An 80-cent price rally in soybean futures occurred during August, thanks to an unexpectedly friendly August USDA report that surprisingly lowered U.S. soybean production.

What’s happened

Just days before the Aug. 12 report, November 2025 soybean futures were trading near a low price of $9.80. Weather outlook for August looked conducive to growing a big U.S. soybean crop, which weighed on price sentiment.

The report was overall viewed as friendly, especially given an adjustment down on planted soybean acreage.

Heading into the August WASDE report, planted soybean acres for the 2025-26 crop year were pegged at 83.4 million acres, a number derived from the June 30 USDA Planted Acreage Report.

The August report, which had updated USDA Farm Service Agency data, stunned traders as planted acreage was reduced by 2.5 million acres to 80.9 million acres (with 1.2 million acres of prevent plant soybeans).

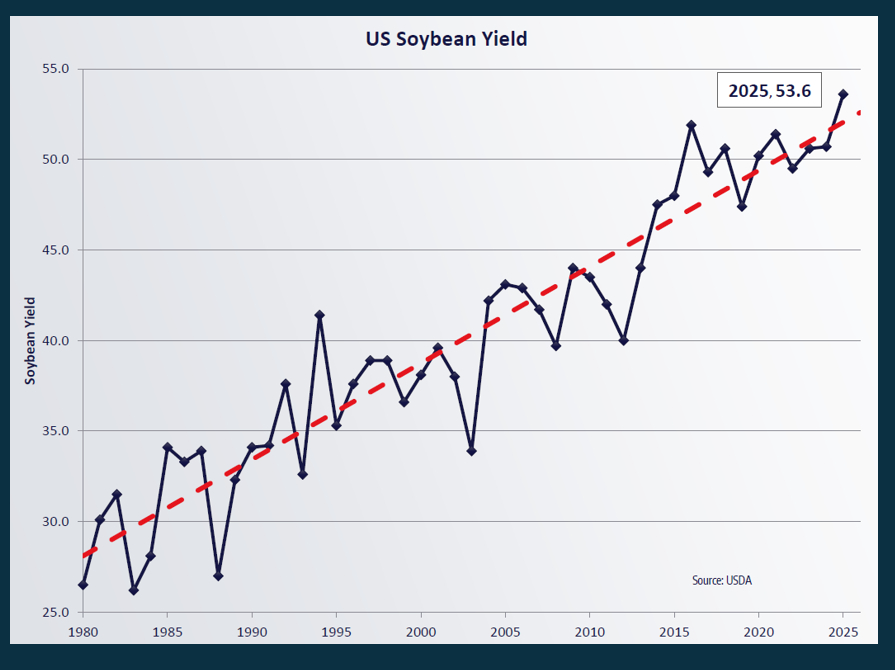

While planted acres were lower, USDA moved soybean yield higher. With cooperative July and August weather, the August USDA report pegged yield at 53.6 bushels per acre, up 1.1 bushel per acre from the July report.

The net result was that total production for the 2025-26 crop year is now projected at 4.292 billion bushels, down from 4.335 billion in July.

Even though production was lowered, which was supportive for prices, the USDA did acknowledge the slow pace of demand for exports (because of lost export demand to China due to trade and tariff strife). New crop exports were lowered by 40 million bushels, and are now pegged at 1.705 billion bushels, down from 1.875 billion during the 2024-25 crop year.

That export demand number could fall further on the September USDA WASDE report if China doesn’t buy any soybeans soon. Overall, U.S. soybean export sales are half of where we were last year at this time. China hasn’t bought any U.S. soybeans yet and rumors are that China has their September and October needs booked through Brazil and Argentina.

