Marketing our crop has never been an easy part of farming.

First, we have a price cycle:

- High price years: The market is so volatile that 50-cent swings in corn futures happen weekly, and we can be too stressed to pull the trigger.

- Low price years: We constantly flirt with our breakeven and try to squeeze out every last penny before making a sale.

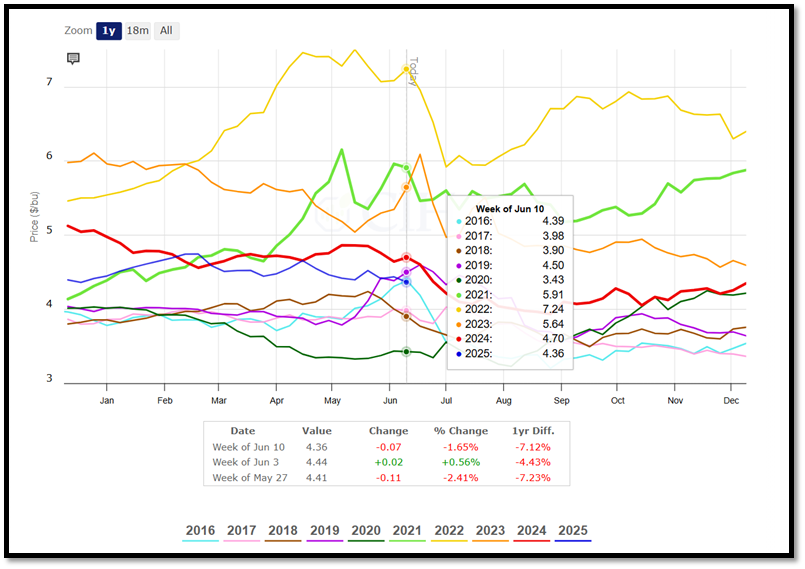

We also have an annual growing cycle that adds to the difficulty of making decisions. Historically, May and June have been excellent months to make corn sales. It’s not unusual to see a weather premium built into the market, but where is the “summer rally” this year?

December corn futures have hit their calendar year high in either May or June for 6 out of the last 10 years (2021-23, 2019,2018 and 2016). In the year years that we didn’t see a high in May or June:

- 2024. The high was set in January, but we did get within 6 cents of it in May.

- 2020. The high was set in November.

- 2015 and 2017. The highs came in July due to weather conditions during pollination.

Is a June rally possible?

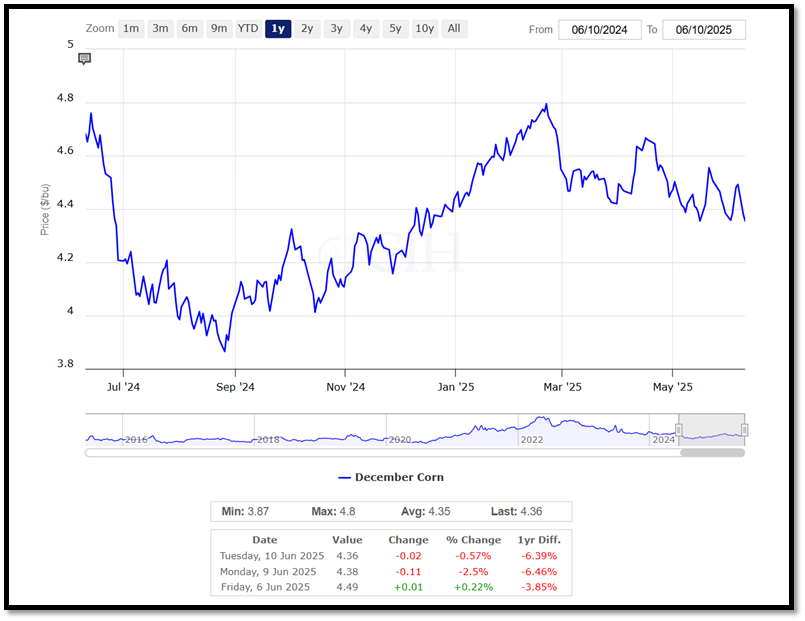

2025 is looking quite a bit different at this point. In mid-February Dec futures hit a high of $4.79. Since then, we have seen rallies stalling out at lower levels. A run in April peaked at $4.69. Our May rally turned south after hitting $4.56. Lastly, a stretch of four consecutive up days in June has us at $4.50.

Will this be the rally that continues up and takes out that February high? Or will 2025 be another year where the high is set outside of summer?

Make incremental crop sales

In my opinion I don’t think we should wait to find out before making sure our percentage sold is where it should be.

Every operation is unique and so are their marketing plans. Some operations will sell up to their crop insurance level early in the growing season, while others stay conservative with sales until we come up on harvest. Either way, I think considering making a few sales during this timeframe makes sense.

With most of the corn crop planted, USDA projecting huge acres USDA, and a shrinking drought monitor, chances of a large summer rally are dwindling. At least that is what the funds are betting on, with being 154,000 contracts short (as of June 3) during a time of the year when they typically are long.

None of this is to say a summer rally is impossible. Weather this time of year changes on a dime and we are still weeks away from pollination.

However, if you are becoming more comfortable with your crop expectations:

- Make a few additional sales.

- Use options to remain flexible, if sales make you nervous due to production issues or missing out on a potential rally, use options.

Don’t assume that at some point we are going to take out the February high and lock up until that happens: We may never get there.

Advance Trading, ATI, and ATI ProMedia are DBAs of CIH Trading, LLC, a CFTC registered Introducing Broker and NFA Member. The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading. Past performance is not necessarily indicative of future results.