By Austin Schenkel

As we push deeper into the 2025 growing season, optimism across much of the Corn Belt remains high.

Early reports from agronomists and crop scouts point to strong yield potential, with many areas off to one of their better starts in recent years. Timely planting, favorable emergence conditions and ample early-season moisture have helped build the foundation for what could be a record U.S. corn crop.

With big yield prospects come new marketing challenges—and this year, discipline and flexibility will be more important than ever.

Keep your eyes on the sky

Crop conditions across key growing states, including Iowa, Illinois and parts of Nebraska, are well above average. USDA’s most recent Crop Progress report has the crop pegged at 74% good/excellent—well ahead of a 5-year average and its highest weekly rating since 2016. Many producers report some of the best-looking corn they’ve seen in July. Early vegetative growth was accelerated by warm temperatures and regular rainfall, pushing development ahead of the normal pace in several regions. Barring a major weather scare, national corn yields could exceed trendline estimates.

While USDA’s Crop Progress ratings aren’t the end all be all, they’re still worthy of attention. Since 2010, when early July ratings topped 70% good-to-excellent—as they have this year—the U.S. produced an above-trendline national corn yield every time. If that pattern holds, we could be looking at a record-breaking crop, with total production potentially surpassing 16 billion bushels, eclipsing the previous high of 15.3 billion set in 2023.

That said, it’s important to temper expectations. The last time we met or exceeded the national trendline yield was back in 2018. Some argue that hitting above-trend levels this year may be a tall order, given the sheer size of planted acreage and the likelihood that growers cut back on inputs in response to lower market prices. The potential is there—but the path to a record crop isn’t guaranteed.

It goes without saying: Mother Nature remains in the driver’s seat. As we move into the latter part of July, silking is rapidly advancing across much of the 2025 U.S. corn crop. But with the crop entering this critical stage, the production outlook remains clouded by conflicting short-term weather forecasts. Some view the recent uptick in rainfall and moderating temperatures across parts of the Midwest as encouraging signs that record yields could still be on the table. Others, however, warn that a warmer, drier pattern may develop by late July and extend into August, potentially stressing the crop during the all-important grain fill period.

Farmers can be price makers

With futures markets already pricing in expectations of a record crop, marketing discipline is crucial. It’s easy to get caught flat-footed when prices drift lower on strong supply sentiment—especially if you’ve been holding out for better values. But just as important as sticking to a marketing plan is building in enough flexibility to react if the weather—or the market—throws a curveball.

This is where option strategies come into play. If you’re still largely unpriced, consider using put options on unsold bushels to establish a floor under current price levels while preserving upside potential. If you’ve sold a portion of your crop ahead of harvest, buying call options against cash sales gives you the ability to participate in a price rally should weather, trade policy/tariffs or supply/demand dynamics take an unexpected turn.

With volatility currently low, options are relatively inexpensive by historical standards.

For example, a $4 December put option is trading around 10 cents—effectively giving you a $3.90 price floor ($4 - $0.10).

Sure, a $3.90 floor isn’t exactly headline worthy. But here’s some perspective: When was the last time the U.S. and Brazil combined to produce 21 billion bushels of corn? Answer: never.

To be fair, global demand has shifted and continues to evolve. But the point stands: This kind of potential supply pressure simply hasn’t happened before.

If futures continue to drift lower, the put gains value and helps cushion the downside. If prices rally, your cash sale benefits. In short, you’ve created a more balanced position.

Personally, I’m not comfortable being long 100% of the crop while staring down the barrel of a potential record harvest. Options offer a flexible, cost-effective way to manage said price risk—and allow you to be a price maker, not a price taker.

The goal isn’t to predict the market. The goal is to be prepared for it. That means protecting your revenue whether yields boom or bust.

Tips for producers

- Stay the course. Only adjust with purpose. Stay committed to your marketing strategy as your yield expectations evolve. Don’t allow the market to dictate emotional/irrational decisions.

- Leverage the tools available. Take advantage of the marketing tools at hand. Establish price floors with futures/options to remain flexible to be prepared for whatever the next headline has in store.

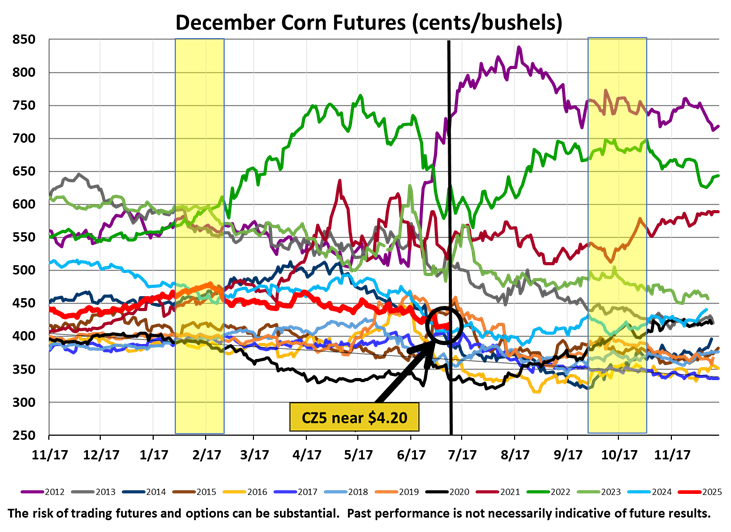

- Be a student of the market. Predicting price direction is a fool’s game. Understanding historical patterns and managing risk isn’t. Is the “bottom” near? Will prices slip further once the combine hits the field? The chart below highlights the performance of new crop corn (Dec futures), with spring and fall insurance pricing periods shaded in yellow. Consistent volatility from mid-July through October is the norm since 2012. Use that volatility to your advantage through options strategies. Don’t allow it to control your decisions.

In a year marked by both promise and unpredictability, smart marketing isn’t about trying to outguess the market—it’s about understanding your numbers, managing risk and striking the right balance between discipline and flexibility.

Take control by adding futures/options to your marketing toolbelt. These tools provide protection without limiting opportunity. Now is not the time to sit back or second guess. Now is the time to stay proactive, sharp and in control

Good luck this fall and stay safe!

Advance Trading, ATI, and ATI ProMedia are DBAs of CIH Trading, LLC, a CFTC registered Introducing Broker and NFA Member. The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading. Past performance is not necessarily indicative of future results.