The January 2025 USDA WASDE report had a bullish surprise for corn with a lower-than-expected drop in U.S. corn yield. This yield drop triggered a larger than expected drop in 2024-25 ending stocks. The combination of surprises allowed for a rally in nearby corn futures prices.

What’s happened

Earlier this week nearby corn futures prices rallied up near the $5 price point, and profit taking was then noted once that elusive price target was met. Corn futures prices closed lower, with front-month corn futures posting a bearish reversal on daily charts, a possible indicator that a short term, technical top, might be in place.

It seems the friendly USDA report may now be fully digested into marketplace news and prices. Traders are shifting their focus onto South American weather, and policy uncertainties with a new U.S. presidential administration.

From a marketing perspective

Corn prices may be at a new juncture – a potential fork in the road – waiting for the next influx of fundamental news to find a new price path.

Looking ahead, now that the ending stocks number has been reduced to 1.54 billion bushels, the market may perceive any global weather threat as a further reason for a potential price rally.

On the flip side, this recent price rally may incentivize Brazilian farmers to plant more corn acres in the coming weeks. Also, the market already anticipates U.S farmers will increase planted corn by 2 to 3 million acres. These expected additional acres will mean more corn production (barring a major weather event), which will alleviate the tighter ending stocks situation.

Lastly, global trade policies and U.S. biofuel mandates remain in question as the new administration sorts through information to make their decisions going forward.

Something to be mindful of is the potential for lower crude oil prices ahead. The new administration is working on increasing domestic energy production, seeking lower prices at the pump for Americans.

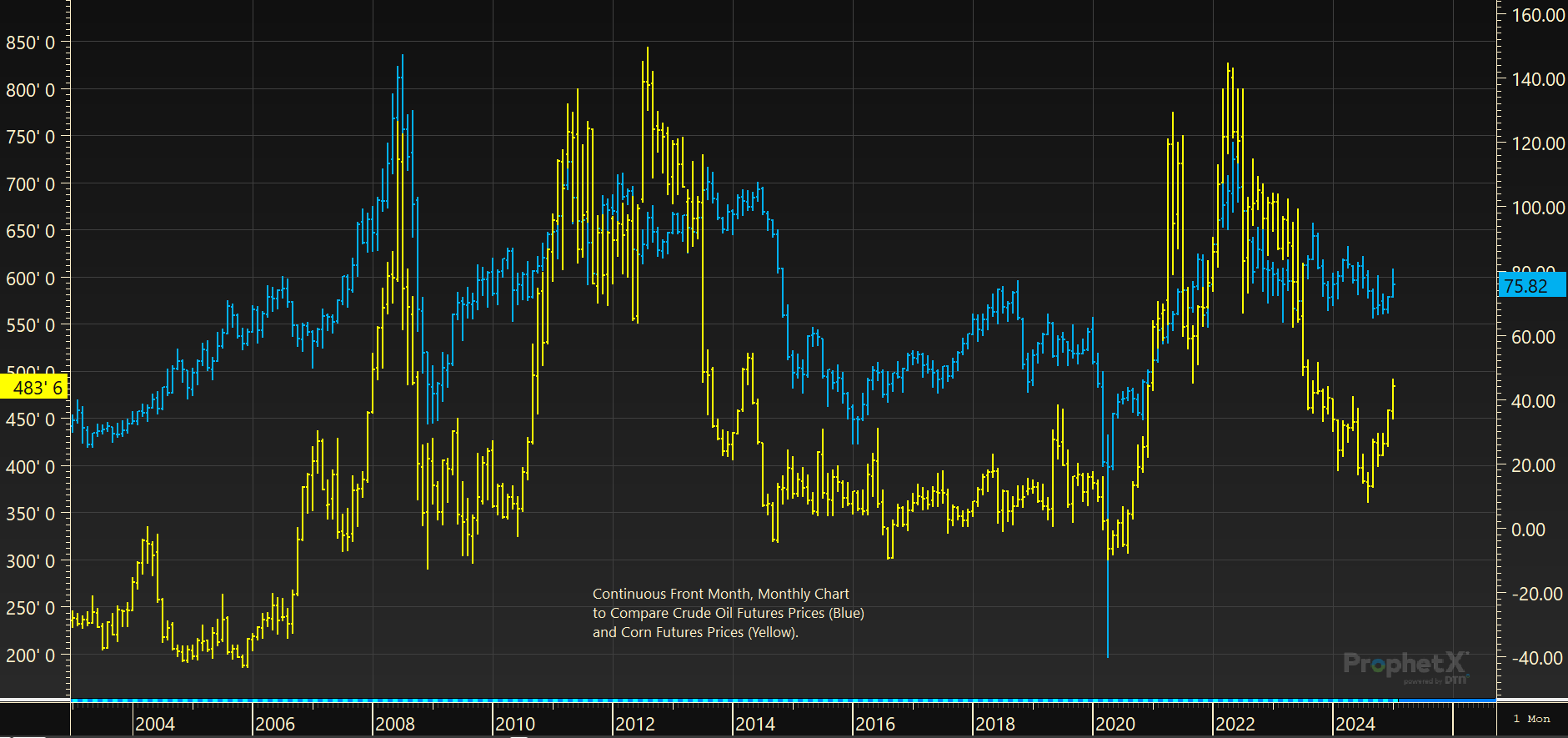

This will not be an overnight action. It may take some time. Keep in mind the historical correlation between crude oil prices, ethanol prices and corn prices. They do tend to trend together, higher or lower, depending on market fundamentals.

Prepare yourself

With corn fundamentals back to having a supportive undertone thanks to the surprise friendly January USDA report, corn prices may act with volatility depending on future fundamental updates. We are back to facing global weather uncertainty, future U.S. demand uncertainty should there be a trade war, along with the future of biofuel demand back to being slightly hazy.

One cannot guess markets or price reaction. With the uncertainty and volatility that lie ahead, be prepared with a scenario plan that protects in case corn prices drop due to a trade war, or a plan that is aware of a rally in case Mother Nature has a trick up her sleeve.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.