Soybean futures traded in a lackluster 25-cent trading range over the past three weeks. Prices seem to be in a holding pattern as the clash of lower U.S. supply meets the uncertainty of potential lower U.S. export demand.

What’s happened

Here is the simple reality. U.S. old crop ending stocks for the 2024-25 crop year are pegged at modest 375 million bushels. This is slightly higher than last year’s ending stock number of 342 million bushels. From a historical perspective, this is a comfortable amount of supply but definitely is not viewed as burdensome or too much.

However, from a global perspective, supplies are record large, with global carryout for the 2024-25 crop year at 122.47 million metric tonnes.

Yet, U.S. soybean futures prices are in a holding pattern for the moment. Why could that be?

From a marketing perspective

The elephant in the room continues to be the uncertainty regarding U.S. soybean export demand. Specifically, U.S. export sales to China for the upcoming 2025-26 crop year in regard to tariff and trade wars.

Without a doubt, it is something to monitor and potentially be concerned about should the United States lose a portion of that export business to China.

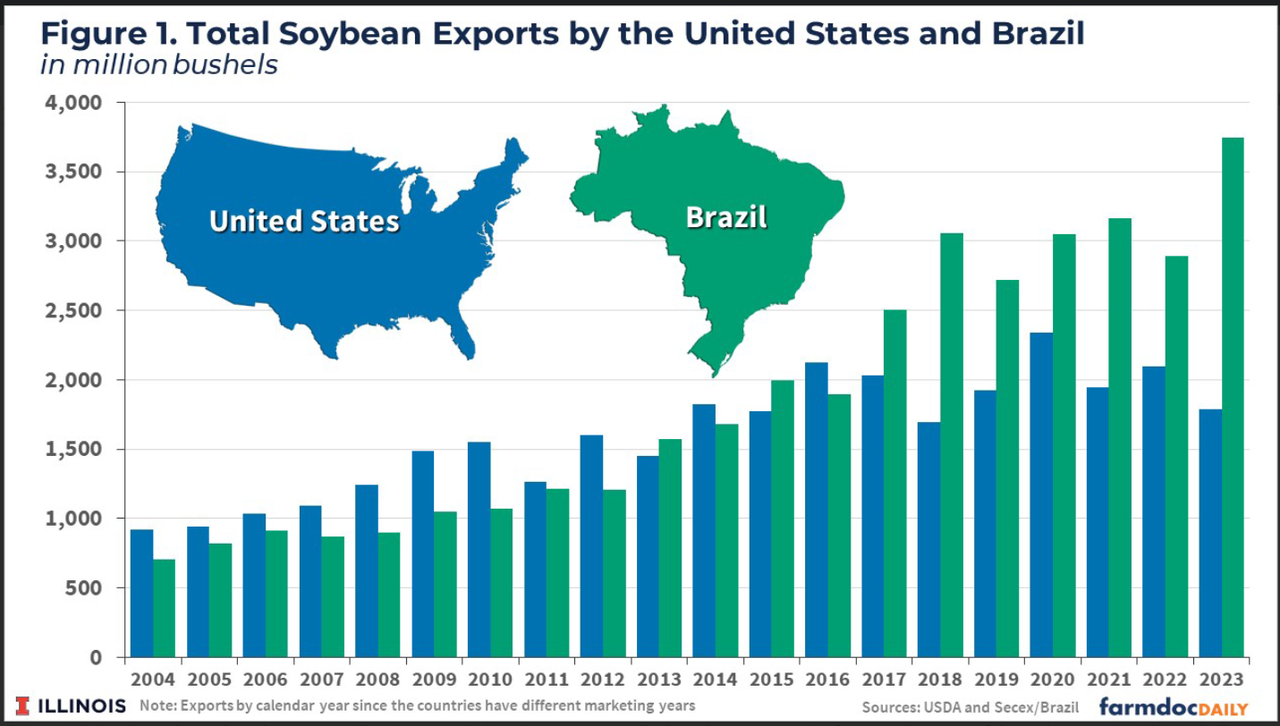

In the 2024-25 crop year, U.S. soybean exports were pegged at 1,825 billion bushels. Roughly half of those exports were destined for China. In the future, could the U.S. continue to lose some of its marketing export share in China? Yes, it is possible. Brazil’s global export share continues to grow.

