Planting more corn and less soybeans seems like a no-brainer for 2025. And that’s just what USDA forecast last week at its annual Outlook Forum. The agency said a drop of 2.3 million soybean acres will help promote the addition of 1.7 million more acres of corn.

But do the oilseed’s prospects really look so bleak? Or could soybeans turn out to be the dark horse choice for 2025? While neither crop comes close to breaking even, based on average costs, history suggests red ink for soybeans could wind up a lot less than the triple digit losses projected for corn.

So, if beauty really is in the eye of the beholder, here’s what growers may be seeing.

Beans don’t look that bad

The key is the metric used for comparison.

Traders faithfully track the ratio between new crop futures for soybeans and corn – in this case November 25 soybeans compared to December 25 corn futures. The “smart money” looks to the ratio for guidance about the choices USDA may reveal in its end of March Planting Perspectives.

The ratio bottomed just above 2.20:1 as we headed into the Outlook Forum and traders anticipated a shift to corn and worried about the impact of tariffs, especially on soybeans. USDA indeed forecast farmers will plant 1.3 million more acres of corn and 2.1 million fewer acres of soybeans.

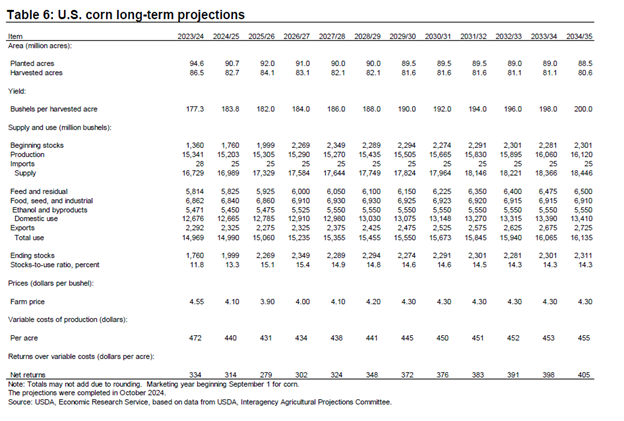

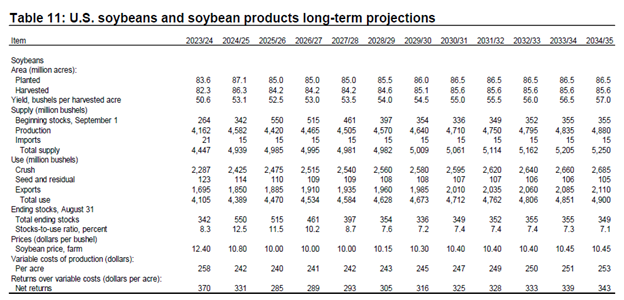

But the ratio of season-long cash prices received by farmers in the Outlook is closer to its long-term average. USDA forecast corn at $3.90 with soybeans at $10 – a ratio of 2.56 to 1. So, are futures down too far on corn?

The market isn’t always right, but in this case, it may not be completely wrong, either. Add in protection from government farm programs and crop insurance – which normally have March 15 signup deadlines – and the choice could indeed lean toward soybeans. While neither crop would make a profit per acre based on average costs, soybeans would lose a lot less than the triple digits of red ink projected from corn. And USDA’s updated “baseline” forecasts show soybeans earning $6 per acre more than corn when returns over variable costs per acre are considered.

So, get ready to hear plenty about corn, soybeans and the Ides of March in coming days – not that Shakespeare or Julius Career worried much about 50-50 rotations.

Not just a garage band

The Ides of March were a fixture of my Chicago youth – a garage band that played all the clubs and sock hops.

Columbus, of course, brought corn to Europe after his first voyage to the New World in 1492. It didn’t attract much attention for a couple of centuries. When soybeans coincidentally arrived from Japan and China in the 1700s, it’s unlikely Shakespeare – of his famous character Julius Caesar – knew much about either.

Growers need not worry about the Ides of March for farm program signup, though some could find the new date ominous since it comes on Tax Day, April 15, due to provisions in the American Relief Act targeting low income and disasters.

Still, March 15 marks the deadline for most farms to sign up for crop insurance, one of the last steps before planters roll.

Get ready to lift

Corn needs some heavy lifting to win back more acres, at least on paper, thanks to costs near $871 per acre, or $4.77 per bushel from fields averaging 182 bushels per acre.

The soybean math puts costs for that crop at $624.77 per acre – $11.86 per bushel for trend yields of 52.7 bpa. But returns over variable expenses predict around 55% of the variance in corn profits, compared to less than 30% for soybean operating profits. Not surprisingly, corn costs are aligned with seed and fertilizer expense, while chemicals, repairs and labor move with soybeans.

And the competition? It’s not standing still, according to the Outlook:

“Brazil’s soybean exports are projected to rise 29 million tons (26.9%) to 137 million tons by 2034-35. This will strengthen Brazil’s position as the world’s leading soybean exporter, accounting for 77.5% of growth in global trade.”

“Soybeans remain more profitable to produce than other crops in most areas of Brazil.”