January, and then again in mid-January. Prices then have a strong tendency to slide lower until the month end.

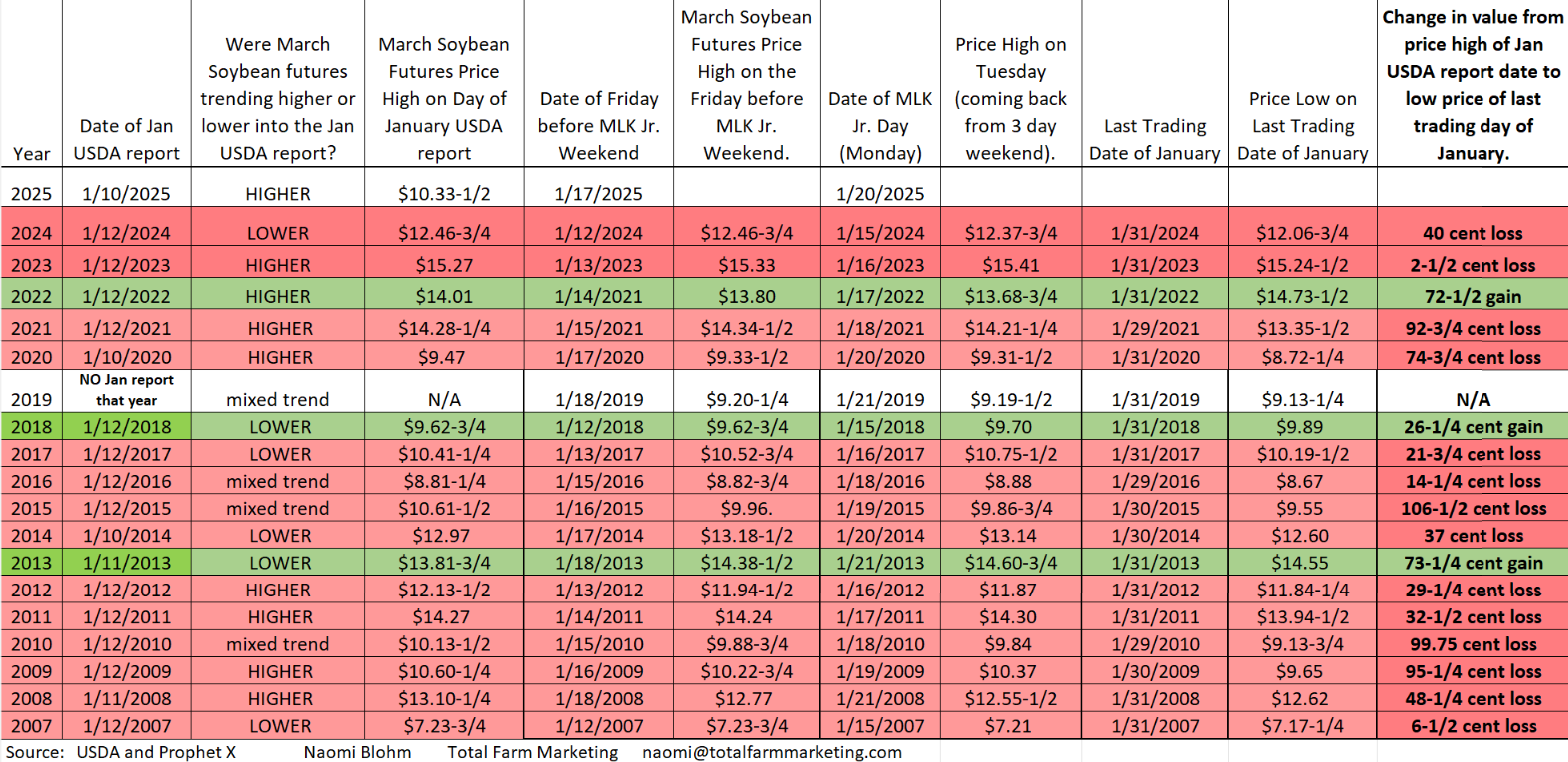

Even though there are no guarantees this will happen every year, curiosity got the best of me, and I looked back at nearly two decades worth of USDA reports, dates and price information.

I put together this chart that shows the date of the January USDA report for each specific year, the date of the Martin Luther King Jr. three-day holiday weekend, and how March soybean futures performed during those two to three weeks.

