After months of tariff-fueled turbulence, grain markets finally seem to be regaining their balance. Instead of reacting to headline shocks, we’re seeing a return to fundamentals—supply and demand.

- Corn stocks are tightening.

- Soybeans remain weighed down by hefty ending supplies.

As the U.S. planting season kicks into high gear, let’s explore what could move the markets next.

Exports: A bright spot amid the noise

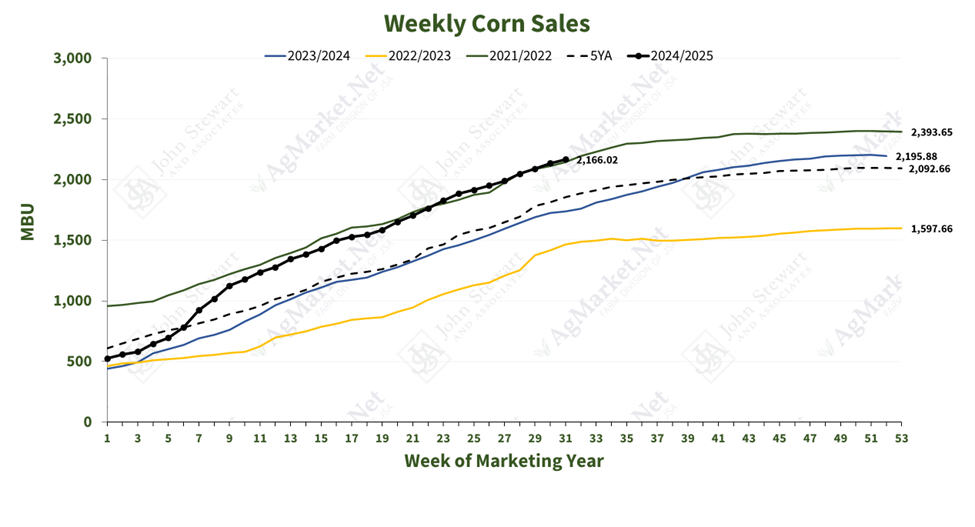

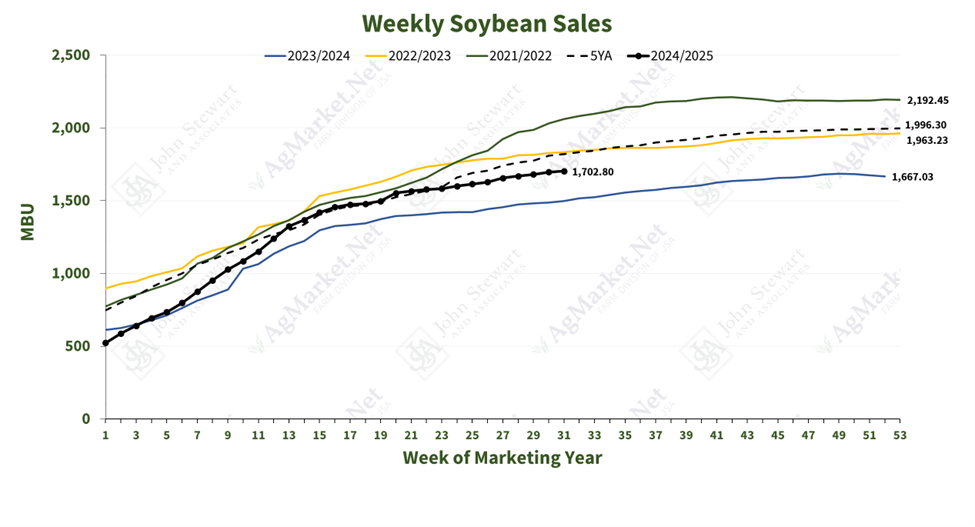

Despite the ongoing trade policy murkiness, both corn and soybean exports show impressive resilience. Weekly sales continue to surpass expectations.

- Corn export inspections are running 176 million bushels ahead of the seasonal pace.

- Soybeans are moving 98 million bushels above trend.

This strong performance could persist, especially if the U.S. dollar keeps losing ground.

Take corn, for instance. Analysts once feared foreign buyers would front-load purchases ahead of potential tariffs. While trade policy remains fluid, the impact on U.S. ag exports has been milder than many expected.

In the April WASDE report, the USDA raised corn export projections to 2.550 billion bushels—potentially the second highest ever. A key driver? Mexico. Still battling drought in critical growing regions, Mexico, which is the top buyer of U.S. corn, is expected to import a record 24.5 million metric tons while slashing domestic production to an 11-year low.