From a marketing perspective

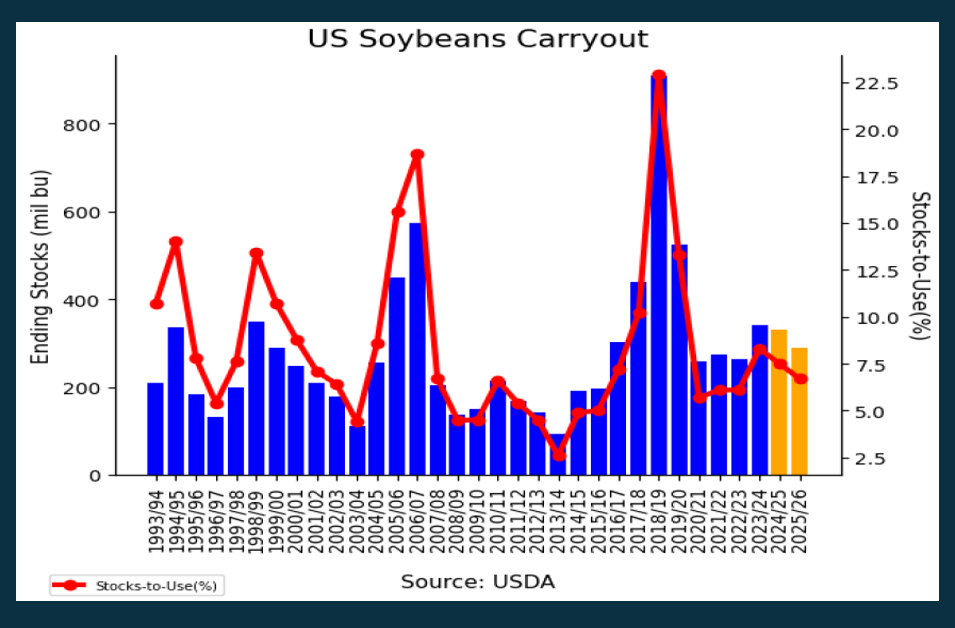

When you combine the updates in supply and demand information, the net result was that U.S ending stocks for the 2025-26 crop season came down. New crop ending stocks for the 2025-26 crop year are now pegged at 290 million bushels, the lowest in three years.

Fund traders saw the friendlier tone of the report and began to exit short positions. This also helped propel soybean futures prices higher. After being short over 50,000 contracts in early August, managed money fund traders as of the Aug. 22 Commitments of Traders, or CFTC, report, had exited all their short positions. Essentially, funds are now "neutral in soybeans." Meaning, they are not active buyers or sellers. They are sitting on the sidelines, waiting for fresh news to enhance the narrative.

