It’s not easy to humble the boisterous egos shouting through the commodity markets. In the blink of an eye, Israel’s move to bomb Iranian nuclear facilities did just that.

Tariffs? Yesterday’s news, at least for now. China may or may not have committed to buying more soybeans from the U.S., as talks ground on between the world’s two super-powers. But surging energy prices and a surprise announcement on biodiesel transformed the narrative, lifting soybean prices off the mat and giving corn a boost too.

The abrupt shift in the news flow helped prices recover from World Agricultural Supply and Demand Estimates out June 12 that disappointed bulls and failed to change the narrative that crops are in good shape, despite a few question marks caused by weather. Traders likely won’t return to that discussion quickly, though a normal focus could emerge even before the outlook on the war and peace front becomes clearer.

USDA won’t be the first part of the government making predictions anyway. That distinction likely will settle as it often does on the shoulders of officials at the Federal Reserve, which offers its latest updates to monetary policy at the end of a two-day meeting June 17-18.

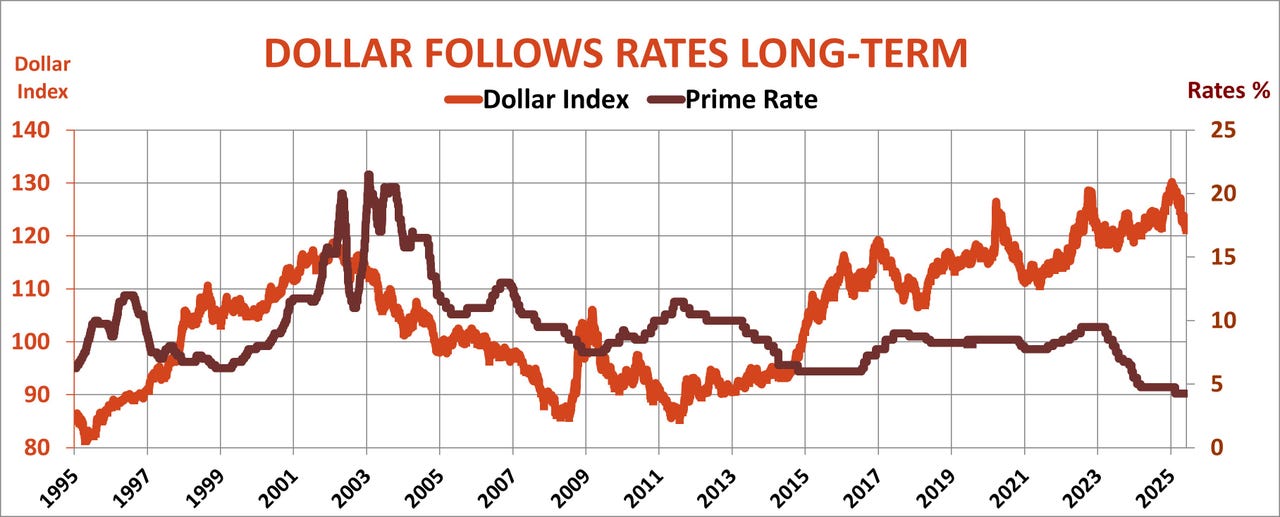

While the market nearly universally expects the central bank to hold rates steady this week, betting on Federal Funds Futures anticipates a cut of one-quarter of 1% by September with another by the end of the year. That would put the Fed’s target for short-term rates in a range from 3.75% to 4% — currently it’s 4.25% to 4.5%.

Watch Crop Progress reports

While President Trump continues to press for a much larger cut, uncertainty about the impact of events increases the bureaucratic propensity to do nothing: Picture a turtle pulling into its shell.

The government on June 12 made no changes to its production estimates for U.S. corn and soybeans, but none was expected. The agency usually, but not always, waits until surveys of farmers and their fields are completed in August, when development advances and harvest nears.

With tariff uncertainty highlighting the soybeans market – at least until bombs started falling – changes in demand also were not likely. You can’t expect government economists to be bold after those in the private sector admitted they didn’t have a clue.

Condition ratings in Crop Progress reports out most Mondays remain the most durable guide to yields this early in the growing season. My models put the U.S. soybean yield at 53.6 bushels per acre with corn at 184.4 bpa. Both are records if they last through the conclusion of 2025 crop cycle, which will take years to finally nail down.

