The Trump administration’s trade policies have resulted in uncertainty in the agricultural markets. China, the EU and Canada’s reaction was to implement reciprocal tariffs on U.S. agricultural commodities. This is not much different than what happened during President Trump’s first term.

Uncertainty at the beginning of a new administration is not new. A favorite quote of mine was written in 1907 by Reed Anthony, "Cattleman: An Autobiography," (Andy Adams, A Public Domain Book, 1907).

"I now understand perfectly why the business world dreads a political change in administration. Whatever may have been the policy of one political party, the reverse becomes the slogan of the other . . .. Politics had never affected my occupation (cattle) seriously; in fact, I profited richly through the extravagance and mismanagement of the Reconstruction regime in Texas and again met the defeat of my life at the hands of the general government."

Just because uncertainty is not new doesn’t make making decisions any easier. History shows that the market adjusts to change and will provide a profit over time. The current uncertain situation is one reason why plans and strategies are a necessity.

At this writing, wheat may be forward contracted for 2025 harvest delivery in Pond Creek, Okla., for $5.46 (KEN25 - $0.55); in Perryton, Texas, for $5.31 (KEN25 - $0.70); in Weatherford, Okla., for $5.26 (KEN25 -$0.75); and in Snyder, Okla., for $5.11 (KEN25 - $0.90).

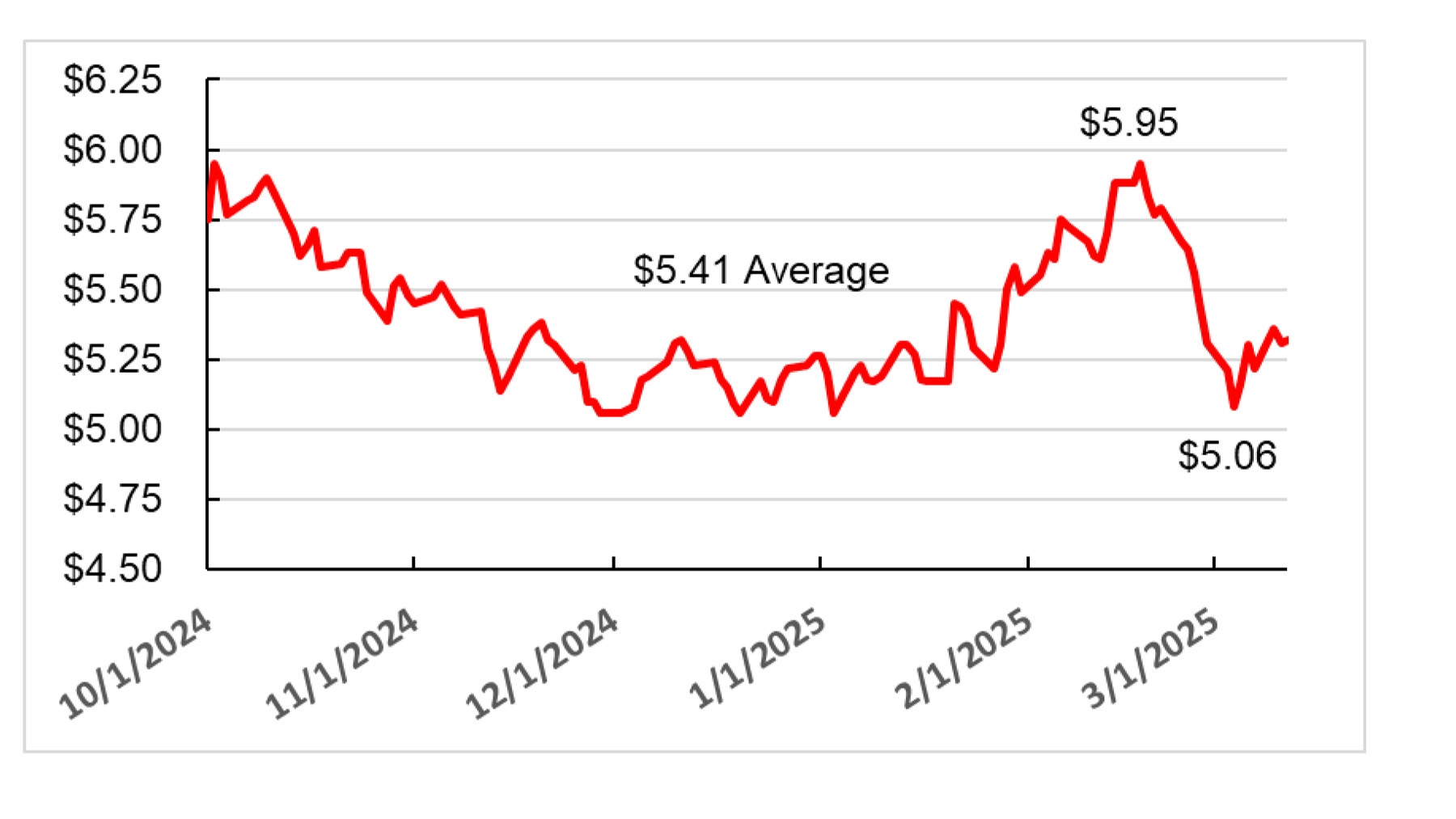

The USDA projected 2025/26 U.S. wheat marketing year prices to average $5.50 compared to $5.55 for the 2024/25 wheat marketing year (USDA Agricultural Outlook Forum: 2025). The average June through August 2024 U.S. wheat price was $5.48. Pond Creek’s 2024 average harvest price (June through August) was $5.25. Pond Creek’s harvest forward contract price of $5.46 is consistent with USDA’s projected average 2025/26 wheat price. Pond Creek’s daily harvest forward contract bids are shown in Figure 1.

Figure 1: Pond Creek Oklahoma daily wheat 2025 harvest forward contract bids.

Source: CoMark Equity Alliance, Enid Oklahoma.

In the March WASDE (World Agricultural Supply and Demand Estimates), the U.S. 2024/25 wheat marketing year stocks-to-use ratio is projected to be 41% compared to a 2009/10 through 2024/25 (16-year) marketing year average of 41%. The USDA also projects the 2025/26 wheat marketing year stocks-to-use ratio to be 41%.

The U.S. 2024/25 hard red winter wheat stocks-to-use ratio is projected to be 57% compared to 49% in 2023/24 and a 16-year average of 50%.

U.S. hard red winter wheat planted acres for the 2025 crop is 24 million, which is 2% higher than the planted acres for the 2024 crop.

A positive price factor is that the world’s 2024/25 wheat stock-to-use ratio is projected to be 32% compared to a 16-year average of 34%.

On March 7, 2025, the USDA reported an average Oklahoma Urea price of $5.52 compared to $5.50 in 2024 (USDA Oklahoma Production Cost Report). Fertilizer prices tend to increase during the summer crop planting season.

Potash was priced at $4.68 compared to $5.16 in 2024. The average MAP fertilizer price was $7.94 compared to $8.40 in 2024. The average Oklahoma farm diesel price was $2.76 compared to $3.18 in 2024.

The USDA will release the first WASDE containing the 2025/26 marketing year wheat, corn, and sorghum supply-and-demand estimates and the world estimates May 12, 2025.

A lot can happen between now and the 2025 wheat harvest. A realistic projection is for 2025 wheat production to be equal to 2024 production. Equal production and demand could result in the same or higher stocks-to-use ratios and equal or lower prices.