U.S. farmers know all about change – and that experience could help them navigate markets as variable as spring weather morphing to summer.

China and the U.S. stepped back from their trade war brinksmanship following negotiations in Switzerland over the weekend that ended with an agreement to reducing tariffs, at least for now. Still, the absence of fog isn’t by any means the same thing as clarity.

Uncertainty still rules the day:

- A trade-related bombshell could explode anytime, keeping demand hopes nervous as the weather does the same with supply forecasts.

- Production potential for corn and soybeans will ebb and flow, with boom or bust price moves providing marketing opportunities.

In the midst of the turmoil, USDA on Monday released its World Agricultural Supply and Demand Estimates for May. The agency mimicked the tone used by officials outside the Trump administration, whose resounding message was: “We don’t know!”

Would the U.S.-China deal help or hurt? Trigger inflationary pressure in the U.S.? Slow GDP growth in either economy? Would the tariff reduction boost ag exports to China, especially for corn and soybeans? Could U.S. export hopes fade due to a stronger dollar or get a boost from the Buy America trend?

“We don’t know” was the answer from all sides, even when they didn’t say so explicitly. The WASDE report, according to USDA, “… only considers trade policies that are in effect at the time of publication. Further, unless a formal end date is specified, the report also assumes that these policies remain in place.” That suggests U.S. shipments to China face a 10% tariff for 90 days before the rate reverts to 125%.

Will the dust settle?

Before the deal came down, companies reporting earnings for the first quarter of 2025 scrambled to revise previous outlooks. Some rolled back forecasts while others stopped forward guidance altogether until the dust settles.

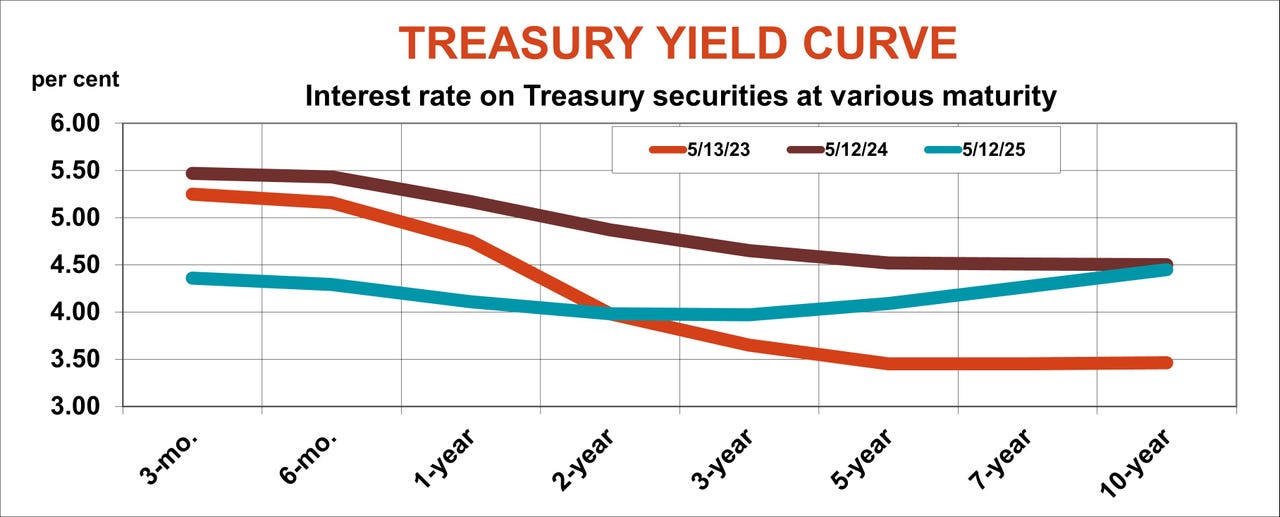

The Federal Reserve added its own voice to the debate, keeping its target rate for short-term Federal Funds unchanged between 4.25% and 4.5%. Fed Chair Jerome Powell, whose term at the helm of the central bank expires May 15, 2026, gave nervous corporate CEOs plenty of cover for their hemming and hawing.

“If the large increases in tariffs that have been announced are sustained, they are likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment,” Powell said at his post-meeting press conference. If the tariff situation changes? Well, never mind!

Buy more, pay less

Indeed, nobody knows where the tariffs will end up, either for crucial markets like China or with countries whose purchases fly more under the radar.

The export picture to date for 2025:

