Are you ready for the Year of the Snake?

First off, that’s not an editorial comment, so please, no angry replies. Snake is the name for the upcoming year in the lunar calendar, which begins Jan. 29, when the Year of the Dragon ends.

Coiled reptiles can be good, bad or indifferent. Some eat rodents and pests. Others occasionally poison humans and livestock. A few, at least in myth, eat themselves. That wide range seems appropriate, because the Lunar New Year marks a confluence with strong connection to China.

Markets in the world’s largest country close for a week during the “spring festival,” providing at least temporary cover during a period fraught with risk. A new U.S. administration with strong feelings about tariffs, not to mention China, takes office just as officials at the Federal Reserve prepare to debate monetary policy Jan. 28-29.

The discussion in Beijing should follow these bookends carefully. Here’s your cheat sheet.

Where’s the pot of gold?

President Trump’s tariff enthusiasm, and China’s response on soybean imports, hallmarked his first term in the White House, at least for farmers. So, will Trump Tariff 2.0 be different?

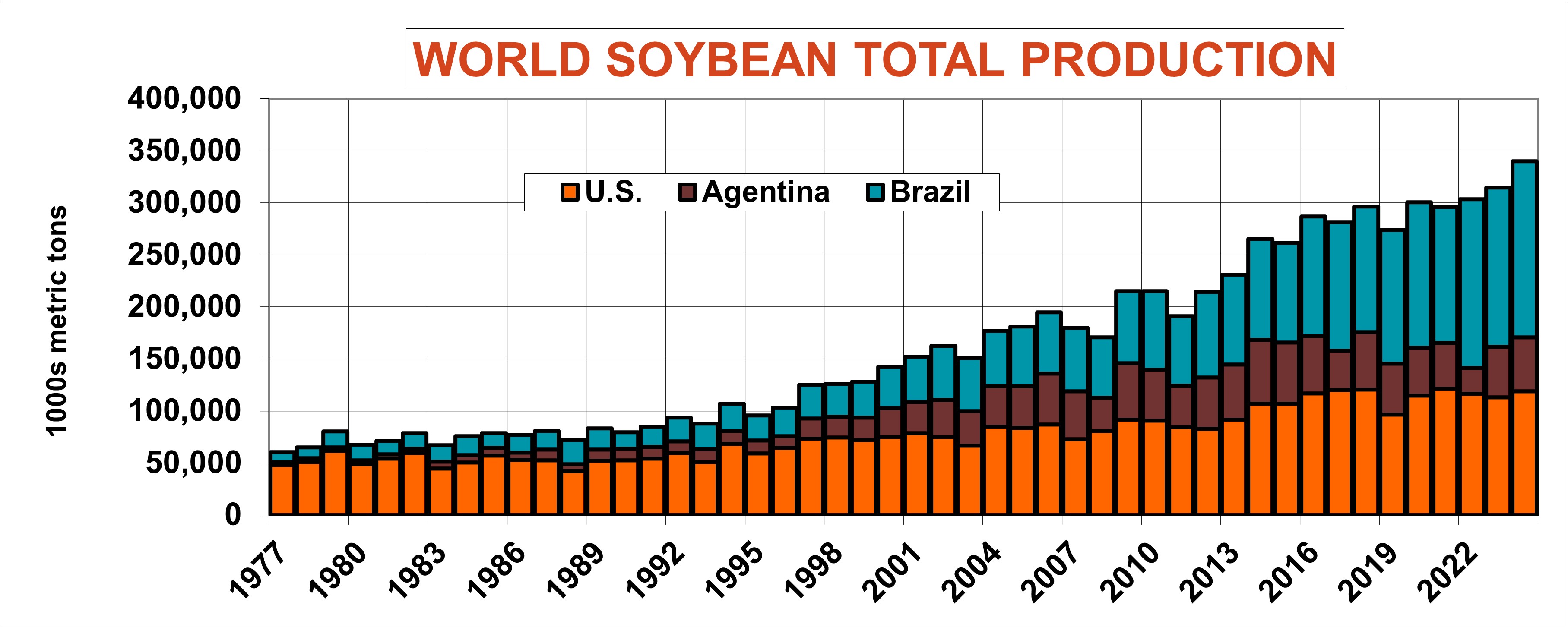

Both sides had time to prepare. China diversified its sources for soybeans, expanding purchases from South America and other regions. Still, China needs U.S. beans, and U.S. farmers very much needs China as a customer. Those dynamics won’t change overnight, even if totals vary from year to year.

