A snapshot of Minnesota agriculture paints a bleak picture for the state’s farmers.

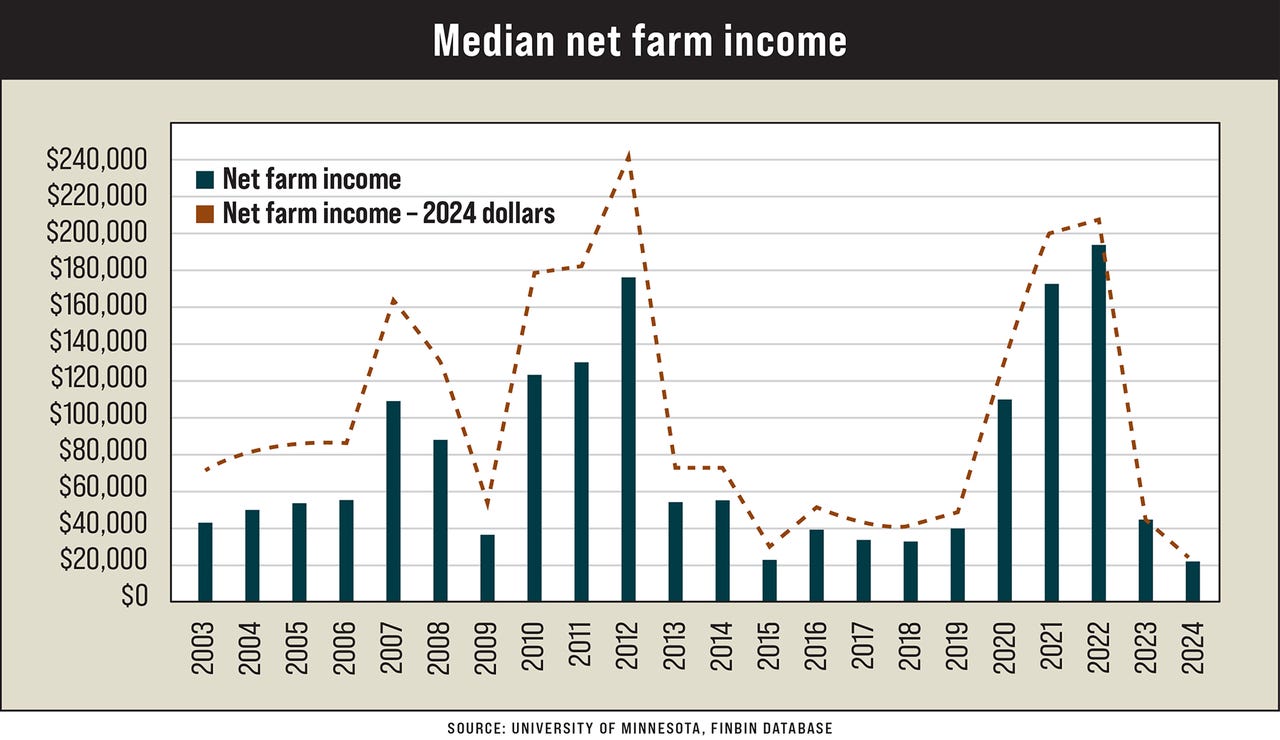

According to data from the University of Minnesota and Minnesota State, median farm income for the state dropped to $21,964 in 2024, the lowest level in this century.

“I think we all unfortunately expected this and anticipated it would be a pretty tough year, especially given the weather challenges, the prevent-plant situation in large chunks of the state, and just lower yields overall and lower crop prices,” says Pauline Van Nurden, Extension economist at the University of Minnesota’s Center for Farm Financial Management.

This snapshot analysis encompasses data from 2,198 farmers participating in the Minnesota State Farm Business Management programs and 115 members of the Southwest Farm Business Management Association. FINBIN is a farm financial database that provides benchmark financial information for farm producers, educators, lenders and other agricultural professionals. The database is developed and supported by the Center for Farm Financial Management at UMN.

Van Nurden has been with the CFFM since 2017, and she has been involved in agriculture since the early 2000s, “so I’ve seen different downturns,” she says. “I worked with dairy producers during 2009, when there was a really difficult price situation.”

She also worked as a lender during the downturn experienced in 2013-15. So, how does this stack up against those?

“Minnesota was the one hit with the weather challenges [in 2024], on top of price declines on the cropping side of things,” Van Nurden says, “so we look back in the 2013, 2014, 2015 time period, and we saw a decline in prices, but yields hung in there. … This time, the culmination of corn and soybean prices dropping by 20 or more percent last year, and then so much prevented plant and just lower yields overall, that certainly did not help anybody throughout this time. Also, the fact that input costs have stayed up there for the most part. We’ve seen things like fertilizer and some of that come down, but a lot of inputs tend to be sticky. It’s just hard, as prices drop, to manage that much differently.”

Bright spots

While the FINBIN picture offers a statewide glimpse, Van Nurden says it is possible to break down the numbers by region, and that shows “that some producers had good years, while others had very tough years,” she says. To that point, she says the southwest, south-central and west-central parts of the state saw the most challenging net farm income, while “the Red River Valley still had a pretty strong net farm income for the median farm in that area.”

Just as data may be broken out regionally, it also can be studied by commodity sector. A quick glimpse shows that the livestock sector buoyed the median net farm income, as crop producers for 2024 showed a median net farm income of only $2,371.

“[Crop producers’] working capital dropped by about 25%, but they still have a strong liquidity position. They still have a current ratio of 1.9, so $1.90 of current assets for every current liability,” Van Nurden says. “So, they did take advantage of the profitable years from 2019 to 2022 and have cash reserves in preparation for this current downturn.”

As a former lender, Van Nurden stresses the importance of always having a close working relationship with your lender, but that is even more important during downturns, as in the current environment.

“Work with your lender, or talk with your lender as you work through these situations. You can’t hide from it,” she says. “It’s not going to go away, but you can certainly have open, honest communication. Lenders are there to help you weather those storms as well. That’s part of their job, and they want to see farms be profitable and prosperous as well.”

Looking ahead

Coming out of 2023, no one predicted the 2024 that many producers experienced, but one can’t help but look ahead. Although tariff wars are fresh news, the USDA Economic Research Service’s most recent nationwide farm income estimate will increase 29.5% over 2024.

“In general, their forecast is that crop producers are probably still going to face some challenges, with lower income yet for this coming year,” Van Nurden says. However, there is buoyancy from Emergency Commodity Assistance Program payments that will help.

“Livestock income is expected to stay stronger, probably increase a little bit, and production expenses are also anticipated to decline a little bit again,” Van Nurden says, but “we’ll see how that actually comes to be with some of the other challenges that are now potentially out there with tariffs.”

Working through known and unforeseen challenges, Van Nurden again stresses the importance that producers know their cost of production. “Look at your situation and what opportunities are out there on the marketing side of things,” she says. “What expenses might be able to be trimmed? Typically, it’s a lot of little things that can make an impact on a producer’s bottom line. So, having a plan, sticking to it, monitoring where you’re at throughout the year, and adjusting as a producer moves throughout the year will help.”

Challenging times bring anxiety and stress to farmers and their families, and Van Nurden says that Minnesotans are fortunate to have rural mental health specialists such as Monica McConkey and Ted Matthews who are only a phone call away at 218-280-7785 and 320-266-2390, respectively. Other resources can be found at the Minnesota Department of Agriculture website.