“Neutral” doesn’t exactly scream excitement. Think brown and grey, not red or vivid blue.

But growers’ hopes for rallies this spring and summer could depend on futures’ response to perceived threats from a neutral reading in the El Nino cycle of ocean temperatures and atmospheric currents in the equatorial Pacific.

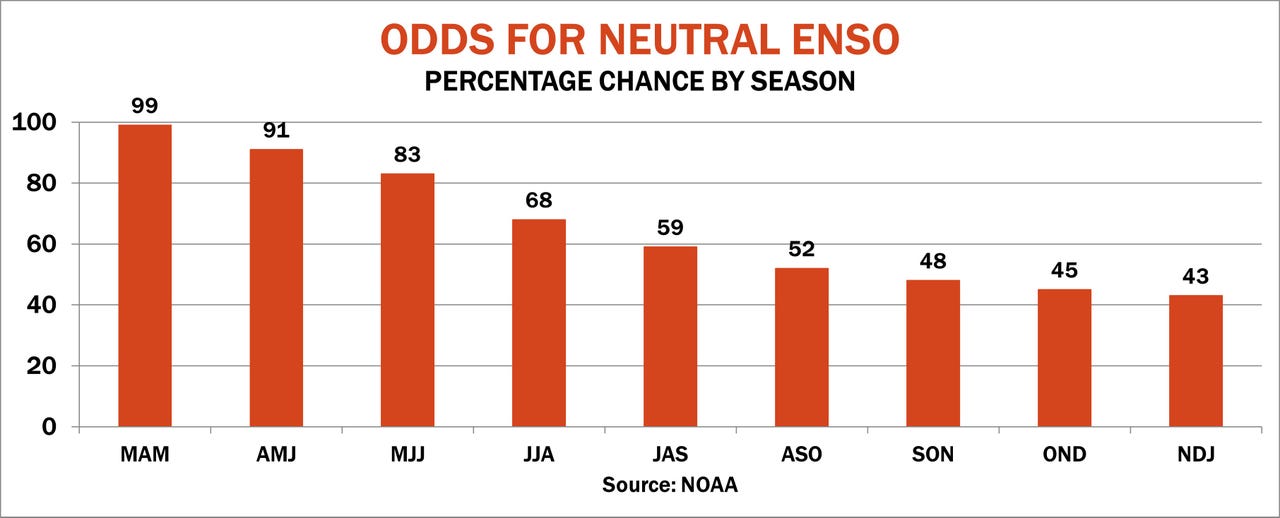

U.S. weather forecasters last week issued a final advisory on La Nina, saying the cooling phase of ENSO cycle ended in March. The new neutral phase is forecast to persist into 2026. While the shift decreases odds for the type of big weather events associated with La Nina, it also means growers should be prepared for both boom and bust — and everything in between.

What extremes could be in play? The most likely range for 2025 crop corn futures, with about a two in three chance, is $4.40 to $5. A rally from $5 to $5.25 could be expected around 15% of the time, say one in every six or seven years. And a move to $5.50 or better has odds of less than 5% — think 2012, 2002, 1995 or 1993 in the last three decades.

Of course, what can go up could also go down, with the worst-case scenario pointing to $3.85 or less. December 2025 corn closed before the long holiday weekend at $4.66, close to the $4.70 February average used for crop insurance contracts.

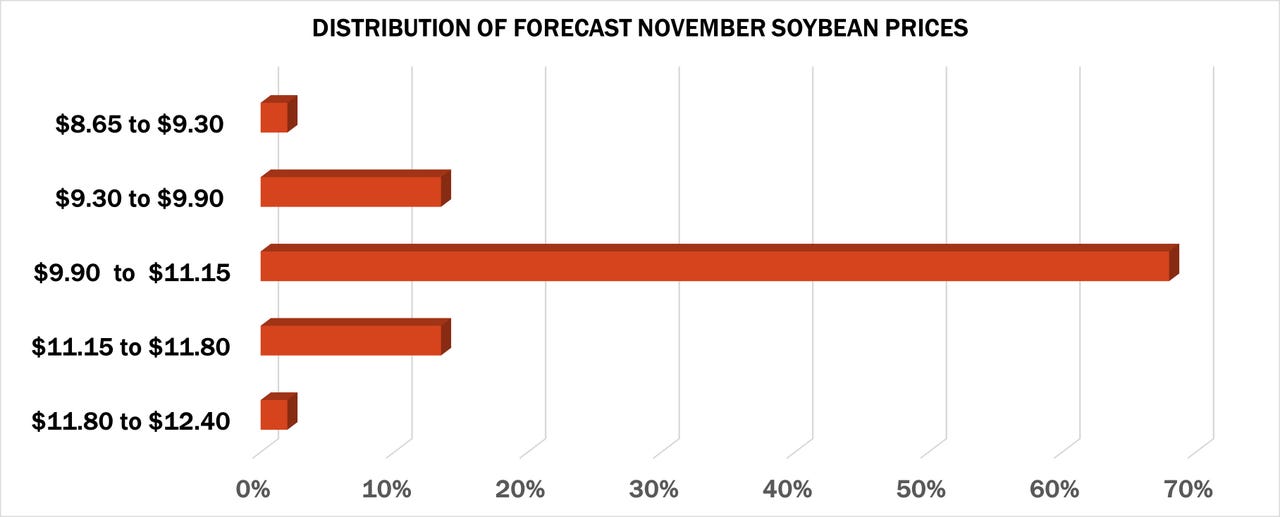

The distribution for soybeans is similar, with $9.90 to $11.15 catching two-thirds of the outcomes.

Weather or tariffs?

Traders who worried about the weather ahead of a mini vacation over Easter focused only on beach conditions, not what might happen this summer. So instead of trading those forecasts, buyers and sellers wondered about potential impacts from ever-shifting tariff news around the world. China raised retaliatory penalties on soybeans to prohibitive levels, and other crops, including corn, faced questions from trading partners in Europe and South Asia. Lurking in the background? Fears of a recession that could stifle demand from the U.S. to around the world.

The latest weekly totals from USDA’s Export Sales report showed new crop soybean business to China off 5.2% from year-ago levels. Despite China’s wanting interest, the current numbers project a 7% increase to 1.95 billion bushels of total exports for the upcoming marketing year. U.S. soybean sales tend to be front-loaded, with many typically made before harvest or even planting of the crop, making news about commitments in the second half of the marketing year less significant.

Not neutral for yields

Demand for U.S. crops can dramatically change depending on what happens to our supplies and those from our competitors. The ENSO neutral phase has something to say about that, of course.

Neutral summers in the northern hemisphere favor above average yields in the U.S., where the growing season tends to be cooler than normal. But that by no means rules out weather threats. U.S. corn yields suffered in two memorable years with the ENSO in neutral, 1983 and 2012, but also set records in others, such as 1992 and 1994.

A neutral reading puts two areas overseas at risk of lower yields, including Argentina and Europe. Much of the growing region in South America tends to get warmer with southern parts of the continent drier during these events. Europe trends drier as well.

The result puts a lot of moving parts into play. It’s a lot to keep track of, but that’s the job of the market. Closing prices on any given day express that verdict — at least until the opening bell sounds anew.