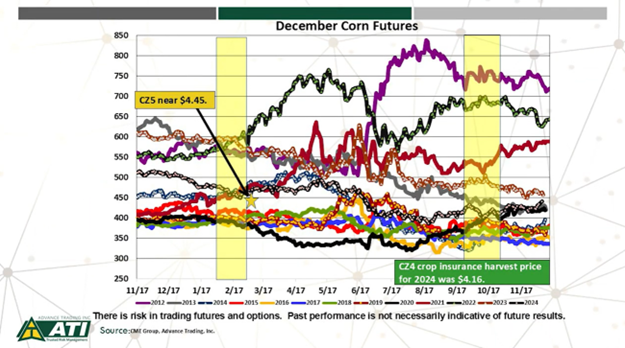

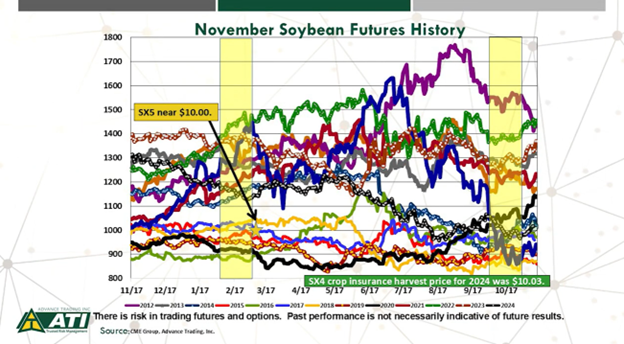

We’ve made it through the crop insurance averaging month of February, and hopefully, the long days of winter are behind us. The next month serves as the on ramp to the busy part of the growing season.

As one colleague used to say, it’s the start of “Silly Season”—a time when markets can experience intensified volatility during the U.S. growing season. This period begins between February, the first crop insurance averaging month, and can extend to, or even through, October’s fall averaging period.

Here are some key market drivers to watch in the coming season:

Are U.S. demand and acreage numbers blurry?

Plenty of debate already rages around U.S. acreage numbers and what trendline yield should be but expect many more adjustments to those figures.

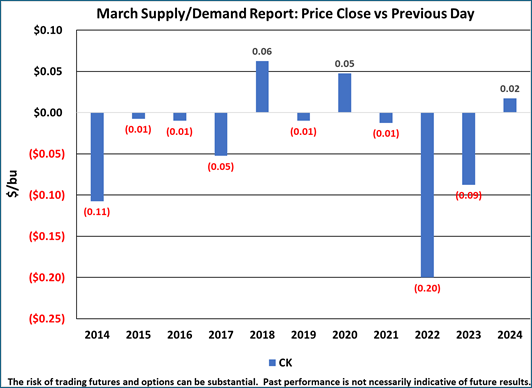

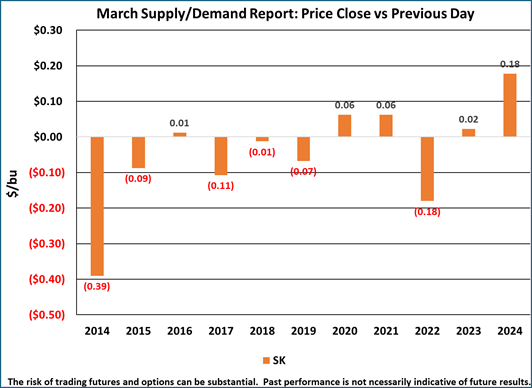

While USDA largely left U.S. balance sheets unchanged in this week’s WASDE report, including the pace of corn exports, the real focus this time of year is on March 31, when USDA releases its Prospective Plantings and quarterly Grain Stocks reports. Will the significant increases in corn acreage and decreases in soybean plantings come to light then? Weather will also play a role in shaping these outcomes.

Will South America’s crops change size?

While much of Brazil is nearing the finish line for its soybean harvest, the final crop size and demand outlook remain subject to change. A late soybean harvest delayed the start of the second corn crop, known as the safrinha, potentially increasing weather-related risks in April and May. Keep an eye on how these developments unfold in the Southern Hemisphere.

Ride out the tariff storm

If there’s anything we learned from the first Trump term, it’s that tariff news and rhetoric can shift by the minute (or tweet). And this situation won’t go away in the next six to nine months. During Trump’s first term, tariff effects lingered into the second year and beyond. Keeping up with the latest tariff developments and retaliatory action could be a full-time job.

While these factors can significantly impact your operation and bottom line, they’re beyond our control. My job is to help you tune out the noise and stick to a plan. It’s essential to remain consistent and disciplined, despite the added volatility associated with trade policy.

All these market drivers can undoubtedly complicate grain marketing in the weeks and months ahead, but it doesn’t have to be overwhelming. Having a solid plan in place now can cut through the noise and keep you focused on the tasks at hand. After all, preparing the planter, securing seed, starting fieldwork and such are just around the corner.

Establish a floor – then look up

Set your grain marketing plan now to help you stay disciplined. Cleaning up old crop bushels frees you up to focus on your 2025 production and marketing strategy. Here are three moves to consider.

- Sell corn where basis is firm and delivery is feasible, then spend 13 to 20 cents on a July corn call for a portion of your sold bushels. This establishes a price floor while retaining upside flexibility into June, especially if a weather market emerges here or in South America.

- A great starting point is to establish price floors by making a cash-sale and simultaneously purchasing a call to provide upside flexibility. In addition, options can be purchased on the remaining, unsold projected production.

- It also can be wise to place offers now for the next sale opportunity on 2025 and ’26 crops.

Just because we’re entering the “Silly Season,” and markets may act irrationally, doesn’t mean your marketing plan should follow suit.

If you need help or have questions, please contact me at (300) 664-4346 or find us at advance-trading.com/contact-us.

For more insights and personalized advice, consider consulting with a professional risk advisor. Their expertise can guide you through these volatile times, ensuring that your marketing strategies are both effective and resilient. With the right plan in place, farmers can navigate the uncertainties of the market and make informed decisions that support their financial success.

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.