After a rough summer slide, grain markets are showing signs of life as we head into fall and prepare for harvest. It is always nice for farmers to get the machines in the field and see what size of crop you really did produce. The market anxiously awaits yield results to see how this crop truly finished.

You also have incredibly important decisions on how you manage the farm finances this winter. Cash flow needs and market expectations are typical factors driving producer decisions:

- How much do you sell?

- When to sell?

- How long should you store the crop?

Let’s take a little walk and talk about the important decisions in front of you.

Cash flow

Cash flow needs are critical. Bills must be paid. One often-overlooked decision that can predictably make an immediate impact to your bottom line is simply reducing the amount of money you borrow and eliminating unnecessary storage fees.

If you’ve got a big note, it makes a lot of sense to pay it down.

If you don’t own storage, it’s expensive to store and difficult to capture basis improvement with bushels in commercial storage.

For these reasons, I’m a big fan of converting bushels to cash. Make the cash sale on bushels that you can’t store on the farm. Get the cash flow situation in check. Now for the bushels can store on farm, the market is offering you opportunities to get paid to store the grain, provided you are willing to capture the carry. I like this choice, especially if you are facing historically weak basis values. For those bushels, I like forward sales to lock in that carry. Use the carry to pay for a call option and keep you upside open.

Market expectations

Market expectations often lead to trouble. Everyone loves bullish rhetoric, being a bull sells newsletters and advisory services and makes plenty of friends.

Yet, being bullish and wrong can cost you, and that’s likely a fresh feeling for some right now. It’s important to stay balanced and avoid the psychological traps of the market.

We can make a similar argument about being too bearish. Underestimating the ability for markets to rally can be incredibly costly. Think 2020 – arguably a doom and gloom summer. Dec Corn traded down to $3.20 mid-summer and eventually the market clawed back to $4 in October. Many sold then. They saw that opportunity was a gift after the emotional rollercoaster they went through over the prior year. Others scaled into sales in smaller increments. Eventually, however, they also ran out of grain to sell into the rally. That’s about the time the fireworks really started – $5, $6. Corn even traded over $7 corn a few times in July 2021.

Keep your upside open

Underestimating a market’s ability to move higher costs you the opportunity to gain equity. In agriculture, opportunities to impact your equity at this magnitude can be far and few between. Producers must be able to take advantage of the good times in order to weather through the tough times.

Cowboys, your day is upon us. As you make sales, it is important to stay in the game and retain upside on old crop bushels. Make the most of market opportunities.

Marketing isn’t easy. This fall, I encourage you to defend the decisions you make. Use tools that give you the confidence to execute, make decisions broadly enough to make an impact on your farm and stay in the game.

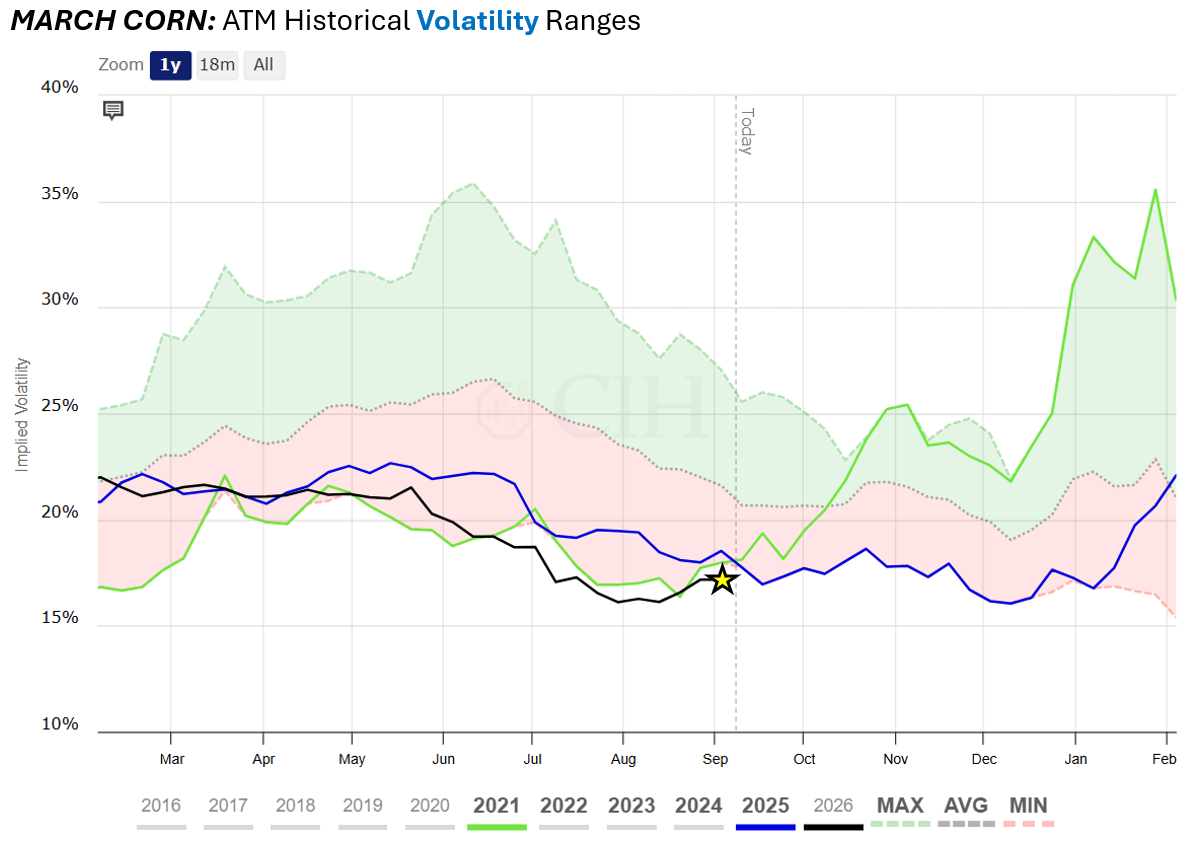

Volatility is low as you can see in the graphic below. Low volatility makes options an inexpensive way to defend your decisions and extend your opportunity.

Advance Trading, ATI, and ATI ProMedia are DBAs of CIH Trading, LLC, a CFTC registered Introducing Broker and NFA Member. The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading. Past performance is not necessarily indicative of future results.