Farmers became the unintended victims of the trade war between the U.S. and China launched during the first term of President Trump. Federal aid partially cushioned the blow from Beijing’s retaliation, which crushed U.S. soybean sales by more than 22% before the calvary arrived with some $23 billion in assistance.

To be sure, farmers did their part, slashing soybean acreage in 2019 due to poor prices – not to mention disastrously wet spring weather that parked drills and ultimately also caused yields to plunge. Exports quickly bounced back once cooler heads struck a trade deal and the weather cooperated, helping production recover. Net farm income posted calendar year records from 2021-23, lifting near soybean futures to test the all-time highs reached during the 2012 drought year.

How things have changed! Despite China’s deep economic troubles and weaker soybean demand, trade war lows around $8 aren’t anywhere near in play as 2025 begins. One reason: Both the U.S. and China replaced tough talk with a back-and-forth exchange that sounds much more like normal negotiating tactics.

Still, fallout from the president’s attempt to rebalance trade remains a wild card for U.S. soybeans and the rest of agriculture. The key could be whether other partners, especially neighboring Canada, perfects the same two-step learned by China. If they don’t dance to the same tune, higher costs for fuel and fertilizer could surface quickly for growers who don’t lock in inputs soon.

Blame Canada

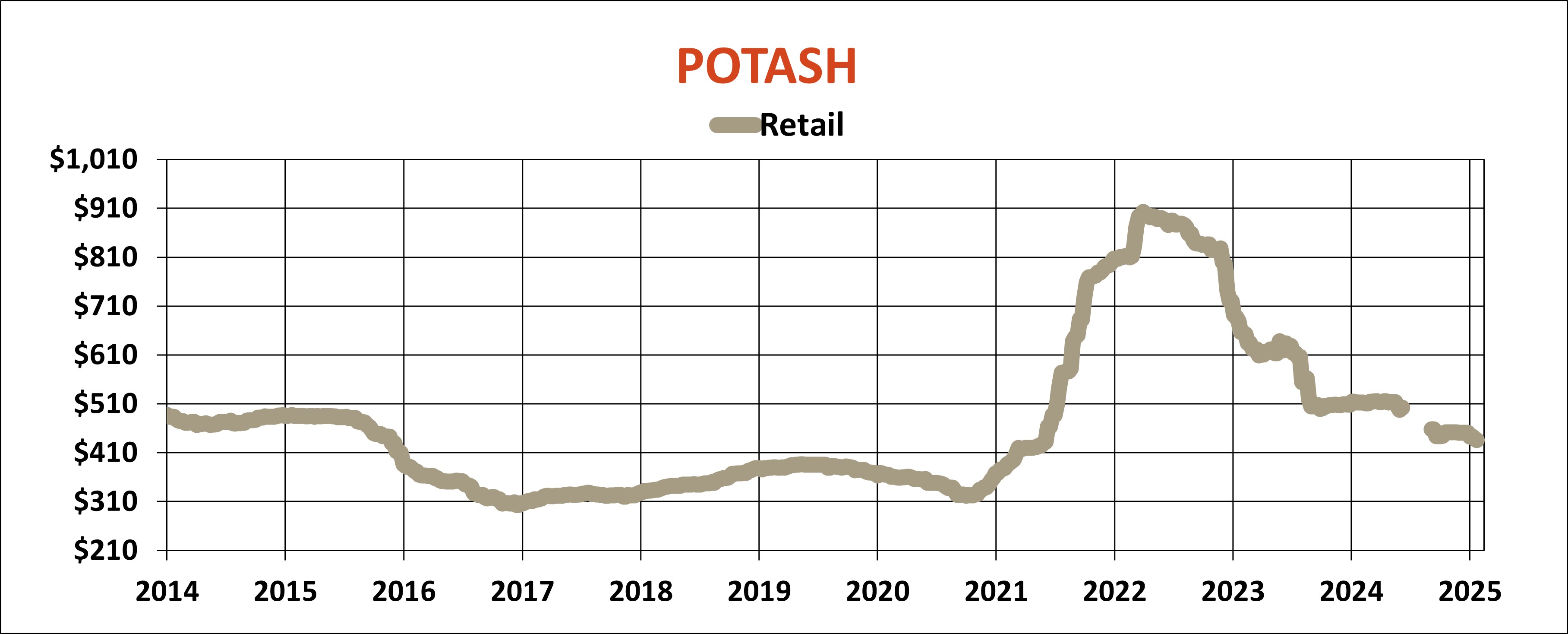

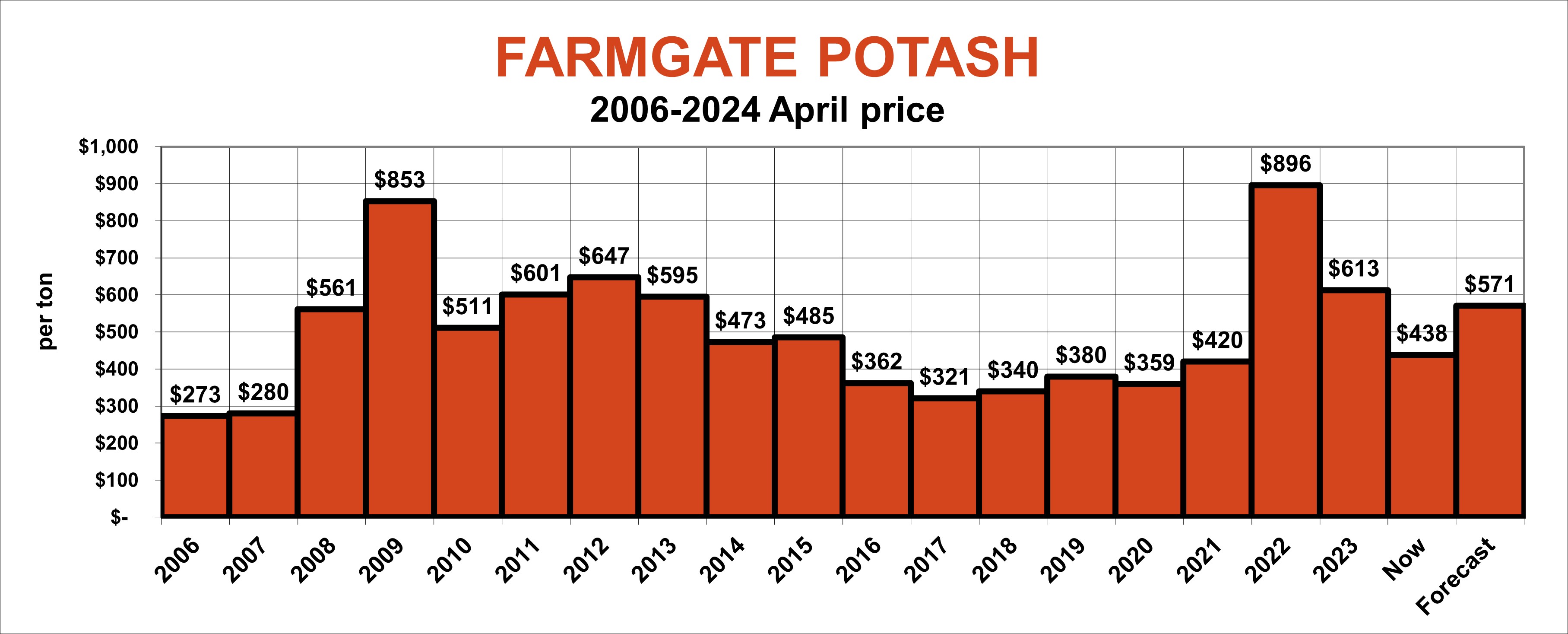

Potash appears most at risk of sticker shock unless growers cut back applications and instead mine soils to stretch budget dollars. That could be a tempting alternative since the average producer put down 15-20% more K on fields in 2024 – but will it be needed?

