Heightened volatility in grain markets in recent weeks created significant uncertainty for producers. In response, many adopted a "wait and see" approach as prices remain below breakeven levels and movements appear driven more by headlines than fundamentals.

A skilled grain marketer’s role is to help filter, interpret and organize this flood of information, primarily to remove emotion from marketing decisions. As we enter the U.S. growing season, volatility is expected to increase (with each update of weather models carrying the potential to shift the market).

The key question now is: How can we stay objective and develop a proactive marketing strategy amid this volatility?

Seasonality: cause for optimism?

Historically, May, June and July offer the best opportunities for making new crop corn sales. During this period, uncertainty about the U.S. crop size and the impact of weather on development often leads to price rallies.

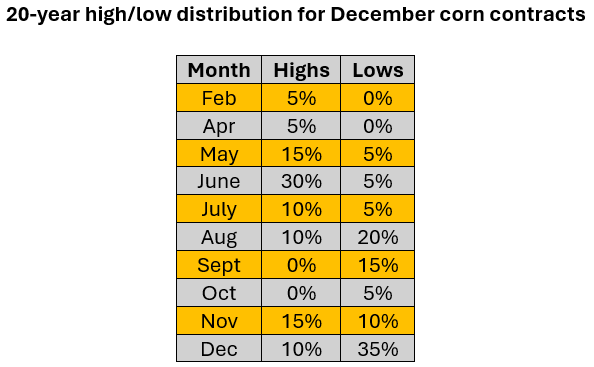

Over the past 20 years, December corn futures posted annual calendar highs in:

- May: 15% of the time

- June: 30% of the time

- July: 10% of the time

In total, over 50% of December futures calendar highs occurred within these three months. This places us squarely in the seasonal window for potential price peaks.

Interestingly, this year’s highest price point so far occurred in February—an anomaly, as the contract high hasn’t hit that month in more than past two decades. History suggests, however, that futures often surpass the February crop insurance price (currently $4.70) at least once during the season. Let’s hope this pattern holds true again.

Also noteworthy: Over 70% of contract lows occur in August, September and December—reminders of how quickly market sentiment can shift.

Managed money: a tectonic shift

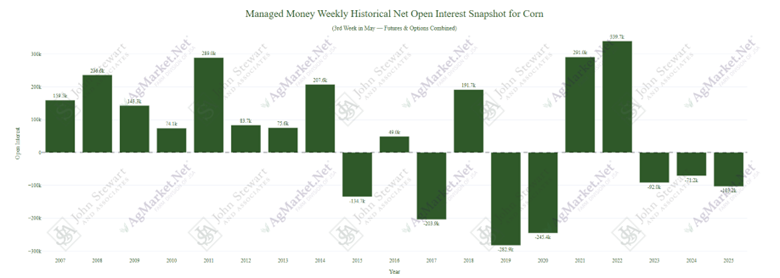

Money managers have aggressively sold corn in recent months. As of the May 23 report, managed money held a net short position of 103,210 contracts. Contrast that with Feb. 4, when they were net long over 364,000 contracts. So, that’s a swing of approximately 467,000 contracts in a short span.

This dramatic reversal has been fueled by:

- concerns about trade tensions and potential tariffs

- a surprisingly large corn acreage estimate

- an expanding second crop in Brazil

If weather conditions begin to deteriorate, we could see a swift round of short covering by these funds. However, if favorable weather persists, there’s a risk of them deepening their short positions. Notably, managed money entered June with net short positions in each of the last three years.

