The marketing landscape changed quickly last week. Just as farmers are about to turn the corner toward planting, President Trump’s “Liberation Day” action put many in agriculture on edge.

While his tariff decision was discussed for months, I think we were all hopeful something would get settled ahead of time. Since that didn’t happen, it leaves us wondering what the long-term effects might be?

The three main trading partners with the United States – Mexico, Canada and China – account for about 40% of the total value of all goods the U.S. imports and exports. Mexico is the largest buyer of U.S. corn, accounting for slightly under 40% of U.S. exports. Canada is the largest buyer of U.S. ethanol, purchasing nearly 37% of those fuel exports. And China is the largest buyer of U.S. soybeans, accounting for almost half of this country’s exports. However, after last week, those relationships are challenged.

What does history tell us?

In an attempt to figure out what kind of reaction the market might have to all of this; we need to look back to Trump’s first term. In April 2018, the U.S. imposed a 25% tariff on $50 billion worth of Chinese goods. China met that with retaliation on the following day. China imposed a 25% tariff on $50 billion worth of U.S. goods – including soybeans.

At the time, Nov 2018 futures were trading around $10.50/bu. By the end of May, the market saw the U.S. crop was off to a good start and realized China wasn’t coming back to buy beans. Two months later, in the middle of July, Nov futures were down to a rock-bottom price, or nearly $8.25. From that point until the end of 2019, new crop November futures basically traded between $8 and $9 – never even attempting a run back to where they were at the beginning of 2018.

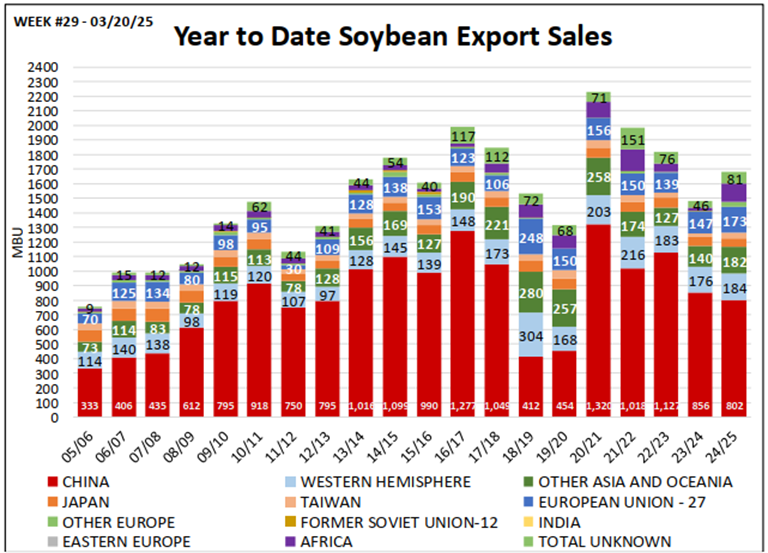

The main thing that happened was China simply stopped buying our beans. From 2013- 17, China annually purchased approximately 1 billion bushels of U.S. soybeans. However, China purchased less than half that many in 2018 and 2019 – 412 million and 454 million bushels, respectively. (See below.) That was a huge burden to the U.S. supply pipeline.

On a positive note, the U.S. and China eventually came together in January 2020, when the two countries sign a Phase 1 deal that would at least halt the trade war. It’s clear that China never actually purchased the promised $200 billion of additional exports the agreement promised. But the deal did at least get the two sides to move forward. Since 2020, China has purchased 800 million bushels or more of U.S. soybeans each year. As a result, November new crop futures rallied above $9 and stayed there.

Three steps to marketing in a trade war

In the middle of a trade war, it’s impossible to predict just what the next move will be from any of the countries involved. So, you need to have a plan in place that will accomplish a couple of things. If you can keep these things in mind, I believe you will have success.

Consistency is the key to successful marketing year in and year out. I too often see customers frustrated with marketing because they change their approach dramatically from year to year. They sell everything ahead of harvest one year. Then, because that didn’t work, they sell everything after harvest the following year. We all know the market doesn’t do the same thing each year, and it certainly doesn’t let us know when it’s about to change course.

So, you keep your emotions in check and stay consistent. If you are comfortable selling 30% in the spring, another 30% during the summer months, and then the rest after harvest, don’t let this trade war change that. Try to set certain target dates for your sales positions and force yourself to stick with them.

Be aggressive. When margins are tight and outside influences are present, being aggressive in your approach is crucial. Waiting around for that second or third pricing opportunity might prove to be a big mistake.

Know your break-even costs and when you get the chance to sell or protect at you’re break-even level, do it on a large percentage.

In years like this, you might not get the chance to lock in at your break-even level. But don’t just give up, move to a different strategy. Consider buying put options or backing sales with calls to give you the ability to “lose less” while at the same time giving you a chance to “win more.” The nice thing with options is they give you the ability to market aggressively since you are protecting a certain price point.

Flexibility. Volatile times can bring big swings to the market. So, as you make marketing decisions for not only 2025 but also 2026, stay flexible.

While it may seem like things are extremely negative, give yourself a chance to gain from a market rally. Often, we get stuck thinking the market won’t ever recover, and then something happens that catches us all off-guard. In the last 5 years, we saw the Iowa Derecho, the Russia-Ukraine War and droughts in Brazil and Argentine, to name a few that gave the market an unexpected boost. And while we all love a rally, the worst feeling in marketing is to when you’re unable to participate because you are sold out.

To avoid that, consider using flexible tools like put options on unsold bushels and call options on sold bushels. You don’t have to use them on every bushel, but you need to include them in your overall approach. They will allow you to gain if that unexpected rally happens while at the same time limiting your downside exposure.

Find a way to enjoy your grain marketing this year. We only get so many crop years to manage during our farming careers. Stay focused, block out the noise and push yourself to make difficult decisions. You will be happy with the results.

Good luck this spring and stay safe!

For more insights and personalized advice, consider consulting with a professional risk advisor. Their expertise can guide you through these volatile times, ensuring that your marketing strategies are both effective and resilient. With the right plan in place, farmers can navigate the uncertainties of the market and make informed decisions that support their financial success.

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.