Currently much of the global trade and tariff conversation stems around China and how tariffs may affect their commodity demand.

New trade deals may be announced in the coming weeks with various global trading partners. And while China continues to be an important piece of the global commodity demand puzzle, India must not be ignored.

What’s happened

Surpassing China as the number one country in terms of population, India is now the world's largest with over 1.43 billion people. India also is gaining momentum as a global economic powerhouse. India is neck in neck with Japan as the fourth largest economy in the world, behind the United States, China, and Germany.

Not only is Indian economic powerhouse but they also have an emerging middle class. Remember how the emerging middle class in China over the last 20 years increased consumer demand for protein? The same may be true for the people of India, which means more demand for protein might be good for U.S. commodity exports to India.

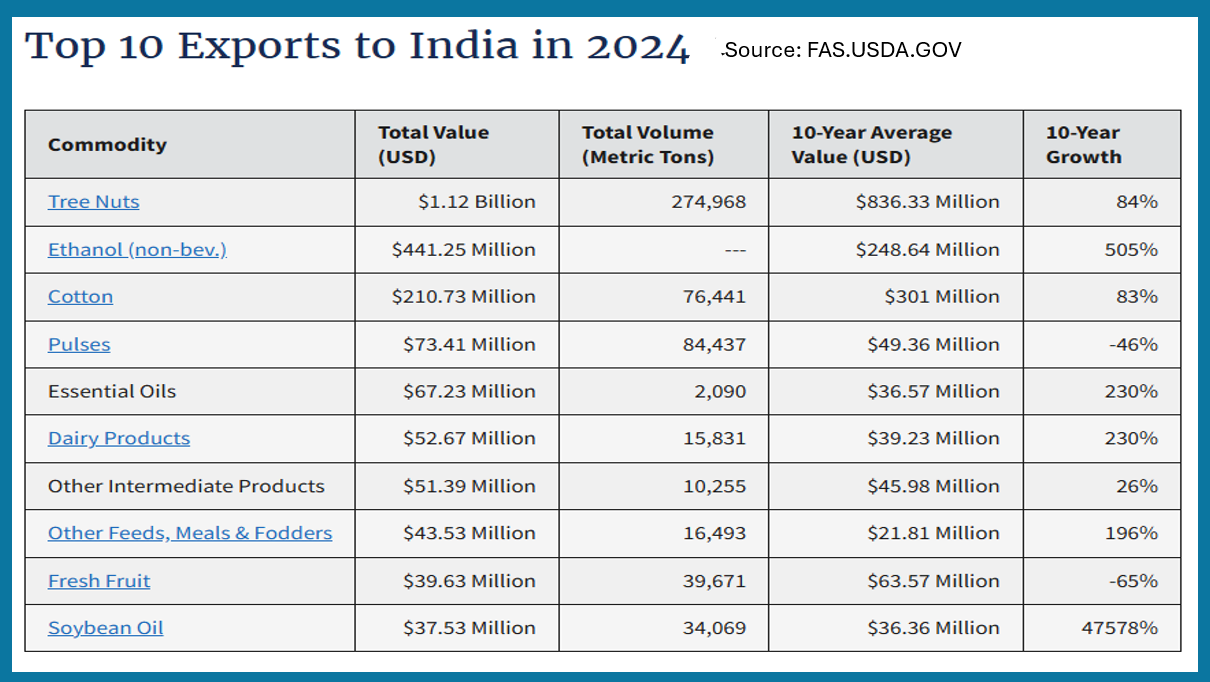

According to USDA’s Foreign Agricultural Service USDA website, India was ranked No. 12 in 2024 in terms of U.S. agricultural exports, with a total value of $2.27 billion dollars.

Because of this, India is the country to monitor in the coming years in terms of agricultural commodity demand. In fact, U.S. Secretary of Agriculture Brooke Rollins plans to visit Vietnam, Japan and India in the next few weeks to discuss President Donald Trump’s tariffs. Her mission is to drum up business for American agricultural products.