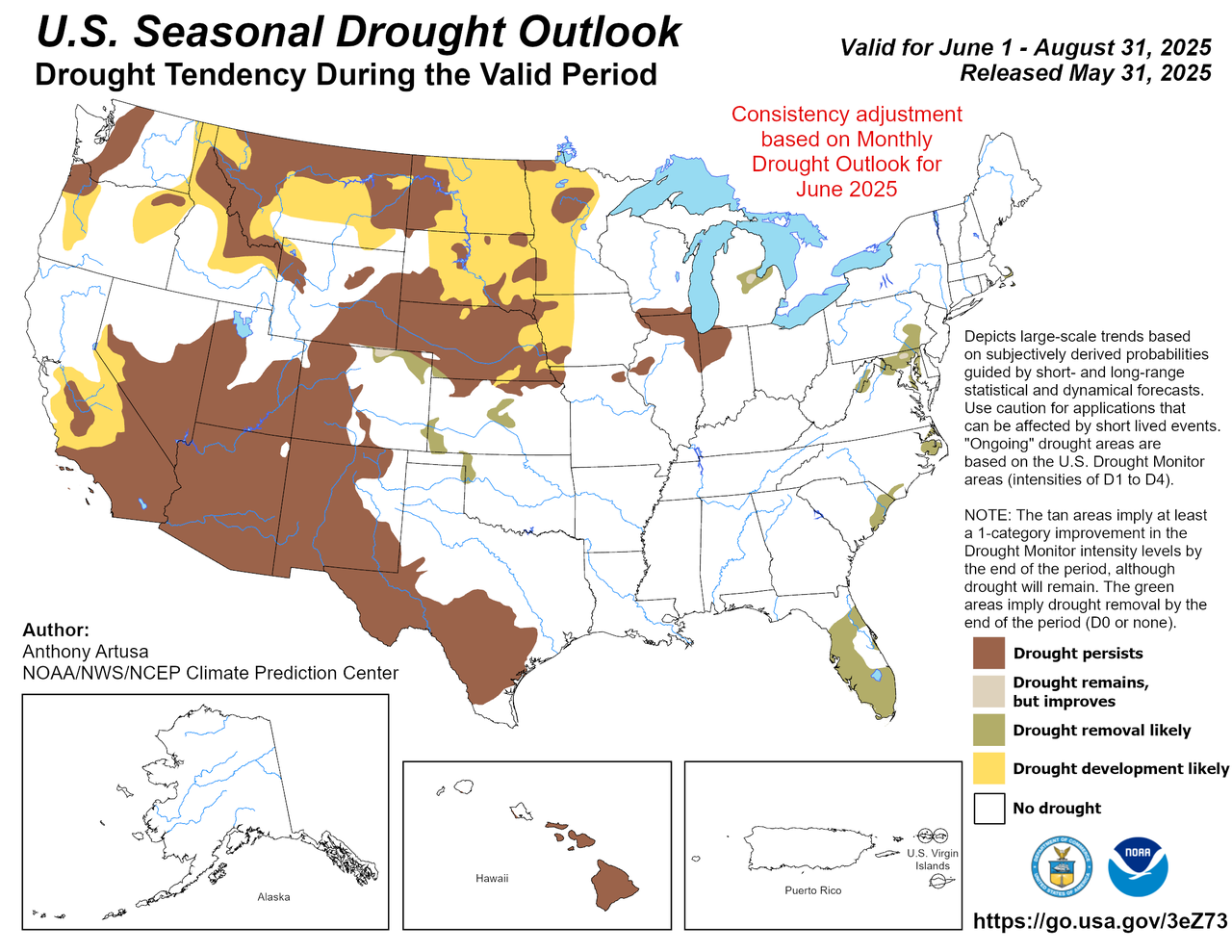

Price impact of record crops

The next piece of the production puzzle comes with June 30 Acreage updates, when weather forecasts already will peer into corn pollination windows. The outlook is a little warmer and drier than normal in parts of the Western Corn Belt that are already trending that way, but don’t appear threatening enough to yank the market out of its tariff and war torpor.

A huge corn crop should boost demand and make ethanol cheaper for blending if drivers don’t rein in summer driving plans due to higher petroleum prices or economic storm clouds. Even that boost could keep corn profits under pressure. The best my model does on that count is put the target for selling at $4.50 to $4.90, just above 2025 crop corn’s nearby selling range for June.

Soybeans could be living on borrowed time. A massive crop could nearly near double supplies leftover at the end of the marketing year Aug. 31, 2025, even if exports return to pre-pandemic levels. Yanking November 2025 futures out of their trading range seems like tall order, with the top of my projected selling range at $10.40 to $11.20.