If it is, “Blame Canada,” as the guys from South Park put it back in 1999. Around 80% of the potash used in the U.S. comes from large mines up north, making the nutrient one of the most Canada-dependent goods crossing the border. That puts it smack in the crosshairs of any conflict, though it also raises risk for a circular firing squad if tit follows tat.

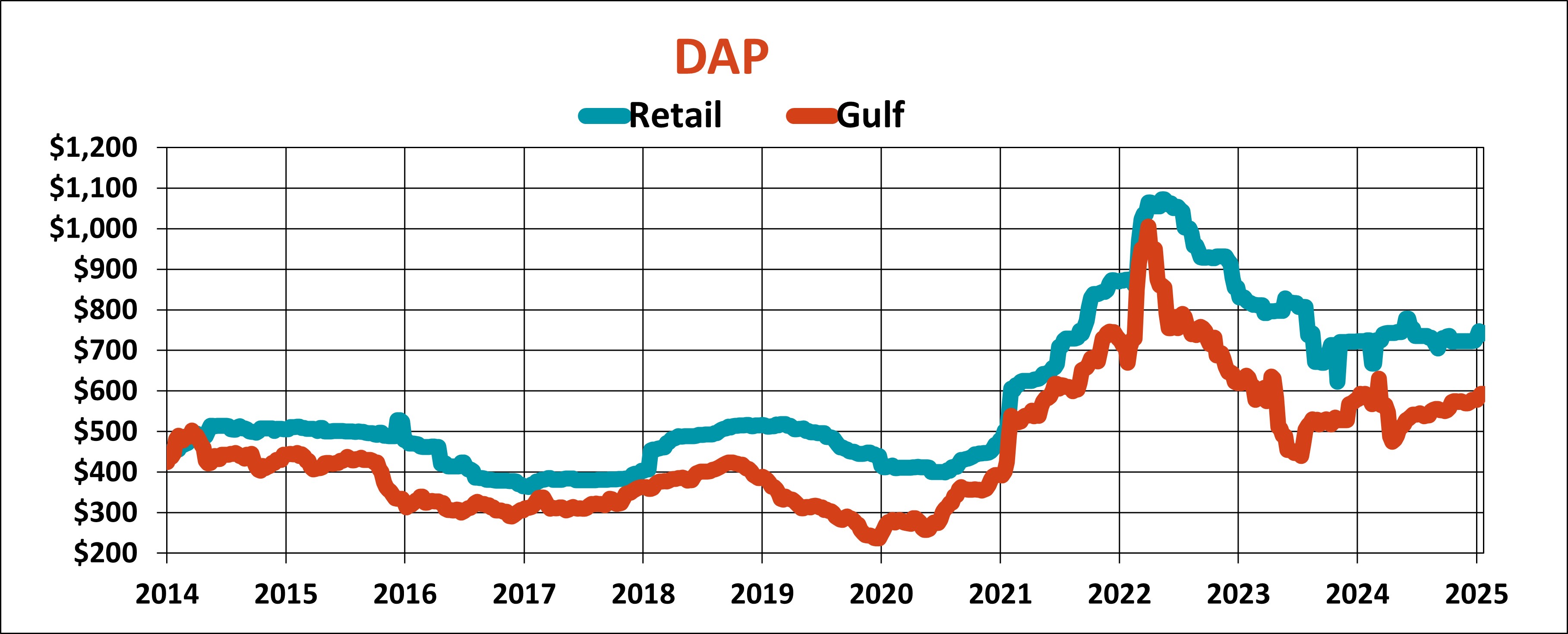

Other inputs face plenty of questions too, including nitrogen, phosphates and energy. The U.S. slapped Russia and Morocco with penalties on DAP and Russia’s huge supply remains threatened by its invasion of Ukraine. Canada also provides some 60% of U.S. imports of crude oil, though Trump vowed to withdraw from the Paris Climate Accord and “Drill Baby, Drill” to unleash U.S. production.