From a marketing perspective

Here are four agricultural commodities to take note of for India.

Cotton. For cottonseed oil and cotton use for the textile industry, cotton is an important commodity to monitor in terms of both production and demand.

India is the world’s second largest producer of cotton in the world, following China. According to the USDA, for the 2024-25 crop year, India is expected to grow 25 million bales (480 pounds each) of cotton, with domestic use of 25.5 million bales. Most noticeable is that India uses all of the cotton they grow, and they also rely on some imports. According to the April 2025 WASDE, India will import 2.6 million bales.

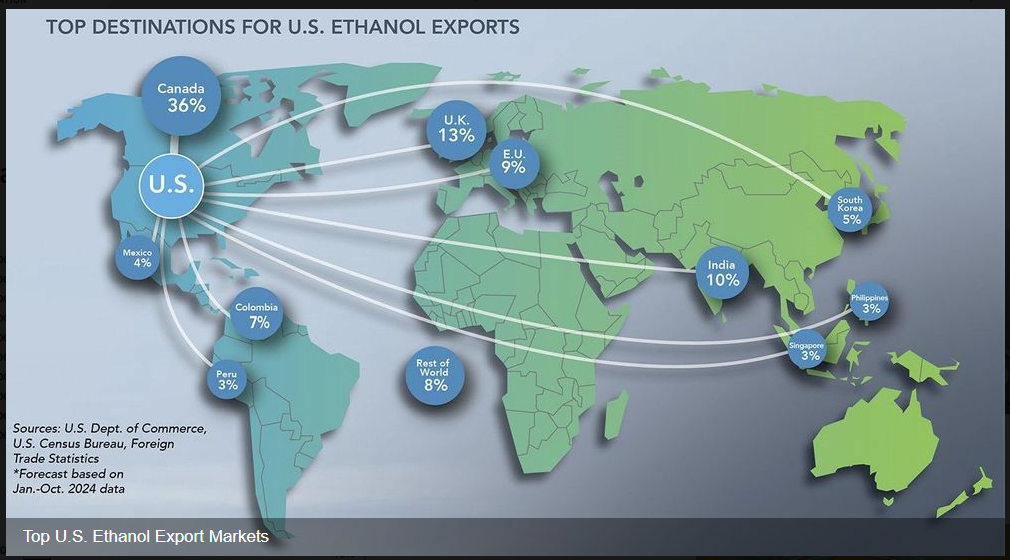

Corn for ethanol. USDA recently said U.S. exports of ethanol totaled 195.8 million gallons in March 2025, up from 138.75 million in February 2025. For 2025 thus far, ethanol exports are running 19% ahead of 2024.

Canada was the top destination in March, accounting for a third of total exports and was followed by the United Kingdom and India.

Wheat. India is the third largest grower of wheat in the world, following China and the European Union.

According to the most recent USDA report, India is expected to grow 113.29 million metric tons of wheat for the 2024-25 crop year, with domestic use of 110.24 mmt, meaning that they use nearly everything they grow.

This is the crop I’m watching the most, as the global demand for wheat continues to remain robust, with global ending stocks of wheat trending lower.

India has no room for a wheat crop failure.

Soybean products. Soybean and soybean product demand is growing in India as a major staple for India’s sustainable protein needs.

Soymeal demand for feed for chicken edges higher with demand near 8 mmt annually, according to the April 2025 USDA WASDE report.

Soyoil domestic demand in India is near 6.5 mmt, with imports of 4.6 mmt. And that demand is likely to grow.

Prepare yourself

As a growing economic powerhouse, India’s demand for commodities likely will continue to grow both due to population growth and an emerging middle class.

Also, because India consumes a majority of its production across several commodities, any severe weather gyration in the country may drastically lower production and shift India to a reliance on imports.

This is a global market that U.S. farmers want to monitor as a future important growing trade partner.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.