Soybean harvest and safrinha crop corn planting picked up speed in Brazil last week. But that doesn’t mean South American farmers are in the clear this season.

Soybean prices have dropped below production cost, reports Matthew Kruse, president of Commstock Investments, who farmers in Iowa and Brazil. Soybean production cost in Brazil sounds like a bargain at $520 per acre, but Kruse reports cash prices are trading at about $8.30.

“As the harvest glut is hitting the market, we create these seasonal lows that are pretty common in Brazil this time of year,” Kruse says in this video. With an average state yield of 55 bu/a per acre, he says farmers there are projected to lose about $62 per acre. “So, it’s kind of a money-losing proposition right now planting beans in Brazil,” he says.

Ultimately, the soybean price situation in Brazil could work to the advantage of U.S. growers.

“If they're not making money, they're not going to want to expand near as quickly,” Kruse says.

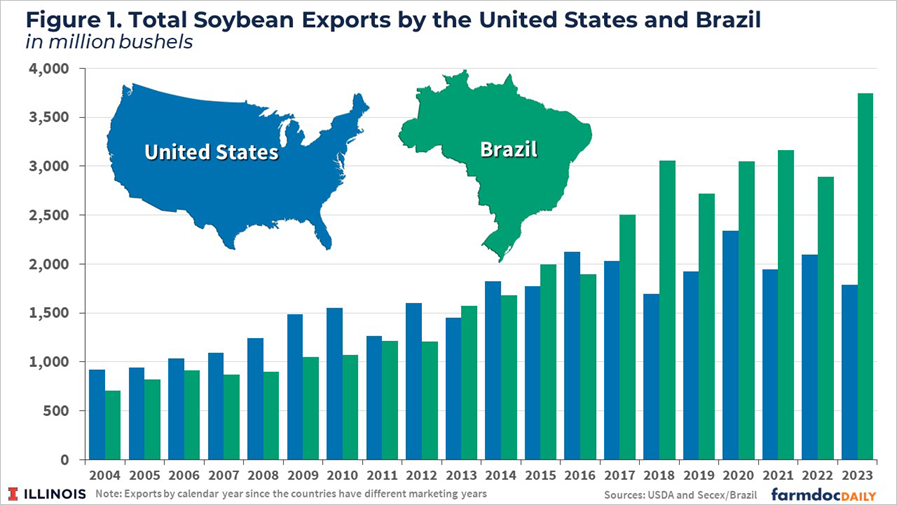

That’s a positive for U.S. growers because Brazil led soybean exports for the first time in 2013 and has been a fierce competitor since.

“Since then, Brazil’s share of the global soybean trade has grown steadily, with Brazilian soybean exports reaching a record 3,744 million bushels for the 2023 calendar year, according to the Foreign Trade Secretariat (Secex),” according to a recent farmdoc report. “At the same time, American soybean exports were reduced to 1,789 million bushels, half the Brazilian soybean export volume, according to the U.S. Department of Agriculture.”

The result is the U.S. is less dependent on China for soybean export demand but still doesn’t enjoy the demand it once did.

“The recent history of the US-Brazil-China soybean trade triangle points to a trade-off between resiliency and growth in commodity marketing. The U.S. has managed to diversify its soybean use which may make markets for U.S. soybeans more resilient in the face of future shocks,” the farmdoc report says. “However, it has failed to capture the growth in global soybean demand due to Chinese imports, which has mainly gone to Brazil.”