Bottom line: In 15 out of 18 years, March soybean futures prices traded lower during the last two weeks of January.

Weather in Argentina. The soybean crop in South America is planted. While Brazil, the world’s largest soybean production country, has enjoyed near perfect weather and growing conditions, the weather in Argentina has turned hot and dry. With chances of rain in the coming days and weeks, traders will be watching closely the total amount of rainfall for Argentina.

Argentina is the world’s third largest grower of soybeans, and the world’s largest exporter of soybean meal and soybean oil. The world can handle a small amount of imperfect weather and potentially lower soybean crop production in Argentina, however, if hot and dry conditions persist, that may change perception quickly.

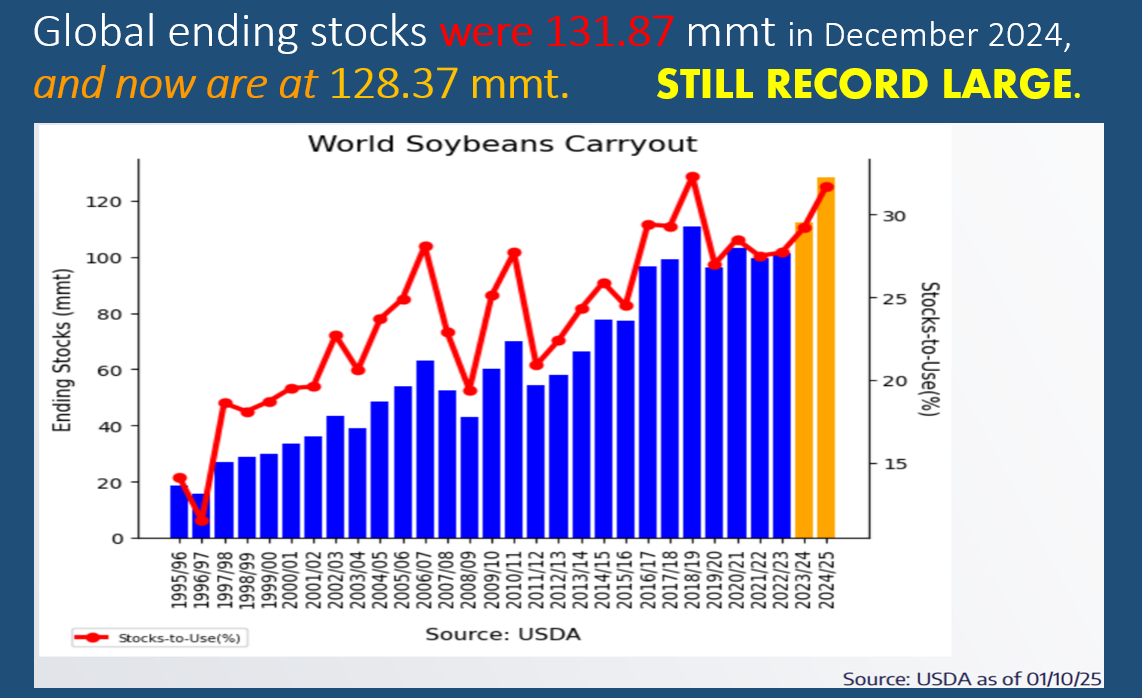

Record global carryout. Here is where a reality check may come into play. Even with smaller U.S. ending stocks, and the potential for smaller soybean supplies out of Argentina (barring weather), the world has the largest amount of soybean supplies on record.

Global ending stocks for 2024-25 soybeans are at 128.37 million metric tonnes, as of the January USDA WASDE report. This reality may keep a lid on any further soybean price rally.

New U.S. presidential administration. The world will be watching the first actions of President Donald Trump. Primary interest is any tariff action against global trading partners, and then, potentially, counter tariffs sparking trade wars. This may affect future demand for U.S. soybean exports.

Adding to uncertainty is what the new administration will do with biofuel policies and mandates. Will it take swift action? Or will the administration again kick the can down the road?

Prepare yourself

While the U.S. soybean story is not as potentially negative as it was perceived to be just months ago, many uncertainties lie ahead.

We are back to facing global weather uncertainty, future U.S. demand uncertainty should there be a trade war, and a slightly hazy future for biofuel demand.

One cannot guess markets or price reaction. With the uncertainty and volatility that lie ahead, be prepared with a scenario plan that both protects in case soybean prices drop due to a trade war and positions for a rally in case Mother Nature has a trick up her sleeve.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.