Crop insurance is a proven, valuable tool in a comprehensive risk management strategy. However, an updated review of various policy coverage levels and yield scenarios for 2025 highlights the limitations of relying solely on crop insurance to manage price risk. This is especially the case when actual yields exceed the APH, which has been seen in some areas.

Selecting a policy for your operation is an individual decision based on a variety of factors. Rather than focus on the policy decision, our objective in this article is to highlight the limitations of relying solely on crop insurance to manage price risk.

Corn Example: 185 bushels/acre APH

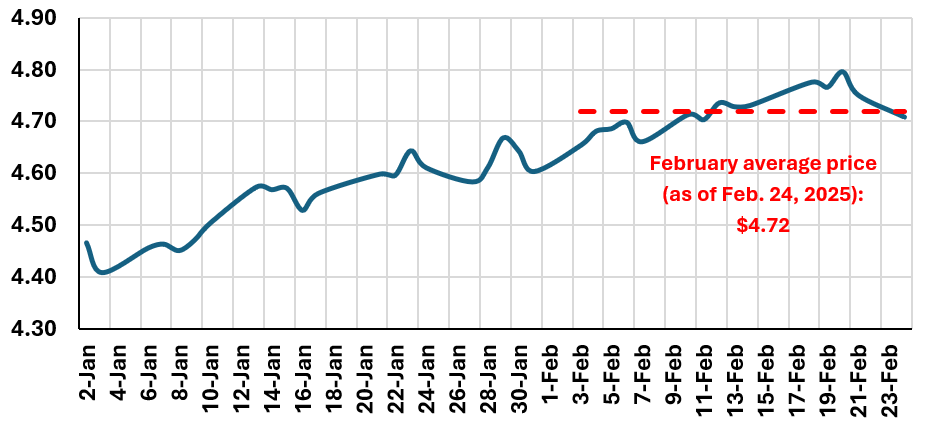

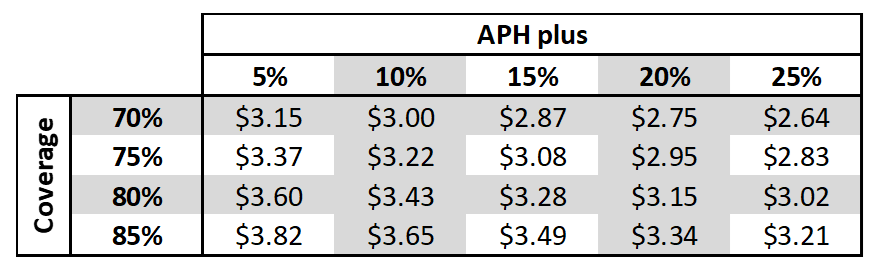

Crop insurance base prices for 2025 will be set based on February numbers. We are focusing on corn in this article, where the base price is projected to be near $4.72 (Figure 1). Specifically, let’s look at various policy coverage levels and yield scenarios for 2025. The grid below (Figure 2) spotlights the price at which an indemnity will be paid if the actual yield exceeds the Actual Production History (APH) by a certain percentage.

For example, a producer with an APH of 185 bushels per acre, and 85% coverage has a revenue guarantee of $742.22 [(185 × $4.72) × 0.85].

Downside protection. Effectively, this provides downside price protection to $4.012 ($742.22/185).

Indemnity. Looked at another way, under these assumptions, an indemnity would be received if the average price of December ‘25 futures in October was below $4.012.

Yield higher than APH. However, one key limitation of utilizing crop insurance alone is what occurs when the realized yield is above the APH. This has been seen in some areas in recent years, e.g., if the realized yield were 5% above the APH (i.e., 185 × 1.05 or 194.25), then the average price of December futures would have to be below $3.82 ($742.22/194.25).

At higher percentage levels above the APH, the lower the net price afforded by crop insurance alone. If the actual yield were 20% above the APH with 85% coverage, the average price of December futures would have to be below $3.34 before crop insurance pays.

Consider options. This scenario is where options can fit in well, especially in the situation that the final price used to determine crop insurance indemnities will only be discovered at harvest, at the end of October. In this case, for example, a put option could be purchased to provide downside price protection while, at the same time, providing the opportunity to participate in a stronger market.

Various factors may potentially affect market prices and volatilities until harvest, such as uncertainty regarding a possible trade war, the end (or continuation) of the Russia and Ukraine conflict, the development of production (and exports) in South America, domestic and international corn demand, the 2025-26 corn crop in the U.S., etc.

Record planted corn acres?

Regarding the size of the new corn crop in the U.S., even though most farmers in the country will likely start planting their crop in April (depending on future weather conditions), the USDA will release initial projections for 2025-26 corn crop production later this week during the Agricultural Outlook Forum (February 27-28).

A recent Bloomberg survey asked analysts to predict USDA’s initial projections for area, production, and ending stocks. On average, analysts expect an annual increase of 2.9 million acres in corn planted area to 93.5 million acres in 2025-26, versus 90.6 million acres last year, with the trading range varying from 92.0 to 95.1 million acres. The projected number suggests planted acres in 2025-26 to be the sixth largest on record.

Top five years for corn planted acres:

- 2012-2013, 97.29 million acres

- 2013-14, 93.67

- 2023-24, 94.64

- 2016-17, 94.00

- 2007-08, 93.53

The recent price ratio between November soybean futures versus December corn (2.23) supports the analysts’ guess of an increase in corn acres in 2025-26. Soybean planted acres are expected to drop from 87.1 million acres in 2024-25 to an average estimate of 84.4.

Analysts expect USDA to peg 2025-26 corn production at 15,487 million bushels, a 4.17% annual increase which, if confirmed, would be a new record high. The prior record, set in 2023-24, is 15,431 million bushes. The trade estimates for corn production range from 15,000 to 15,823 million bushels.

Guess 2025-26 ending stocks

The average trade estimate of 1,907 million bushels for corn ending stocks in the 2025-26 marketing year represents an estimated increase of 0.367 million bushels (+23.83%) compared to the current projection of 1,540 million bushels for 2024-25, and the largest value since 2019-20. Trade guesses for next year’s corn ending stocks range from 1,635 to 2,180 million bushels.

The estimates to be released this week will serve as references for market participants until the USDA provides two other important survey-based reports on March 31: the Prospective Plantings and Quarterly Grain Stocks. The Prospective Plantings Report is the “first survey-based estimates of U.S. farmer’s planting intentions for the year.”

As students of the market, we all know that price prediction is impossible. With so many “what ifs” possibly affecting the corn market before crop insurance price is determined, it is important to review scenarios for your operation before you develop and implement a marketing program tailored for your particular circumstances.

Contact Advance Trading at (800) 747-9021 or visit www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures: The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance does not necessarily indicate future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.