The president also sees oil as the key to cooling inflation, arguing lower energy prices should give the Federal Reserve plenty of room to slash interest rates, though no action on monetary policy is expected at the end of the central bank’s two-day meeting Jan. 29. Betting on Federal Funds futures doesn’t see that happening until May at the earliest, though lower borrowing costs could cut both ways for growers due to potential impacts on the value of the U.S. dollar.

Dollar diplomacy

The dollar plunged last week after getting a boost past two-year highs. Investors tend to place bets on currencies according to the strength of their underlying economies, so some investors bought Greenbacks to take advantage of “U.S. Exceptionalism” if the American economy far outpaces Europe, Asia and the rest of the world’s emerging markets.

A weaker dollar tends to be bullish for dollar-denominated commodities, so the currency’s drop could influence prices for grains and energy.

Some of the early dollar strength also came as a hedge against a breakdown on Wall Street. That prospect faded last week, thanks to new all-time highs on the S&P 500 Index, giving traders an opportunity to look at alternatives, including gold. The precious metal posted its own record London fix, as some investors feared tariffs – 25% on Canada and Mexico, and 10% on Chinese imports – could trigger inflation. Bullish bets by large speculators on corn jumped to the highest level in more than two years but buyers hit the brakes on soybeans, as lower taxes on Argentine exports could cut into U.S. hopes.

Buying time

Despite all these machinations, locking in spring inputs remains job one. Here’s on where fuel and fertilizer stand.