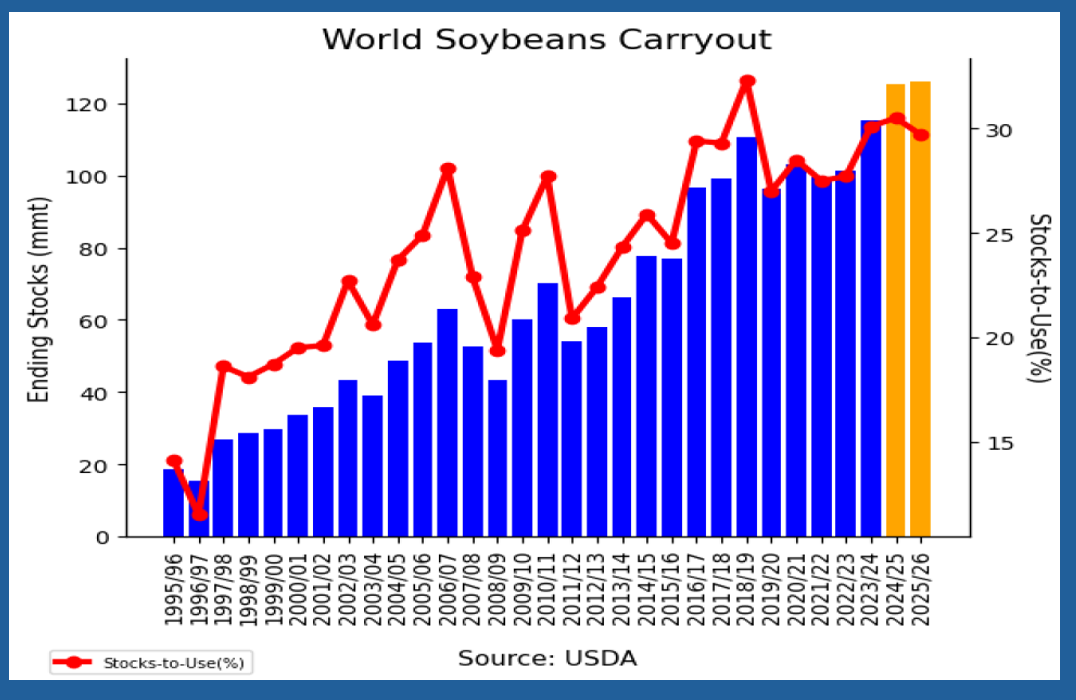

The smaller U.S. production number is friendly, However, uncertainty surrounds U.S. export demand. Also, the funds likely are aware that global soybean production is ample and so are ending stocks, which might keep a further price rally from occurring in the short term.

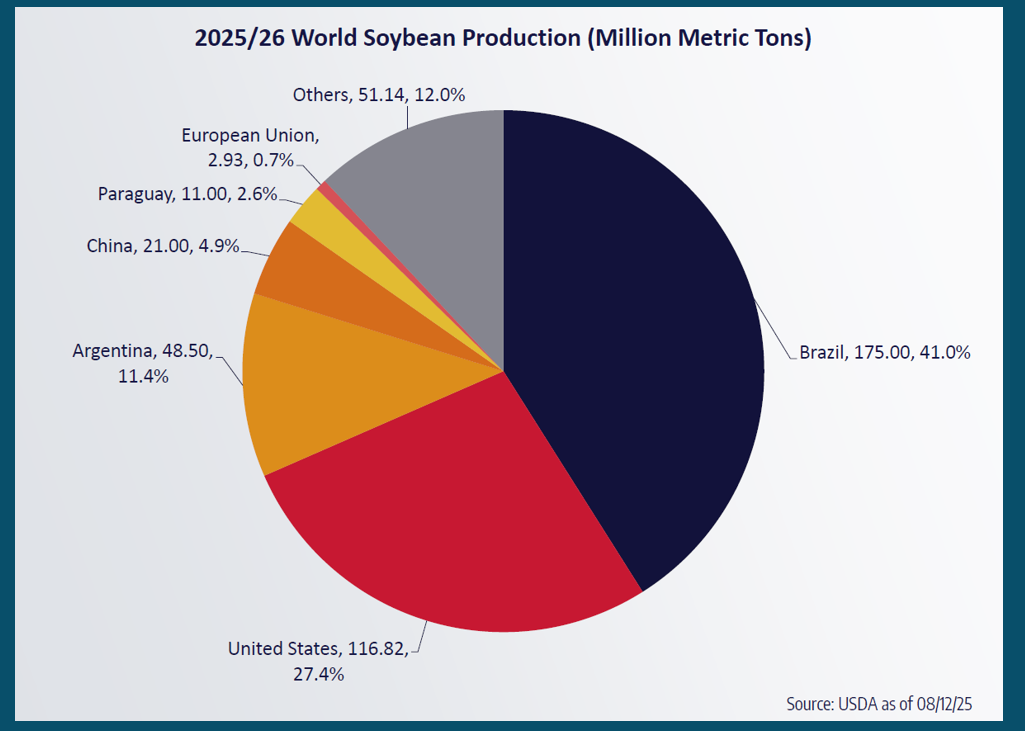

From a global perspective, soybean supply is plentiful. Brazil remains the world's largest soybean grower, with production pegged at 175 MMT. According to USDA data, Brazil’s soybean production continuously increased in recent years. Last year Brazil’s crop was 169 MMT, and the year before that, it was 154.50 MMT.

The United States is the second largest grower of soybeans, with production pegged at 116.82 MMT, while Argentina is in third place at 48.50 mmt.

The biggest elephant in the room likely continues to be the record large global ending stocks. For the 2025-26 crop year, global soybean ending stocks are said to be at 124.90 MMT, near the same level as the 2024-25 crop year of 125.19 MMT. These numbers are up sharply from the 2023-24 crop year when global soybean ending stocks were pinned at 115.31 MMT.

Prepare yourself

Expect plenty of continued price zigs and zags for the soybean complex. A lack of export buying from China might send prices crashing back down to the early August lows. However, if China begins to buy U.S. soybeans, that would be quite supportive to the soybean price story.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.