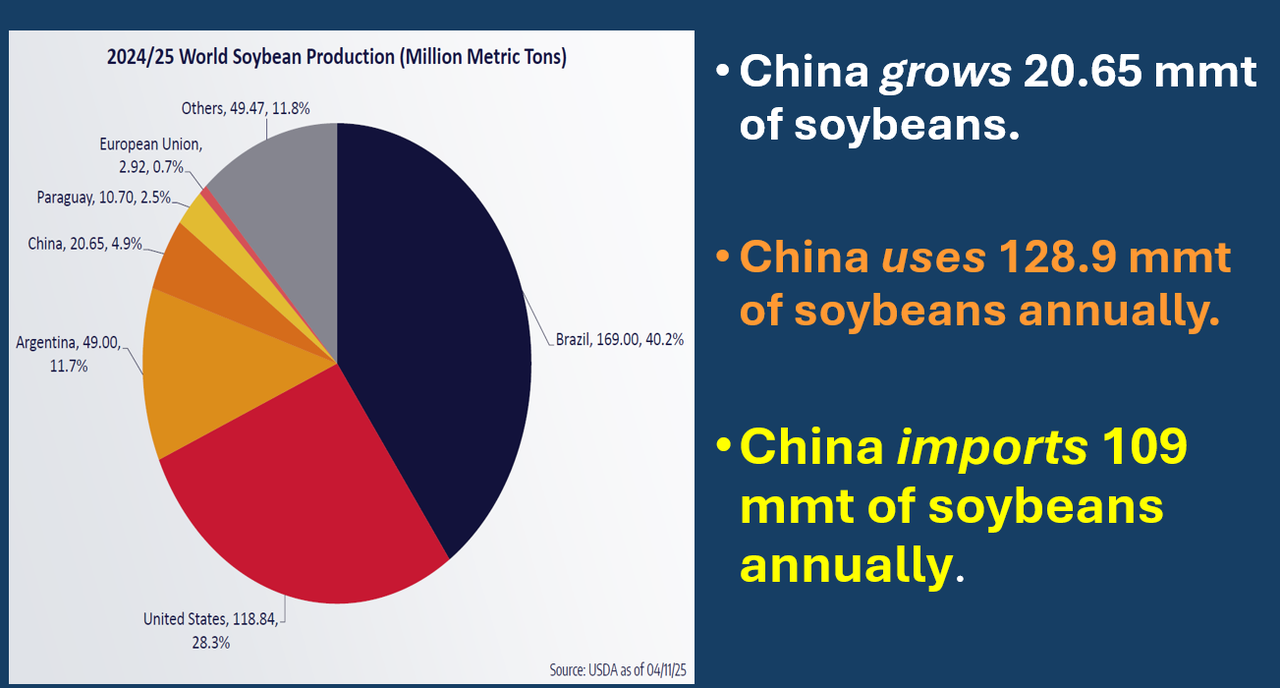

However, in my opinion, China’s insatiable annual soybean consummation requires year ‘round delivery from reliable sources across both hemispheres.

Yes, Brazil could theoretically sell more soybeans to China. However, China’s import needs likely cannot be met solely by Brazil.

According to the April 2025 USDA WASDE report, China grows 20.65 mmt of soybeans annually. To compare, Brazil grows 169 mmt of soybeans annually, the United States grows 118.84 mmt of soybeans annually, and Argentina comes in next with 49mmt.

Important to note: China consumes 128.9 mmt of soybeans annually, relying on imports of 109 mmt to meet their needs.