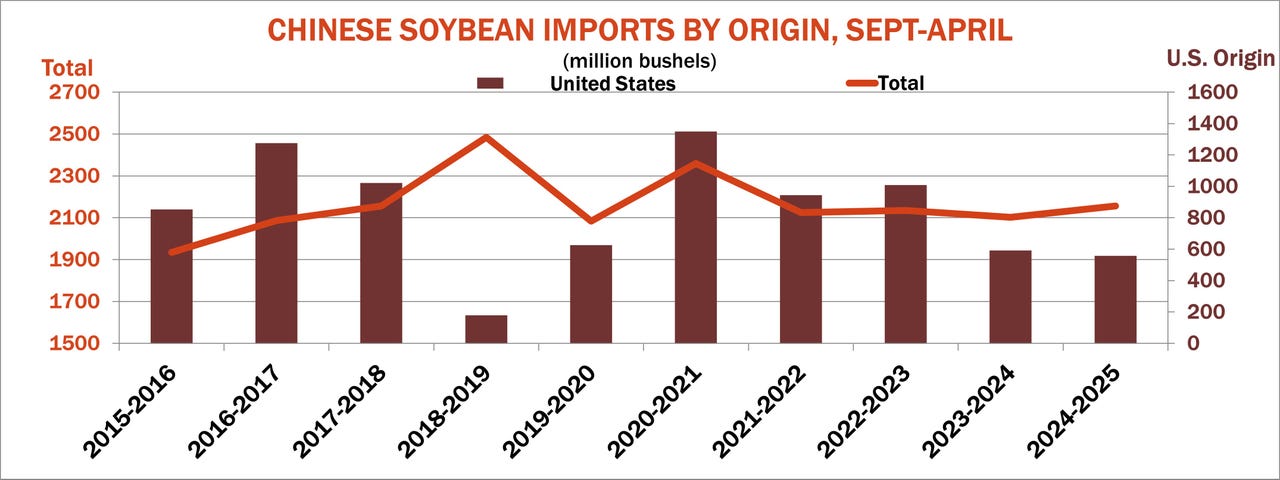

- The value of U.S. soybean exports to China during a prime selling window from January to March fell 50%, according to Beijing’s customs data, even though those expenditures were still one-and-a-half more than those from Brazil.

- Total commitments to China for the marketing year from the U.S., as figured by USDA, were off 5.7%, falling to 2.43 million bushels in the latest week.

- But total U.S. sales and shipments to all customers were up 11.4% year-on-year, thanks to more aggressive buying from Mexico, Egypt and The Netherlands.

- Still unknown is whether these other countries front-loaded deals because of the tariff uncertainty.

The WASDE predicted China’s total soybean imports would rise 3.7% for the 2025-26 marketing year, enough to prevent any serious build-up in world inventories, which might go up marginally, say 1% or so. That’s not an unreasonable forecast. If current trends hold, U.S. supplies at the end of the current marketing year Aug. 31 could be modestly tighter than the government’s take.

Export demand is key

As is so often the case, the key is export demand. Current trends suggest soybean exports could be around 65 million bushels better than USDA’s new outlook, which already calls for average cash prices to rise from $9.95 to $10.25. Still, that’s below the cost of production for the average grower by nearly $2 a bushel, which could be a disincentive to stop planting corn and switch to soybeans.

Is corn moot?

Whether corn is an attractive alternative is rapidly becoming a moot point, with the crop already 62% planted as of Sunday, according to the latest Crop Progress report. That pace keeps producers comfortably in line with expectations for good yields, assuming the rest of the growing season doesn’t disappoint.

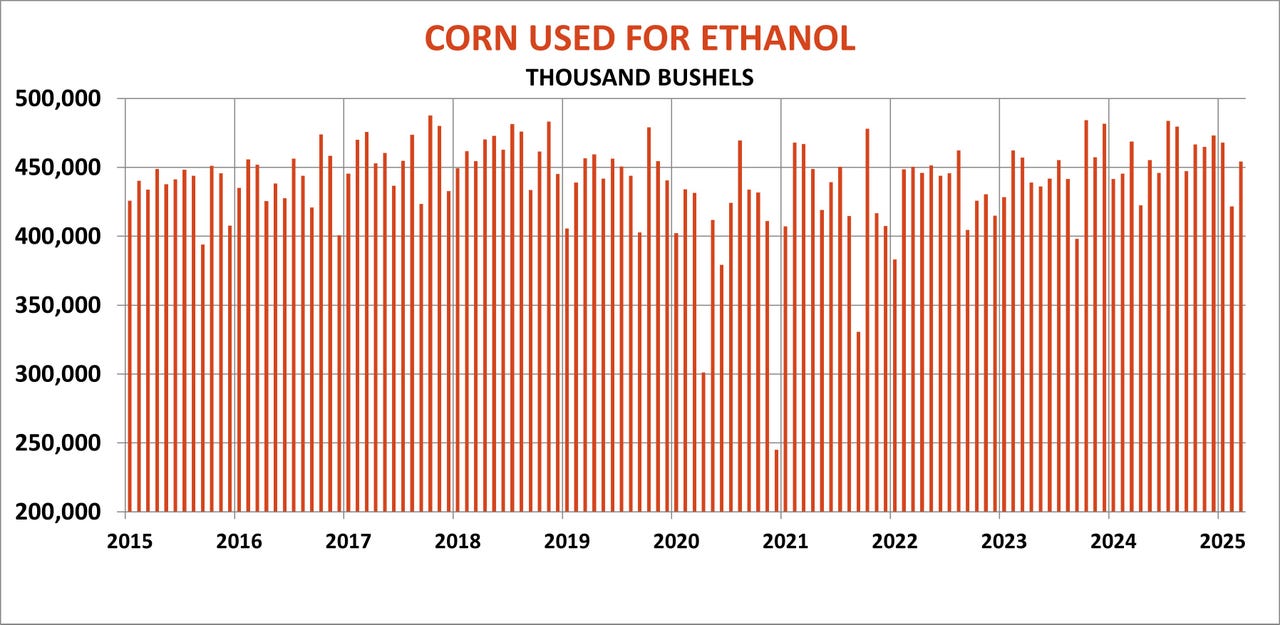

USDA plugged that optimism into the WASDE, though the 181 bpa average yield forecast may even be a little conservative. USDA’s cash price forecast for the 2025 crop was down 15 cents to $4.20, and even that also looks a little iffy. Old crop export demand likely isn’t as robust as USDA forecasts and corn grind for ethanol may hinge on petroleum prices, which recovered after crude oil ended last week below $60 a barrel.