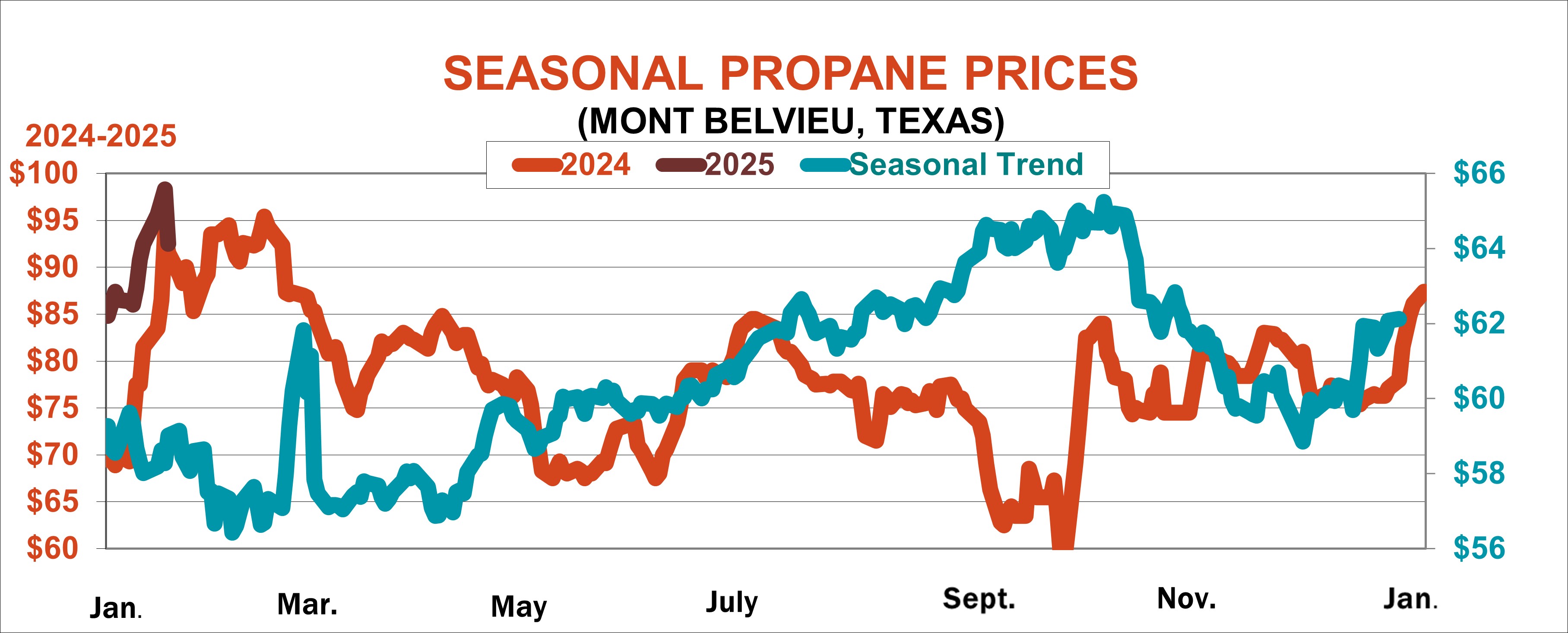

- Propane costs tend to weaken into the end of winter, with opportunities into summer some years as well. But in 2024 buyers also got a chance into the end of September – before the market jumped more than 25 cents a gallon in little more than a week during harvest.

