Each season give farmers plenty of opportunities to feel stretched to the breaking point, say at planting or harvest, when operations require near round-the-clock attention. Mid-July isn’t nearly as frantic unless winter wheat fields are ripe and ready for combines and then double-crop soybeans.

Still, staying close to grain markets and brokers on your final road trips this summer remains a priority. From corn to currencies, prices appear ready for big moves. The impacts could affect not only selling prices for crops, but the cost of raising them, too.

The World Agricultural Supply and Demand Estimates that came out July 11 won’t drive markets much. Results overall were slightly bullish but mostly in line with trade expectations. So, what could trigger action in the second half of summer?

Big yields loom

The next WASDE, due Aug. 11, is the first measuring yields based on surveys of farmers and their fields.

Last week’s numbers:

- Projected record corn production, as expected.

- Maintained official average corn yield at 181 bushels per acre

- Slightly dropped corn acreage, chopping 115 million bushels off the June production mark.

- Held onto average soybean yield at 52.5 bpa

- Marginally dropped soybean acreage, which lowered total forecasted production by 5 million bushels.

USDA’s “official” yields are based on historical data, not an actual assessment of growing crops. The corn number takes into account planting conditions, which were within the bounds of normal this year, along with average weather for July. Soybeans, meanwhile, appear close to the statistical trend over the last 25 to 30 years.

Is USDA underplaying corn yield?

Harder data projects bigger yields. Weekly conditions reported in Progress reports showed corn fields improving last week, with a whopping 74% rated good or excellent,12.5% above he long-term average. That projects a huge yield of 188.7 bpa, though with plenty of leeway for statistical error, which could knock them down to 177.3 bpa. The Vegetation Health Index showed slighter improvement but still suggests output at 182.7 bpa.

The difficulties in soybean forecasts

Soybeans are always trickier this time of year when some double-crop seeding is still underway. Weekly ratings from USDA were up 6.5% year from average, putting the yield at 53.6 bpa, with my VHI model at 53.2 bpa.

Weather woes aren’t widespread

While the Western Corn Belt, northern Illinois, Indiana and parts of Michigan have some dry spots, severe drought is absent, according to the latest Monitor. Just 12% of corn and only 9% of soybean fields are in drought on the weekly index. Dry areas around the Great Lakes could expand over the next week, but two-week maps are both wet and a little dry, too.

Extended maps show no significant soil moisture deficit over the Plains and Midwest. El Nino also is missing in action, with neutral conditions in place since winter and forecasted to stay there into the fall, and perhaps beyond. La Nina cooling of the equatorial Pacific is sometimes associated with big U.S. droughts but yields trend higher in years when it’s getting ready to emerge in the fall, and some models are hinting at that this year.