U.S. weather: the wild card

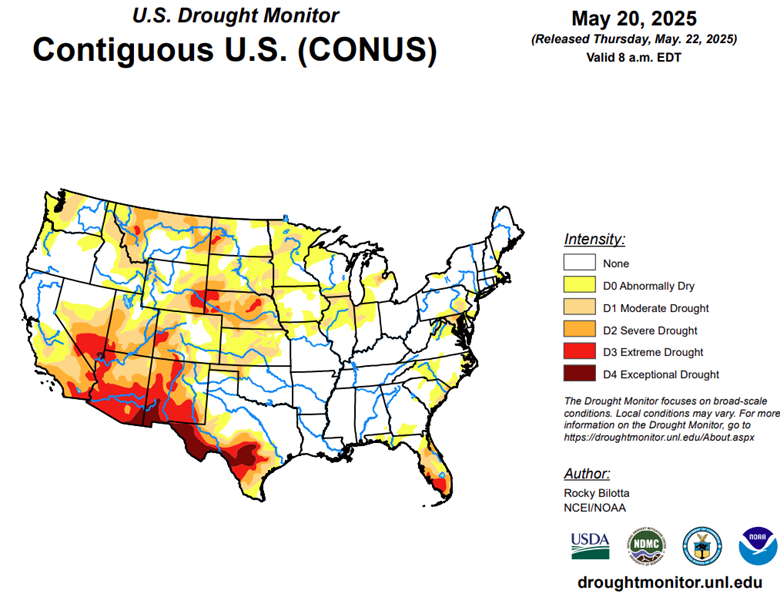

Weather remains the biggest variable. The Western Corn Belt has been statistically drier than normal, which allowed for rapid planting this spring. Meanwhile, the Eastern Corn Belt has seen excess rainfall, delaying planting efforts.

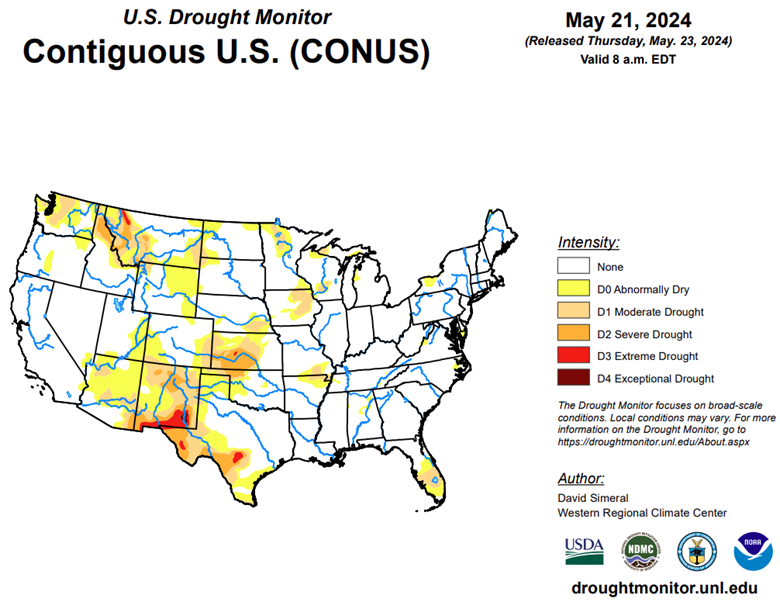

Could this disparity impact yield? It’s too early to say definitively, but it’s a scenario the bulls may latch onto later in the season. Compared to last year, a large portion of the Corn Belt is already experiencing drier conditions, as recent drought maps suggest.

In summary

This article examined three key factors influencing the corn market:

- Seasonality. Historically strong months ahead for pricing.

- Managed money. A large and recent shift to short positions.

- U.S. weather. A complex and developing story as dryness expands.

Weather remains the biggest wildcard. While timely rains could mitigate drought-related fears, a combination of heat and dryness could spark significant short-covering by funds.

Could seasonal patterns drive a rally once again? It’s possible—but geopolitical developments like tariffs or trade disputes could quickly upend market expectations.

As we approach the historically volatile mid-year window, now more than ever, it’s critical to stay informed and have a solid marketing plan in place.

Markets move fast. Preparation is key. Opportunity favors the informed—let’s make the most of this season together.

If you're seeking guidance in these unpredictable times, don’t hesitate to contact me directly at 314-626-4019 or contact the AgMarket.Net team at 844-4AG-MRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net® is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.