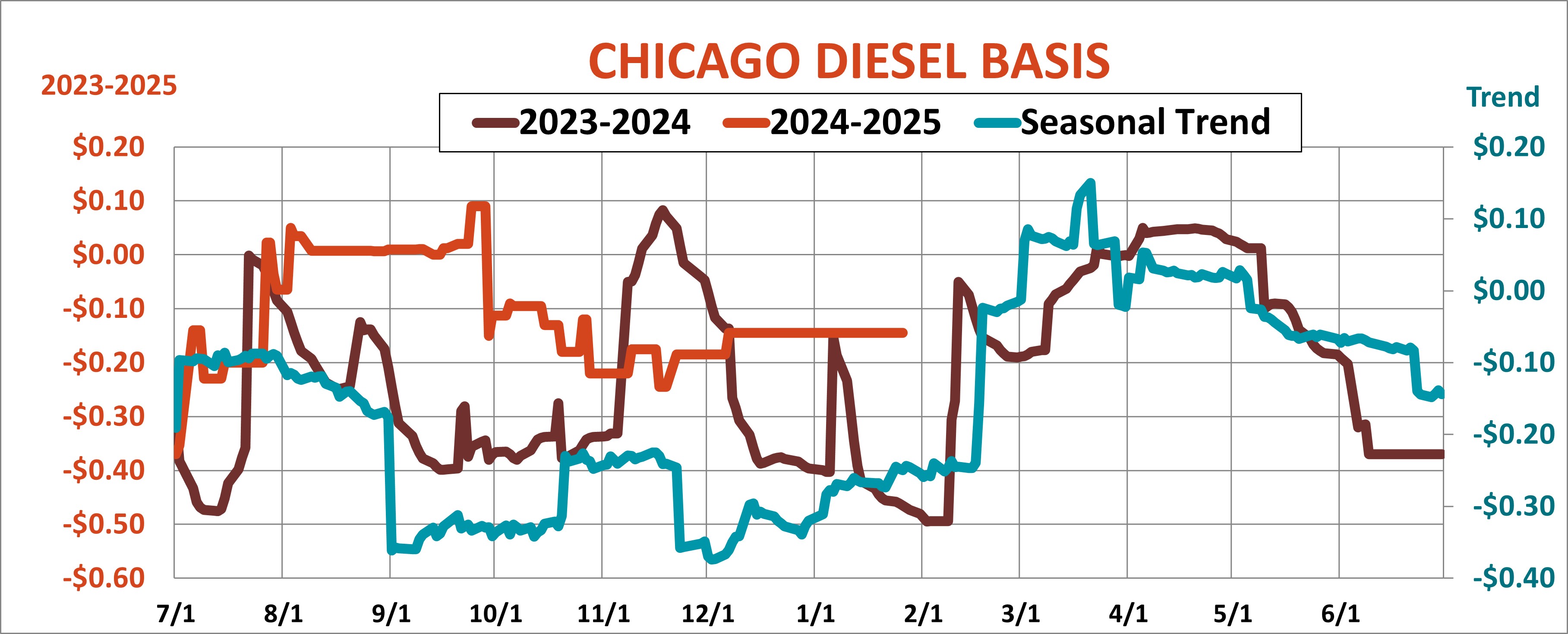

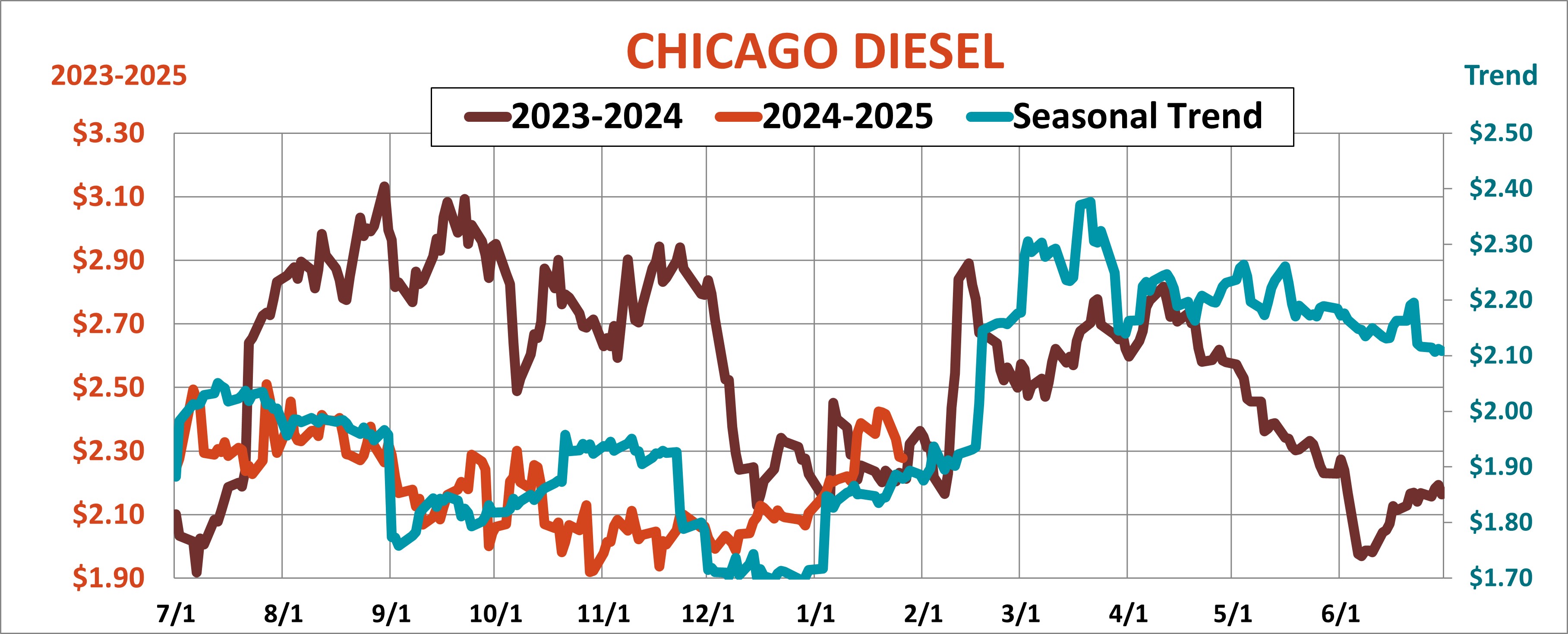

- Diesel prices tend to be weakest after harvest, when agricultural use fades, then rally into spring planting. For clues, watch your basis – in this case the difference between cash prices and futures delivered in New York Harbor. Chicago bids are higher than normal but could firm even more when farmers refill tanks.

