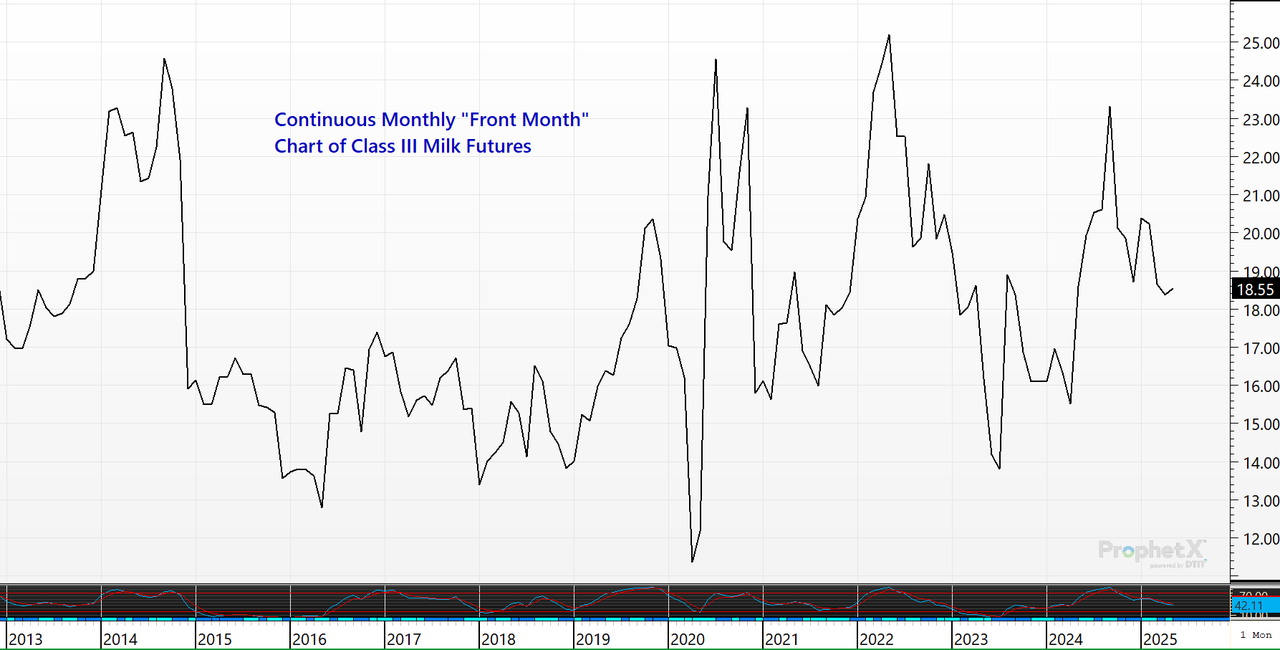

Over the past decade, Class III milk futures, like many commodities, saw extreme and volatile price swings. Heading into summer, milk futures prices may be gearing up for another big move.

What’s happened

In 2014, milk prices were as high as $24 per hundredweight, while the pitfall of COVID in 2020 brought milk to as low as $11.50 per hundredweight. Currently, May 2025 Class III milk futures are hovering near $18.50, nearly smack dab in the middle of that historic range, as the market waits for fresh fundamental news to dictate the next price turn.

From a marketing perspective

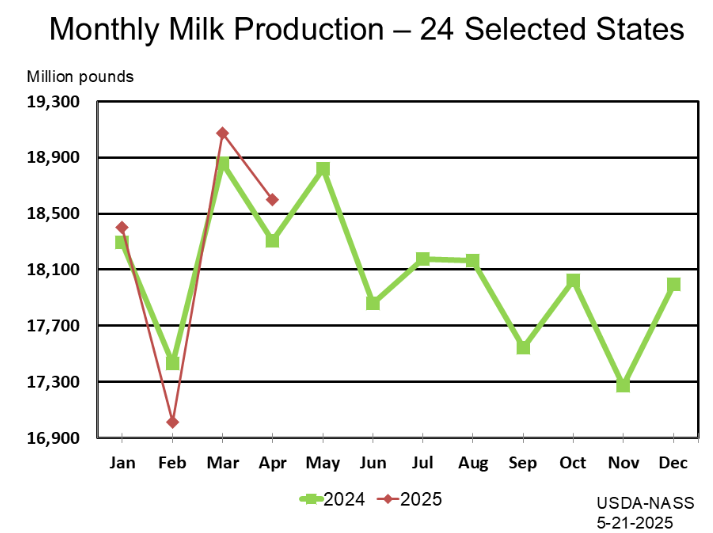

Looking at U.S. milk production over the past few months, production numbers have been relatively neutral. However, that sentiment may be starting to change based on the April milk production report.

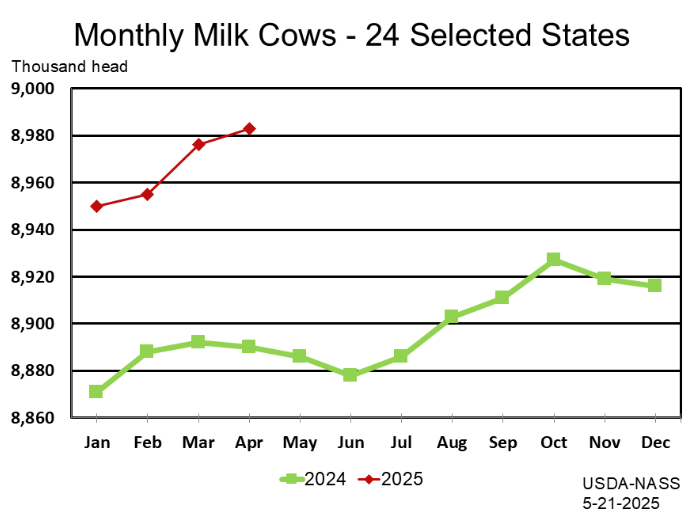

The recent April report from USDA showed April milk production up 1.5% thanks largely to the reality of 89,000 more dairy cows than a year ago.

In addition, for the April report USDA went back and revised the March milk production report to show higher production, with growth now up 1% (from the previously reported 0.9%).

Prepare yourself

With Class III milk prices in the middle of an historically wide trading range, U.S. and global production will continue to be monitored in the coming months, along with global demand for dairy production, which overall has been strong.

The cold storage report comes out later this week. Traders will watch to see if cheese inventories are building, and if so, at what pace. If traders see that U.S. cheese (and butter) inventory is growing, that may keep a lid on any summer price rally.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.