Corn prices are best currently summed up this way: “I don’t look at the board. I don’t want to be depressed.”

These anchors are pulling down the market:

- good weather

- projecting of large U.S. planted acreage

- a Brazil crop that’s getting larger

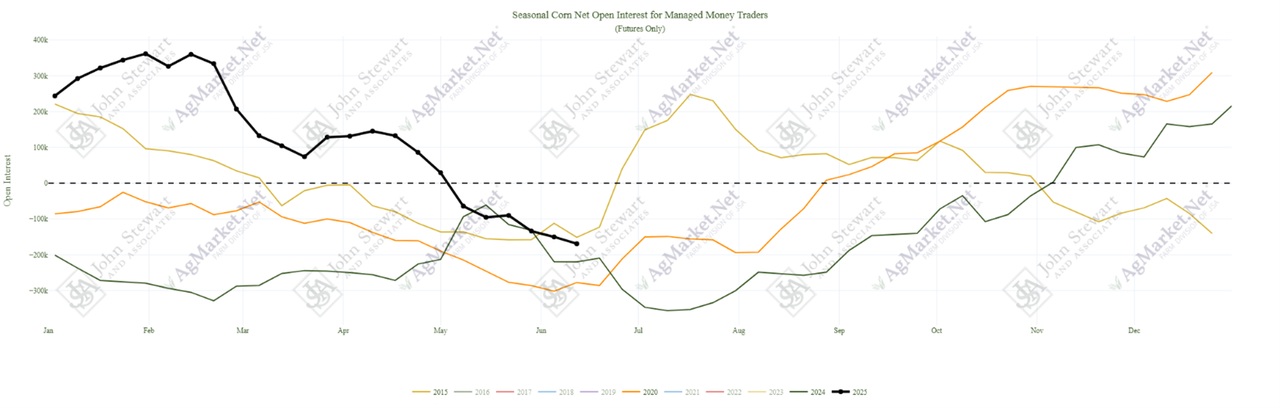

- a significant managed money short (just over 169,000 contracts)

As time moves closer to the June 30 Grain Stocks and Acreage report, a three-day July 4 weekend, and the July 11 Crop Production and WASDE reports, I looked at the occurrences of the late-season rallies. Weather is out of my wheelhouse, so this article will look at two other factors over the past 10 years: managed money shorts and the June planted acreage.

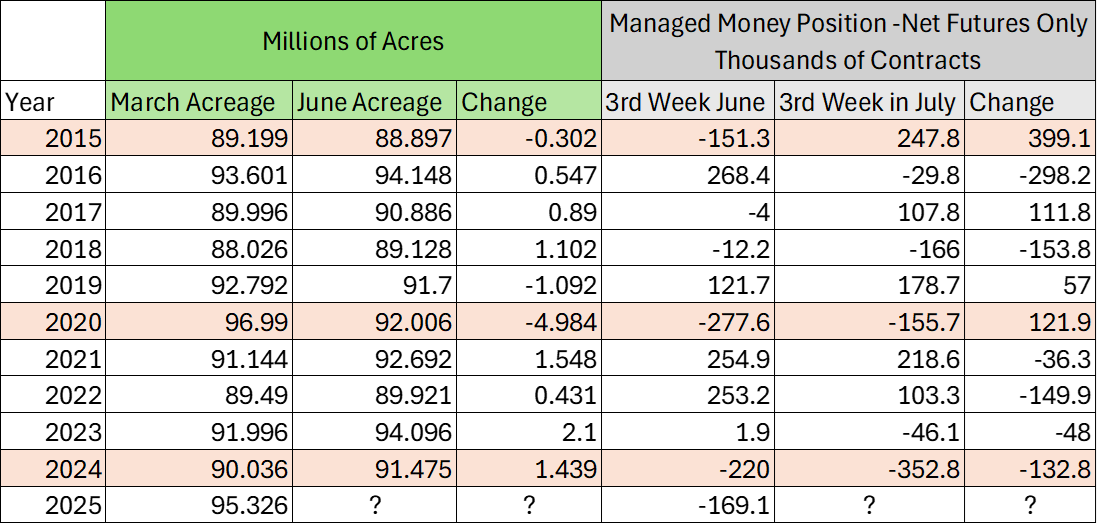

The chart below shows the change in corn acreage from the March Prospective Plantings report to the June Planted Acreage report. It also shows the change in managed money positions from the third week in June to the third week in July.

Highlighted are the three years where managed money had large short positions, like 2025, moving into the June Acreage report.

The result of these three years?

- In 2015 and 2020 reports, June acres were revised downward and managed money decreased their short position.

- In 2024, more acres were added and managed money shorts increased.

Price behaved as you would expect.

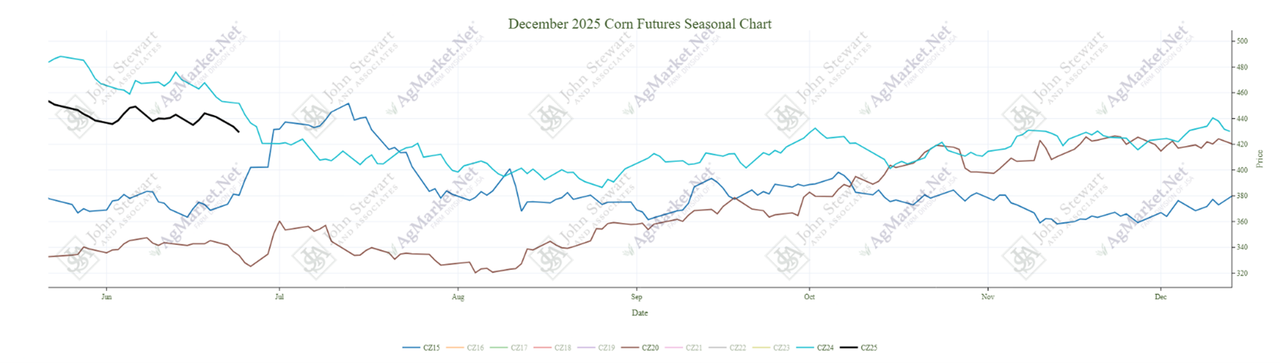

- In 2015 and 2020, prices increased on the decreased acres and managed money short covering. Note how short these rallies were leading up to harvest (chart below).

- In 2024, prices continued their downward slide through the summer.

Less acres causing managed money short covering is not a revelation. The main takeaway here is that things could get worse (2024) but that isn’t always the case (2015 and 2020). Two of the last three times that the market was in a similar position, corn saw short relief rallies. The short span of these rallies is something to note.

The factor not discussed was weather – the biggest part in the story (and a factor everyone will be watching).

Questions? Give me a call directly at 701-401-9600 or any hedging strategist on the AgMarket.Net team at 844-4AG-MRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.