By Hallie Gu, Pratik Parija and Keira Wright

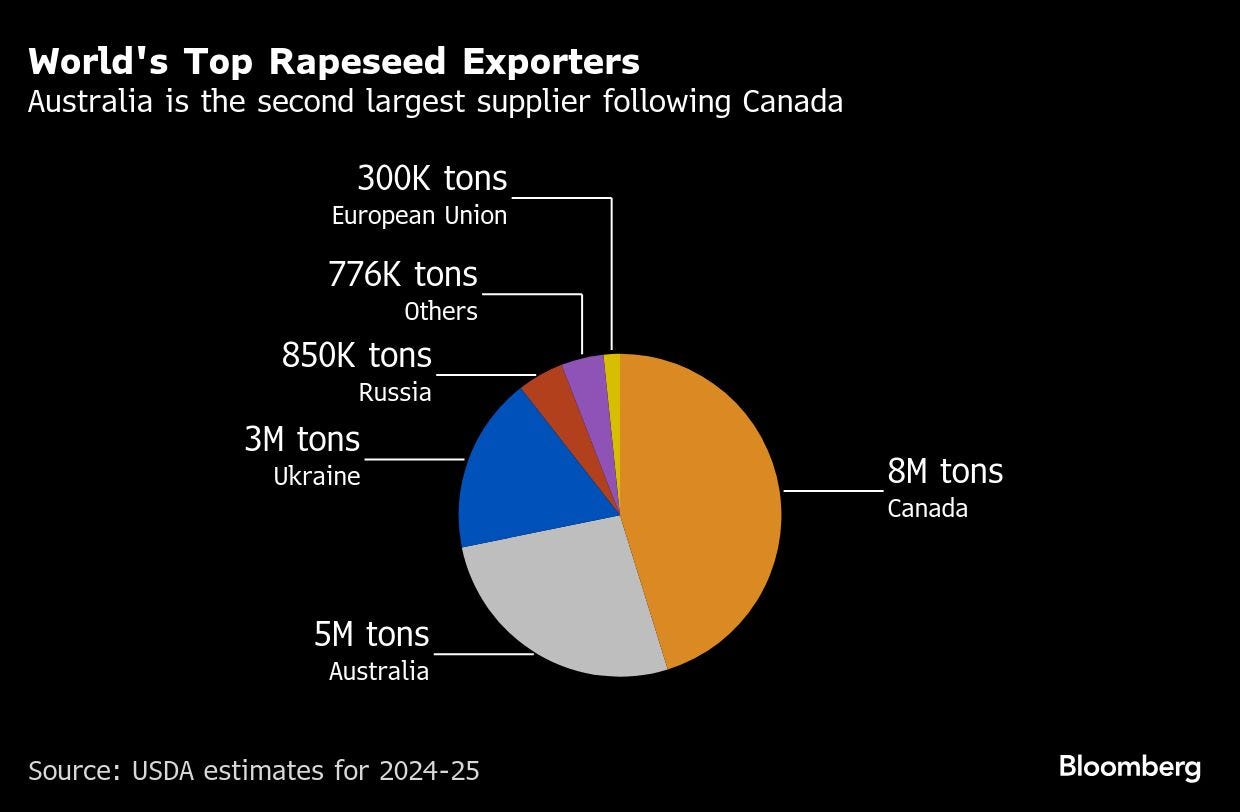

Chinese traders are scouring the globe for alternative sources of rapeseed, as tensions with Canada, their top supplier, risk choking imports of a key ingredient in animal feed.

Buyers have tapped exporters in Australia and India, according to people familiar with the matter, in a bid to replace Canadian purchases, which are subject to either tariffs or the threat of measures due to worsening trade relations between Beijing and Ottawa.

China has typically relied on the North American country for the bulk of its imports of rapeseed, known as canola in Canada, and the meal that’s derived from crushing the crop into a product that’s easily fed to livestock and fish.

But the trade has been on the skids since March, when Beijing slapped hefty tariffs on cargoes of rapeseed meal in a tit-for-tat response to Canadian duties on Chinese goods. The government has imports of the crop itself under an anti-dumping review that’s been ongoing since September. China’s meal imports from Canada topped 2 million tons last year, valued at $780 million, while its rapeseed purchases were worth $3.3 billion.

The spat with Canada mirrors China’s wider breakdown of trade relations with the U.S., another important supplier of farm goods that in some cases compete with rapeseed as an ingredient for feed mills.

Chinese buyers have inquired over the past month or so about booking rapeseed from Australia, the world’s No. 2 exporter of the crop, the people said, declining to be named discussing a private matter. It’s an about-turn from earlier this decade, when Australian shipments to China dropped to nothing. That was ostensibly due to concerns over quality, which also coincided with deteriorating political ties between Beijing and Canberra.

Traders in both countries are now waiting on sign-offs from the two governments before restarting purchases, the people said.

Indian Shipments

Imports of rapeseed meal from India, the world’s second largest exporter of the processed crop, are also being stepped up. Trial shipments to overcome quality concerns among Chinese farmers have been booked for delivery this month, the people said.

Buyers in China have objected to Indian meal, citing a high proportion of foreign material and inconsistent protein levels in cargoes, but the country’s exporters are keen to recapture market share that’s been lost over the years.

The local industry is lobbying the government to ask China to loosen its requirements on shipments, according to B.V. Mehta, executive director of the Solvent Extractors’ Association of India.

“We want Chinese authorities to relax the stringent norms so that more shipments can go,” Mehta said. “This can increase India’s rapeseed meal exports to China to about 500,000 tons annually, compared with a very small quantity now.”

Currently only three Indian companies export rapeseed meal to China. But there’s a big incentive to expand that. Export prices in the European Union, another top supplier, were last quoted at $332 a ton in Hamburg versus $202 a ton from the Indian port of Kandla, according to the Solvent Extractors’ Association.

© 2025 Bloomberg L.P.