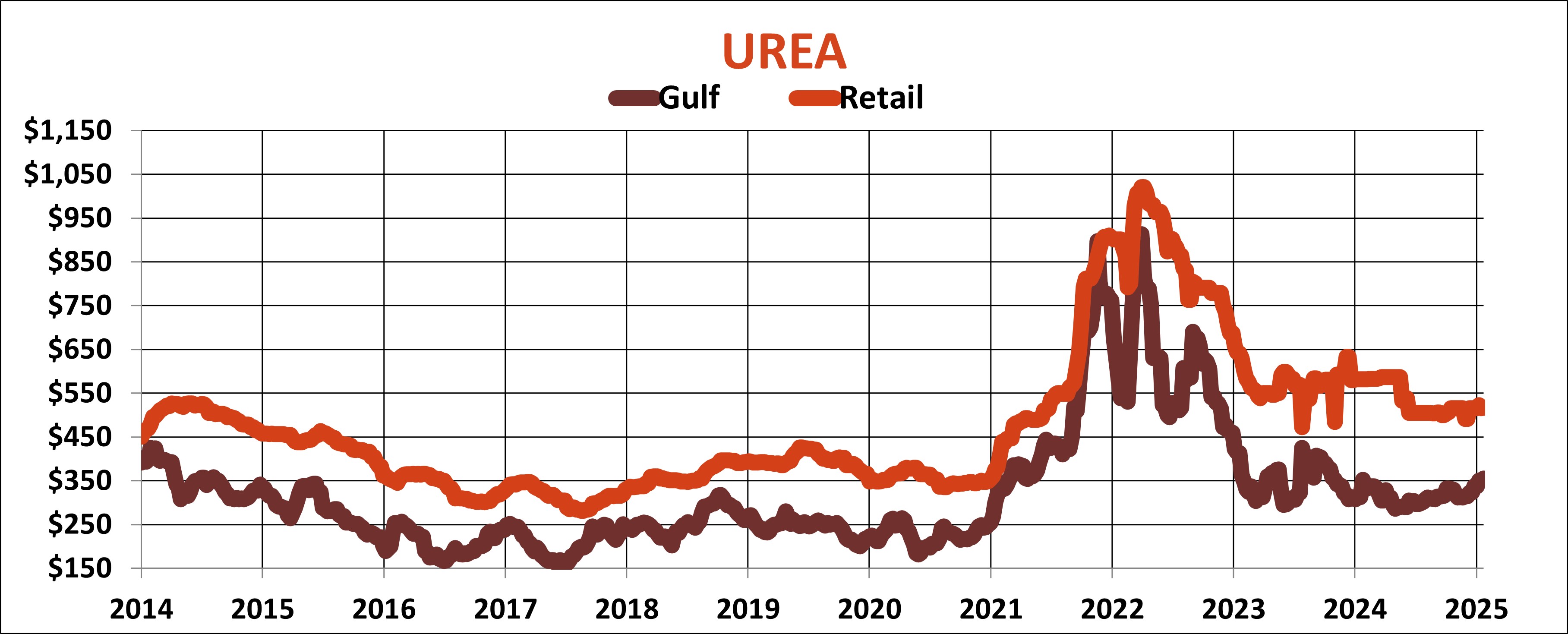

- Ammonia swaps settled at the Gulf for December broke more than $30 a short ton. Based on current values, anhydrous could have around $50 upside risk into spring, though that also assumes supply chains from plants on the southwest Plains and Midwest to trains and barges on the river system functions normally. Otherwise, spring squeezes could be more painful. Wholesale UAN and urea value have already rallied toward the tops of 2024 ranges.

- Phosphates at the Gulf are priced about the same as spring 2024 levels, suggesting tariffs and Ukraine are question marks for 2025.

- Potash looks the cheapest – at least relatively – of any of these markets, with on-farm costs down around half from 2022 highs.