Corn and soybeans rally for a reason during the growing season. Offers tend to be best for both crops because a lot can happen to fields to affect supply not only in the U.S. but around the world. Demand, too, can be variable, depending on what happens to the global economy. So, capturing gains during the growing season takes more than just reading the weather report.

Of course, you’ve got a marketing plan – maybe even one the lenders endorsed. But when push comes to shove, will you be able to execute your plan? The time to answer that question is now, before the heat of battle fogs the windshield.

It’s one thing to consider making sales once tractors start rolling and crops push out of the ground. Actually doing it, however, requires cash. Using exchange-traded futures and options takes margin, which can accelerate quickly in volatile times. Even making sales through elevators or end users can tie up funds, depending on the particulars.

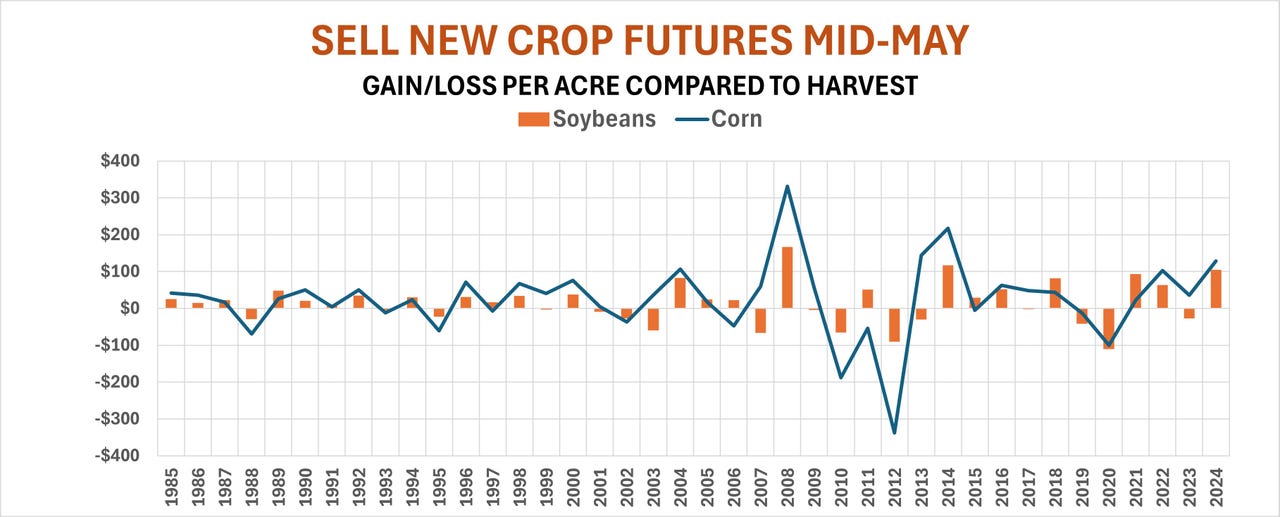

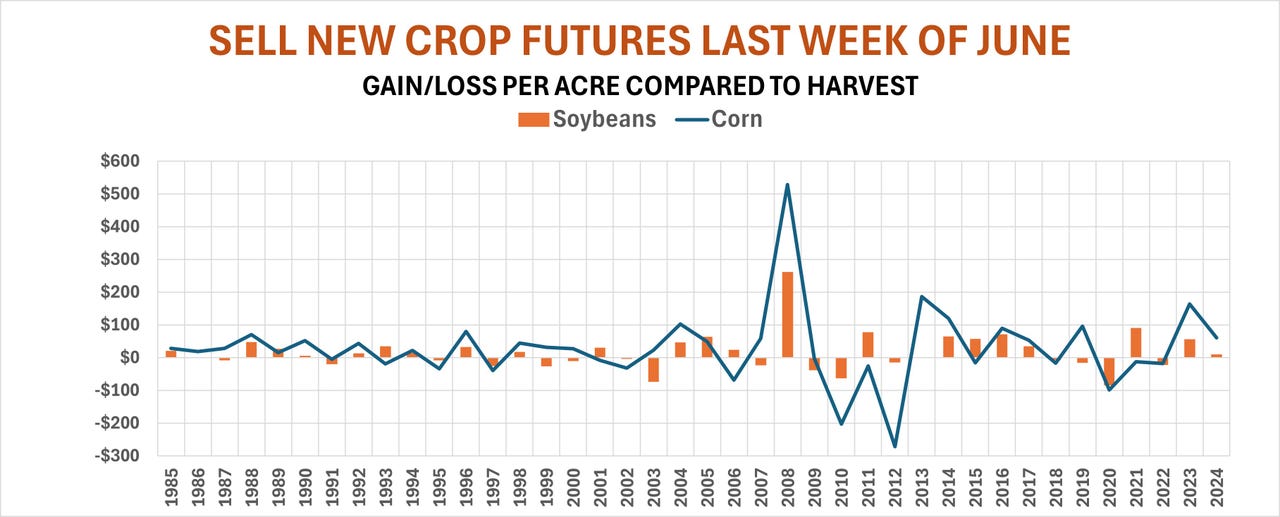

Don’t look for guarantees, either. Sure, seasonal windows for corn beat harvest results at all 11 of the locations included in Farm Futures long-term study of selling strategies and performed nearly as well at the nine locations observed for soybeans. But those averages mask big swings in profits and losses from year to year. And despite soybeans’ reputation, gyrations in corn are larger, showing two and even three times the variance since 1985 when trading in ag options resumed after a hiatus in the wake of the 1929 crash on Wall Street.

Gut check for profits

Phase One of weather rally planning is to find out how big a gut check any positions could bring. Not only is that important for the profit or loss on your ultimate bottom line, that gut check also shows how much funding a losing bet could require for margin calls and loans to finance them. Even these estimates are only a starting point because they’re based on how positions settled when liquidated and offset with cash market sales or values – not the worst-case scenarios when the markets top out and typically experience peak volatility.