Average corn prices barely top $4

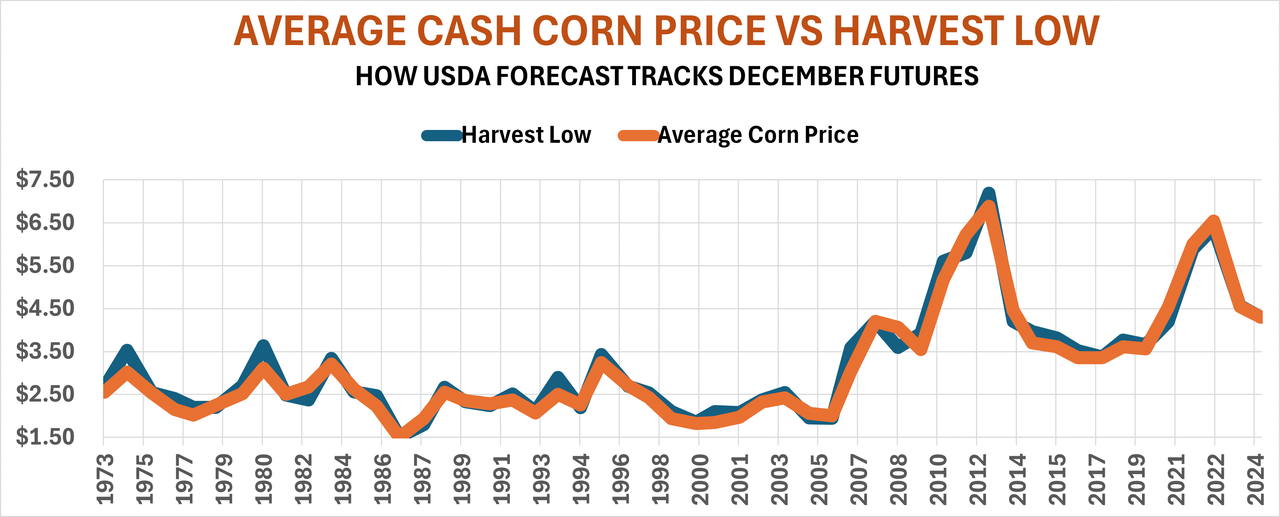

If the government production forecasts were uneventful, so were its predictions about prices and usage. The agency kept its 2025 crop average cash corn price forecast at $4.20. It’s worth noting that USDA’s average and harvest lows for December futures have a very strong, almost perfect, correlation, which translates to just under $4.25 based on the July WASDE print.

As for demand, tariffs and other policy question marks cloud how much end users both here and abroad require. Feed usage for the 2025 crop was cut modestly, in line with lower production. Soybean crush was forecast higher on biofuel demand while exports of the oilseed look weaker due to increased sales from Ukraine and Argentina and big supplies in Brazil. Chinese soybean imports would continue to grow, despite questions about U.S. availability.

The dollar and tariffs

One factor often associated, rightly or wrongly, with export demand is the value of the U.S. dollar. Questions about the impact of tariffs on inflation and economic growth dogged the dollar since the Trump Administration first announced the duties in April, though the greenback began its freefall on Inauguration Day.

While the weakness gives foreign customers more dollars to spend on U.S. crops, a bigger factor historically is whether competitors have inventory to sell. Parts of Europe remain dry, and much of Brazil and Argentina are also short. Soybean planting in Brazil can’t begin before mid-September most years and 2024-25 Argentine corn harvest was only 70% completed last week.

Don’t discount the currency market’s ability to influence prices, nonetheless. The dollar, interest rates, and the stock market could all produce shocks that rattle loudly, as aptly demonstrated last week.

Worries about the safe haven status of Treasuries caused some to abandon Treasuries, pushing interest rates higher, with the 30-year Bond flirting with 5%. While the dollar fell to new three-year lows before bouncing back Friday, the stock market whistled past the graveyard, making new all-time highs.

The gyrations extend to commodities aside from grain markets.

Crude oil is typically traded in dollars, so a weaker dollar should favor higher energy costs.

Petroleum indeed sank to four-year lows on the tariff drama in April, and weakness also came last week from OPEC+ news of increased production as Saudi Arabia seeks to increase its market share. But seasonal factors, like summer driving demand, not to mention Middle East tensions, pulled West Texas Intermediate towards $80 last month before the market cooled sharply.

Energy products farmers rely on are also in play. Propane often bottoms at the end of the winter heating season, as it did this year, but a double dip can also be seen in summer if weakness threatens the economy.

Propane at the Gulf fell last week but could be set for a demand rally if a record corn crop increases drying demand.

Ag usage also is the swing factor in demand for ultra-low-sulfur diesel, which fell to four-year lows before planting kicked into gear, though they’re in the middle of their fairly narrow range since 2023.

Some traders who normally use dollars for these transactions abandoned the greenback for other currencies, further clouding the issue. This type of switching could also impact fertilizer costs, which are still trying to normalize after Russia’s invasion of Ukraine.

Phosphates are also on the move, since so much of the world’s needs come from North Africa and Russia.

DAP at the Gulf surged to its own four-year high last week, topping $725 a ton.

Gulf urea closed at $435 a ton last week, in the middle of its wild range of near $150 this spring.

Potash, by contrast, was up less than the 10% tariffs announced for Canada, which slid under the radar thanks to the free trade agreement with Mexico and the U.S. And compared to a year ago, costs appear to be down or only slightly higher.

All these markets seem itching to make a move. But like everything these days, their future is anybody’s guess.