August 2025 Class III milk futures prices peaked near $20 in late May. Over the past seven weeks, prices have lost nearly $3 in value as U.S. milk production ramps higher.

What’s happened

Back in May, I wrote that while demand for milk and milk products was strong, U.S. milk production was slowly starting to increase and could tip the scales to more of a negative fundamental bias, which would pressure prices lower.

Unfortunately, the reality of higher U.S. production has indeed surfaced, which caused milk futures price to plummet lower.

From a marketing perspective

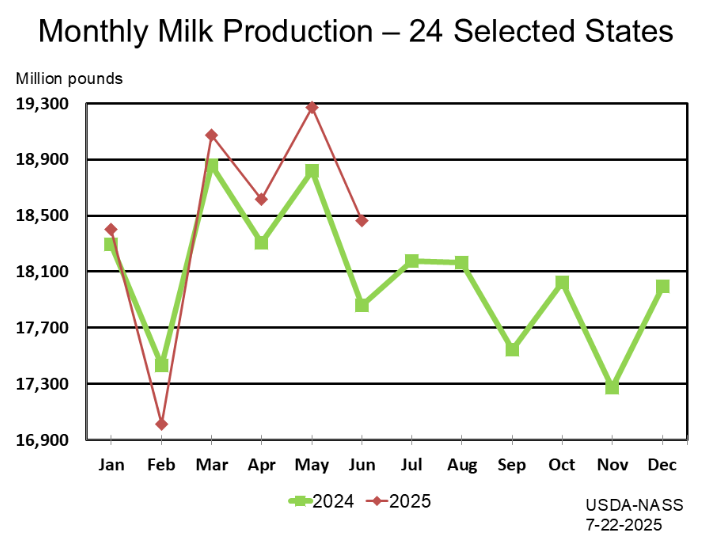

The most recent monthly milk production report confirmed yet again growing supplies of milk. June milk production totaled 19.233 million pounds, up a whopping 3.3% year over year. It wasn’t just the June production number that was large, the USDA also revised the May production number higher, now pegged at 20.072 million pounds.

More cows being milked and higher production per cow contributed to the growth. This report showed cow numbers totaled 9.469 million head, up from 9.323 million in June of 2024 and up from 9.465 million last month. Production per cow was 2,031 pounds, up from 1,998 pounds one year ago.

Much of that milk is being processed into cheese. The most recent cheese production report said that U.S. cheese production during May 2025 totaled 1.25 billion pounds, which was up 3.3% from May 2024 and 1.4% higher than April 2025. Cheese production is strong, and thankfully so is both domestic and international demand for cheese.

While we continue to wait to hear about reports of trade deals, exports of U.S. dairy products thankfully remain strong. United States dairy exports in May 2025 totaled 228,179 metric tons, up 3% from month prior. Cheese exports came in at 51,549 metric tons, up 7% from last year.

Prepare yourself

The reality of stronger milk production may keep futures prices on the defensive in the short term. Class III front month contracts currently have technical price support near the $17 area.

A monthly Cold Storage report, which will shed light on butter and cheese inventories, will be released late this week. Traders also will be eyeing demand news that might emerge from trade deals, to help support additional export demand for U.S. dairy products.

The short-term question will be whether $17 can continue to hold as technical price support. If not, it might be a quick drop down to the next technical price support near $16.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.