Sales made in mid-May incur a little less pain than those at the end of June but still required lots of cash. The poster child for corn is the drought year of 2012, while the 2020 pandemic whip-around bled coffers of those trying to stick with soybean hedges.

Corn hedges made in mid-May 2012 faced losses of $338 an acre if held to harvest, while those in late June wound up $272 in the red. Sideways soybean deals at harvest peaked at $110 an acre in 2020 for mid-May sales with late June hedges losing $84 in 2020.

Weather, of course, is the primary influence for these numbers. Since 2012 weather impacts explain nearly a quarter of the statistical variance for corn. For all you non-math majors out there, that’s the same as a probability exceeding 95%, or around 2.5-to-1 odds.

Grain market two-step

Weather is a big dog in the soybean market, but the U.S. is not the only one barking, and this also helps explain corn’s big losses in 2020. Soybeans dance a two-step because what happens in South America also impacts prices. Emergence of La Nina cooling of the equatorial Pacific in 2020-22 hurt yields below the equator and convinced growers to back off on expansion.

But the big culprit was China’s demand for imports, which plunged in the wake of the first trade war with the U.S. and culminated with the start of the pandemic. Sinking GDP growth was another factor because Chinese import demand followed that ship.

The world hopefully won’t have to worry about another big pandemic for a century or so. However, impacts from the latest phase of the U.S.-China confrontation can already be seen in China’s shift to Brazilian supplies, including reports of large deals last week. New U.S. sales of 2025-26 soybeans to all buyers were negative over the past month, and total demand could be flat at best compared to the marketing year ending Aug. 31, 2025.

China historically isn’t a big buyer of U.S. corn, but other customers could be having trade war doubts and could use the feed grain as their bargaining chip in tariff negotiations with the Trump administration.

Add up weather and demand uncertainty and the result makes the cash flow consequences of both corn and soybean hedges this spring and summer hard to predict. But heeding lessons from the past can at least provide guidance on how many dollars positions could require from the ATM.