And it’s not just Mexico. Global demand is turning to the U.S. as the go-to source for corn. Ukraine’s output remains constrained by conflict, and geopolitical tensions persist in the Black Sea region. South American supplies also are tight since last year’s crop was hurt by drought and current harvests are prioritized for domestic use. Brazil’s second corn crop won’t hit export markets until later this summer.

If this strong export pace holds, USDA may trim corn ending stocks even further. With a stocks-to-use ratio of 9.6%, history suggests continued support for prices. Soybeans remain in surplus at 375 million bushels but there could be a spark from biofuels or emerging markets down the line.

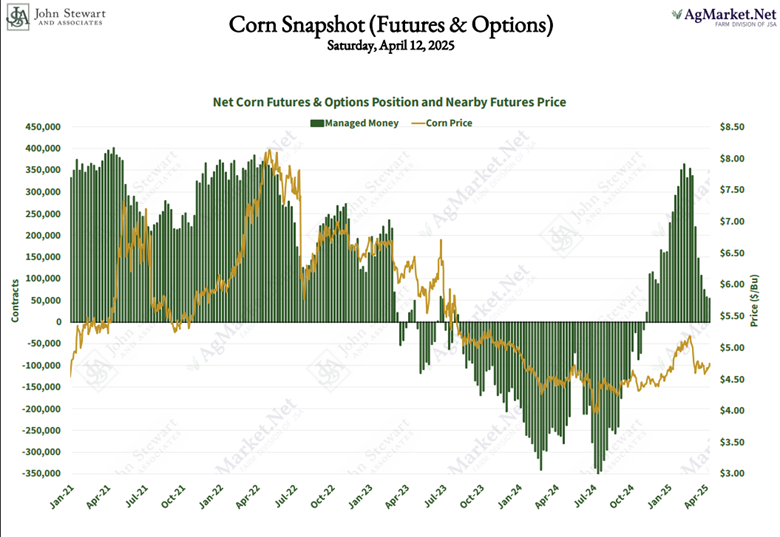

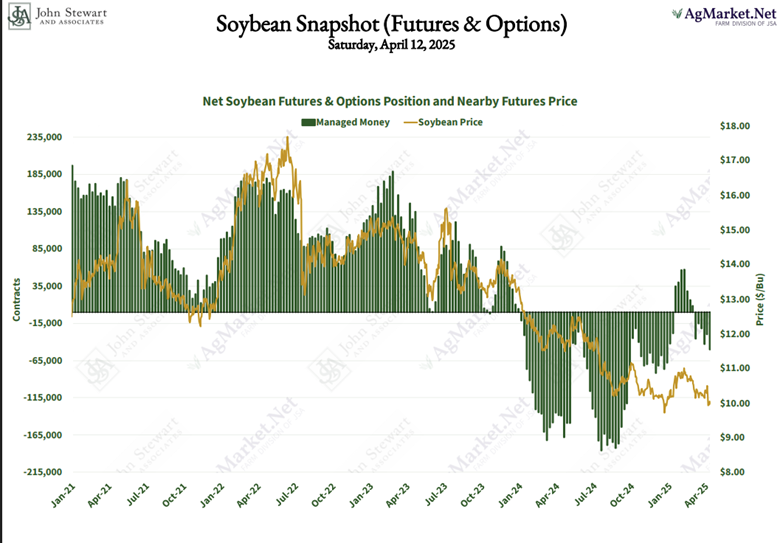

Managed money: A powder key waiting to ignite?

After dominating the winter rally, managed money recently took a back seat. According to the April 11 Commitment of Traders report, funds continue to exit positions. Corn longs have dropped to 53,576 contracts—down from a peak near 373,000 this winter.

In soybeans, managed money flipped from long 73,000 contracts in January to short 50,447 now.

So, what does this mean? Simply put, funds are mostly on the sidelines but that can change in a heartbeat. If weather risks develop, the stage is set for a fast return of speculative money—potentially igniting rapid market moves.

Looking ahead: Volatility on the horizon

As we step into the heart of the U.S. growing season, brace yourself—this is traditionally the grain market’s most volatile stretch. Recent months have already brought dramatic price swings, and more turbulence is likely. Global demand remains strong, but weather could become the primary driver, especially as dryness lingers across the Midwest.

Even with increased corn acreage, we’re a long way from harvest. Meanwhile, fewer soybean acres this year mean yields will face more scrutiny than ever.

Having a trusted advisor by your side can help navigate this volatile landscape and spot profitable opportunities in the chaos.

Markets move fast. Preparation is key. Opportunity favors the informed—let’s make the most of this season together.

If you’re looking for guidance in these unpredictable times, don’t hesitate to reach out to me directly at 314-626-4019, or connect with the AgMarket.Net team at 844-4AG-MRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net® is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.