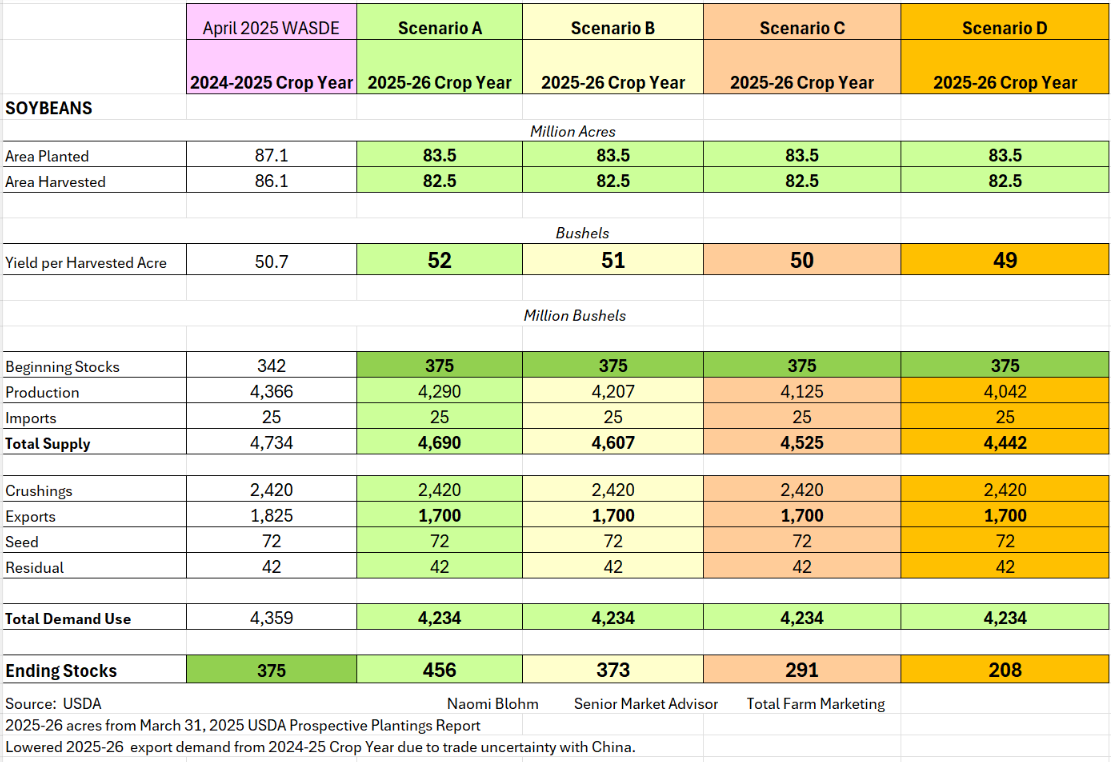

On the U.S. supply side, the March 31 Prospective Planting Report suggested that U.S. soybean acres for the 2025-26 crop year would be at 83.5 million acres this spring, down from 87.1 million acres last year. Looking ahead to summer, the weather still matters in terms of yield and ending stock scenarios.

In the chart below I created four yield and ending stock scenarios based on the Prospective Planting Report acres report.

Please note, I lowered export demand to 1.7 billion bushels (down from 1.825 billion last year) to acknowledge potential demand loss with China for the upcoming crop year.

In the export comparison chart above, U.S. soybean exports have not been below 1.5 billion bushels since the drought of 2012. Even during the 2018 tariff war with China, U.S. soybean exports were near 1,875 billion bushels.

As you can see, even some demand is lost on exports to China, weather this summer will still matter to soybeans. We must critically monitor August weather.

Prepare yourself

Soybean fundamentals have plenty of moving parts to monitor for the coming months. Ultimately the price direction for U.S. soybeans likely points to geo-political trade news with China and U.S. weather this summer.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.