While “eggflation” continues to garner mainstream headlines due to historically tight egg supplies and record-high grocery store prices, dairy heifers ready to enter the milking herd have become another agricultural headline due to tight supplies and high prices.

“However, dairy heifers are not making national news because consumers aren’t directly buying those animals,” says Corey Geiger, lead dairy economist for CoBank.

Fewer dairy heifers

USDA just released its Cattle report, Geiger says. “Any way you work the corral, there’s fewer heifers in that corral with each passing year as dairy farmers pivot to breeding dairy cows to native beef bulls to capitalize on record beef prices,” he explains. “That trend will not slow down anytime soon, as live cattle futures have pushed into the $200-per-cwt range and represent an all-time high.”

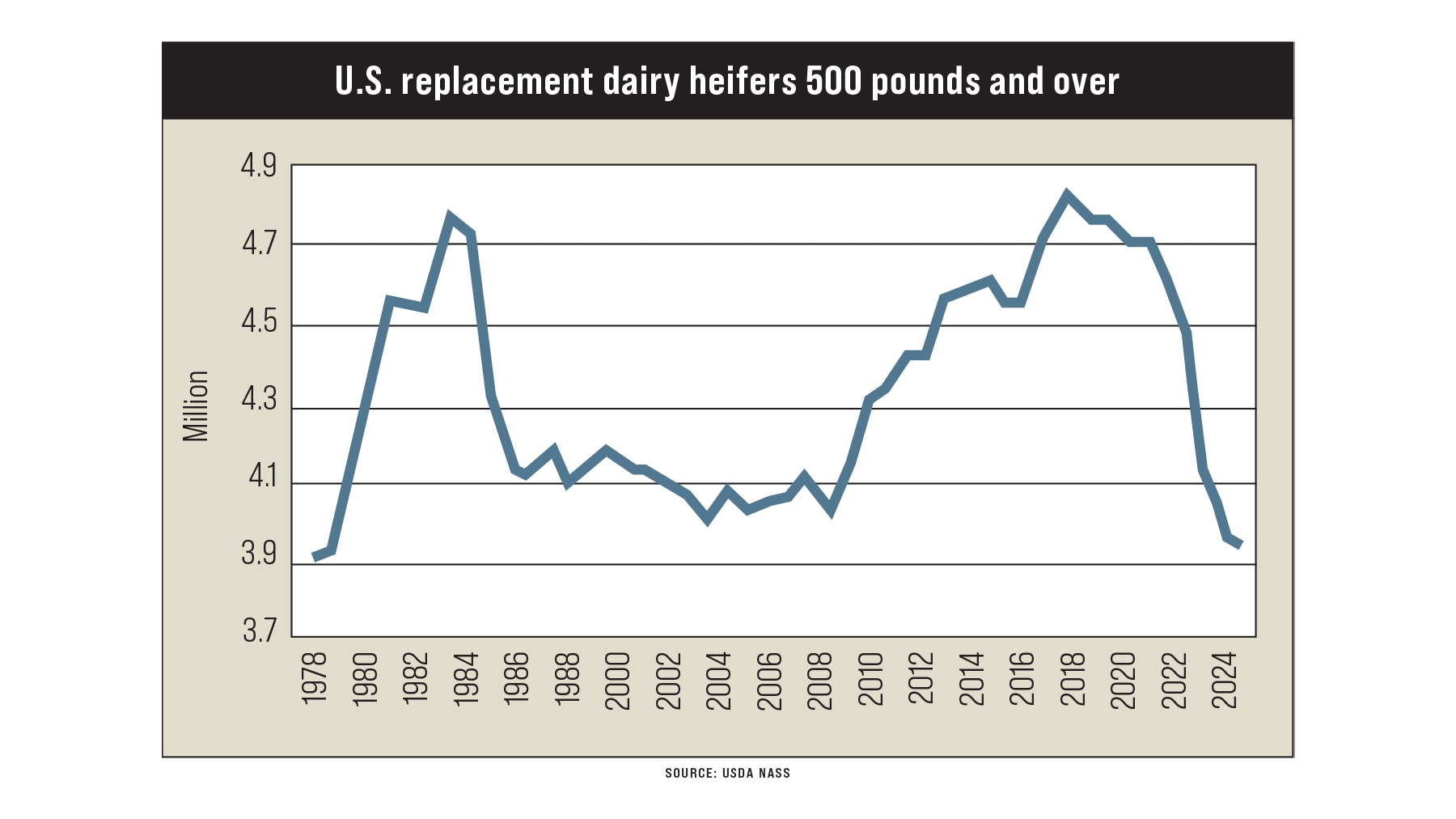

In its latest estimate, published in late January, USDA projects there are 3.914 million dairy heifers in the 500-pounds-and-higher category.

