What a week it has been already. Tariffs, tariffs, and more tariffs. That has been the buzz around markets as of late, and the number one question is: What is going to happen as we go forward?

Unfortunately, I do not have the answer to that question in this article, however a person can make some strategic market moves to help protect themselves from all this volatility. I want to preface this article by noting that with the tariff war escalating quickly, a totally different discussion regarding may be happening on this issue by the time you read this.

As of this morning, President Trump’s 104% tariffs on Chinese goods are in force. That’s right, anything from China will now be more than double the price it was before any tariff plans were announced. So, the question is, how does that affect the farmer?

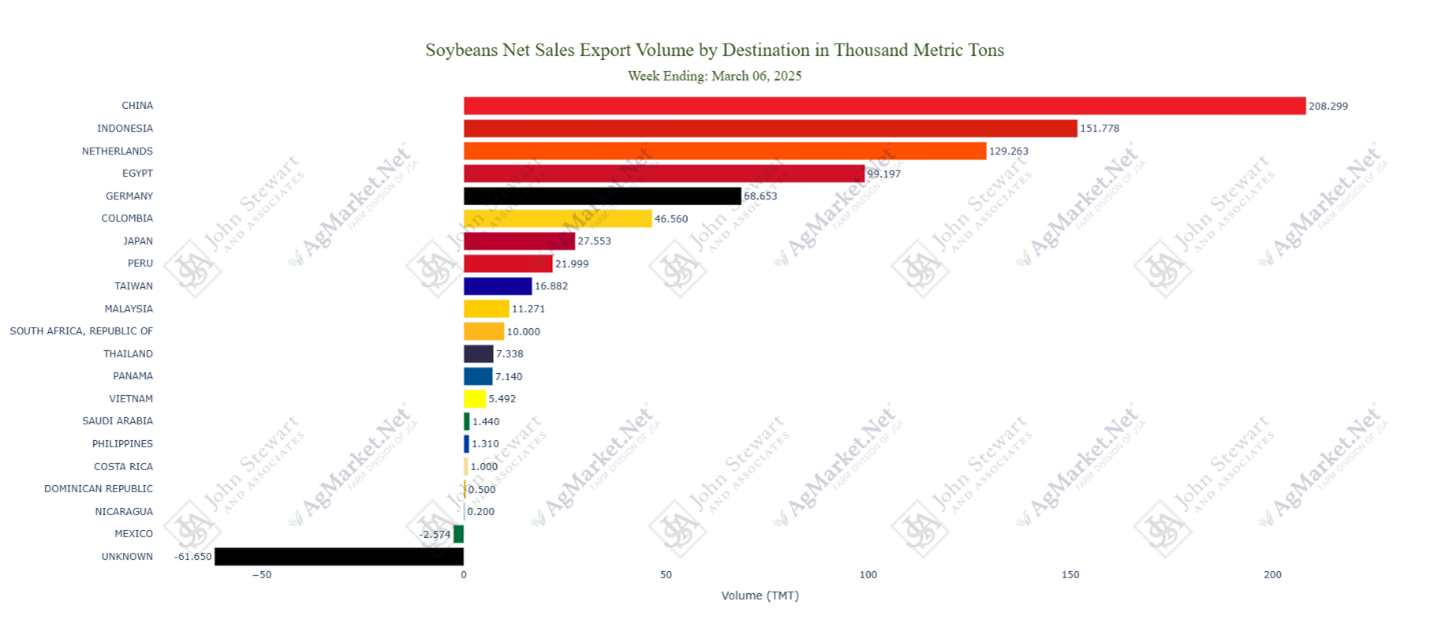

To be quite honest it has a huge impact, especially for soybean growers. China is the number one buyer of U.S. soybeans by a wide margin, as illustrated in the chart below.

China focuses most of their production efforts on growing corn but imports most of their soybeans. Therefore, the tariffs could have a huge impact on the soybean market as they would likely do more business with South America. At the end of the day, China cannot shut us out completely because South America simply does not produce enough to meet their demand. However, anytime you take a hit to demand prices are going to suffer.

How to hedge soybean sales

So how do you protect yourself from these tariffs?

That is the million-dollar question. It’s hard to lock in a floor at these levels, which are below break even for most producers. This is why I like to use a flexible strategy that allows for some volatility. The following strategy could be executed for around 25 cents this morning:

- Buy November $10 put

- Sell November $11 call

- Sell November $9 put

With all the headline risk and volatility, the out of the money options have increased in price, which offers an opportunity to capture some time value in the market.

- If we stay stagnant and go nowhere, you could buy back the short call and put and collect more than 40 cents.

- On the other hand, if we go down and test $9, you can collect around 20 cents from the short call and have a solid floor at $10.

- If the market moves higher, you could collect the premium from the short put and would be short at $11 if we trade above that.

Please reach out if you disagree, but most of the clients I work with would be happy with an $11 sale under current market conditions.

All in all, given the amount of headline risk we are susceptible to, this market has been very difficult to trade. However, if you stay disciplined to a set marketing plan and use options to protect floors and capitalize on opportunities, I’m confident you can make it through the treacherous waters that lie ahead.

If you would like to chat or have any questions, please don’t hesitate to reach out to myself or any of the AgMarket.Net brokers. We would love to hear from you. Good luck with planting season and stay safe!

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.