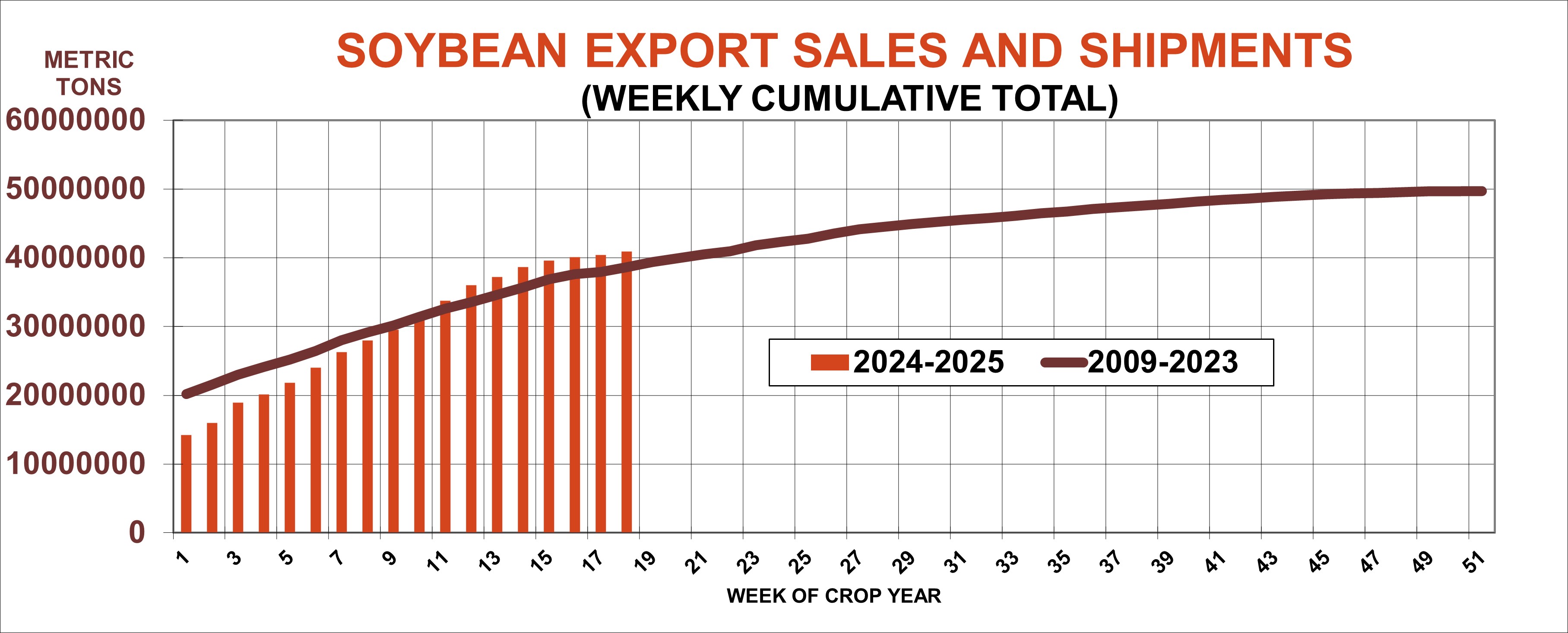

While U.S. sales of 2024 crop soybeans to China are down around 4.5% from year-ago levels, total commitments to all customers were strong this fall. A smaller crop harvested in Brazil a year ago helped boost U.S. prospects and kick off a strong start to the selling season that began Sept.1, though inventories kept on farm rose faster than supplies held off farm.

But China is not the same pot of gold in 2025 for three very important reasons: economics, demographics and competition.

Brazil bust goes boom

Brazil should have plenty of soybeans to sell, with local sources there forecasting an increase of nearly 13% over last year as harvest of the country’s first crop is cut in January. Acreage there is up 2.6%, and the Vegetation Health Index points to yields rising 12%.

China’s once-insatiable appetite for soybeans is also on a diet, thanks to a country growing older – and smaller. China’s total population fell for a third consecutive year in 2024. Births rose in the year of the Dragon – a good time to conceive according to the culture. But deaths of an aging populace outnumbered new arrivals – and old folks eat less, too.

China’s growth in soybean imports varies with GDP growth, so these esoteric numbers are important. USDA forecasts a 2.6% drop in Chinese soybean imports, even though the Communist government says economic growth hit its target of 5%. The International Monetary Fund’s latest outlook isn’t quite so upbeat. Its latest projections put China’s 2024 GDP growth at 4.9%, dropping to 4.5% over the next two years, which could take the edge off soybean demand.

Oil, not ag

That prospect mirrors changes in commodity prices as central banks and governments around the world continue to grapple with lingering inflation – or fears of it. Commodity indexes with ag contracts removed rose 4% faster than broader yardsticks. The wild card is energy.

Crude oil futures topped $80 last week, given a boost by large speculators, who hiked their bullish bets more than 60% over the past month alone. Funds pumped up crude as stronger Western sanctions bit into Russian exports of petroleum and refined products. This reduced supply could continue to support costs, as long as demand holds up too.

Like soybeans, crude consumption has a strong connection to economics, and hinges in part on China needs. The other factor to watch is the value of the U.S. dollar, which eased from a two-year high last week. Prolonged weakness by the greenback could also boost dollar-denominated crude contracts, convincing producers to sell the currency to protect the value of output from their pumps and refineries.

As for the buck, its direction is closely tied to interest rates, because investors tend to move money into countries where they can earn the highest return. Traders betting with Federal Funds futures widely expect no changes from the Federal Reserve at the end of its next two-day meeting on monetary policy Jan. 29, with a majority believing in a pause until the second half of 2025.

But with so much news in play, look for volatility to persist long after the confetti is cleared in Washington. The pace of U.S. soybean exports through the second week of January translates into total sales around 100 million bushels more than USDA’s current forecast for 1.875 billion bushels. A shift of that size could add more than $2 a bushel to average cash prices for the crop. That would boost the top third of the futures price range to $14.30 to $15.40, taking aim at 2023 highs.