“Generally speaking, those dairy heifers 500 pounds and larger are either ready to enter breeding pens or those that are pregnant and will soon enter the milk barn,” Geiger says. “That 3.914 million total is the lowest since 1978, when USDA calculated that there were 3.886 million heifers in that herd category.”

Those market interactions have caused dairy replacement values to soar to record levels, with USDA pegging the average price at $2,660 per head. Vermont leads the nation at $2,930 per head, and Wisconsin is a close second at $2,860, according to USDA’s Agricultural Prices report. On the other end of the spectrum, Kansas is the national low at $2,350, despite new dairy plant capacity coming on line in that region.

“Those prices reported by USDA tend to lag real-time reports from auction barns,” Geiger says. “High-quality Holstein replacement heifers have routinely fetched over $3,000 per head, with some premium heifers receiving over $4,000 per head in California and Minnesota auctions.”

Caught by surprise

If one looks at the latest USDA report, it doesn’t tell the entire story of just how scarce dairy heifers have become. The Jan. 31 Cattle report indicates there are 3.914 million dairy replacements compared to 3.951 million at the same time one year earlier. At a 36,900 spread between the two years, dairy heifer inventories are down just 0.9%. However, that’s only half the story, Geiger says.

“In its latest report, USDA officials revised its original January 2024 heifer estimate of 4.059 million head down to 3.951 million head,” he notes. “That’s a hefty 108,000-head shift in just one year and represents a 2.7% downward adjustment.”

This isn’t the only major revision. As reported in CoBank’s report Dwindling Dairy Heifer Numbers May Inhibit New Milk Production, USDA had a similar adjustment on its January 2023 numbers.

“Between 12 months of reporting, the federal agency shifted heifers down from 4.337 [million] to 4.073 million head — a 263,600 adjustment, or a 6.1% shrink, largely propelled by the beef-on-dairy super-trend,” Geiger says.

When these two adjustments for January 2023 and January 2024 are combined into one number, it means USDA revised its dairy replacements down by 371,600 head for an 8.6% reduction.

What does this mean?

“The beef-semen-on-dairy-cow trend is taking hold like shoppers looking to grab deals on a Black Friday shopping spree,” Geiger says. “In this particular case, the beef-on-dairy trend shows no signs of slowing as long as beef cattle numbers remain in retreat. As for looking to the horizon … when the National Association of Animal Breeders releases its 2024 sales data, the 7.9 million units of beef semen sold to dairy farmers could push to the 9 million-unit range.”

Looking at the bigger picture

Dairy replacements 500 pounds and larger is just one of 14 metrics released in the Cattle report. The largest figure — all cattle and calves — stood at 86.6 million head in January.

“That’s the lowest total since Harry Truman was serving his second term as president in 1951,” Geiger says. “In those days, the U.S. had 150 million residents, not the 341 million folks living here at the start of the new year. Simply said, beef supplies are mighty tight.”

Of those 14 categories, the only category that showed any improvement was dairy cow numbers. That category creeped higher by 2,500 head. That took place largely because dairy farmers culled 367,000 fewer cows in 2024, based on data from USDA’s Food Safety Inspection Service.

Another important metric — dairy replacement heifers expected to calve — fell to 2.922 million head. That’s the lowest since USDA began tracking the statistic in 2001, Geiger notes. “What’s more, each of the last three successive years have posted new lows,” he adds.

When evaluating one final measure — ratio of heifers to cows — the 41.9 ratio is the lowest since 1991, when there were 4.122 million heifers and 10.3 million dairy cows.

What might be USDA’s next cattle forecast?

Geiger says dairy heifers will remain tight for the next two to three years at a minimum “because the U.S. dairy herd is like an ocean liner, and it takes three years from conception to reach the milk barn. That would be the time necessary to make more heifers,” he says.

“Then there’s two more economic facts,” he adds. “It takes well over $2,000 to raise them, and newborn beef-on-dairy calves are fetching between $600 to $900 per head within a week of birth. Since consumer demand for beef has remained relatively strong, dairy farmers will look to capitalize on these high prices for the foreseeable future.”