Corn futures rallied to 10-week highs and soybean futures jumped to two-week highs as optimism over grain demand overshadowed higher than expected yield and production numbers in USDA’s latest monthly Crop Production and Supply and Demand reports today.

USDA’s updated yield estimates were slightly above analysts’ expectations for both corn and soybeans, and the agency unexpectedly hiked its corn production outlook even further into record territory. However, USDA also boosted its estimate for U.S. corn exports in the 2025-26 marketing year to an all-time high near 3 billion bushels and trimmed its outlook for supplies at the end of the year.

Futures prices had a muted response immediately after the reports were released before soybeans led a delayed-reaction rally and corn soon followed. December corn jumped 10.25 cents to end at $4.30 per bushel, the contract’s highest settlement since July 3 and a 12-cent gain for the week.

November soybeans surged 12.75 cents to $10.4625 per bushel, a two-week closing high and a gain of 19.25 cents for the week. December SRW wheat rose 2 cents to $5.2350.

Quick take from Advance Trading’s Brian Basting: Stay flexible, consider your options

Why did corn and soybean futures rally today? “It’s impossible to say for sure, but one thought is that soybean and corn yields may eventually decline from current levels due to the extremely dry conditions during August,” said Brian Basting, an economist at Advance Trading Inc. “Another line of thought is that a trade deal with China may be forthcoming, although that’s highly uncertain at the moment. A deal—of lack thereof—will be especially important for beans.”

“Given the potential buildup in U.S. corn supplies and considerable uncertainty surrounding the future of U.S soybean exports to China, it is crucial for producers to utilize risk management marketing tools to defend their balance sheets for 2025 production,” Basting said.

“In that light, maintaining marketing flexibility is essential,” Basting continued. “One strategy to consider is the simultaneous sale of production at harvest and the purchase of a call option. The sale would lock in a price floor while the call option would enable the participation in potential market rallies.”

“Alternatively, newly harvested 2025 production can be placed into storage while simultaneously purchasing a put option,” Bastin added. “The put option would provide a floor while also enabling the participation in potential market rallies.”

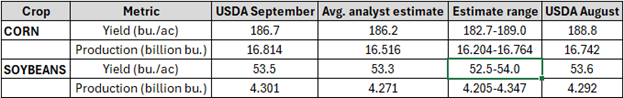

The following is a brief summary of key USDA corn and soybean numbers for the U.S.:

Corn planted acreage highest since 1936

For corn, USDA slashed average yields by 2.1 bushels per acre to 186.7 bpa following a dry August in much of the Midwest. Approximately 49% of the Midwest is experiencing drought, according to the latest U.S. Drought Monitor. Analysts were expecting to see a 2.1 bpa yield reduction.

Among top producing states, USDA lowered Iowa’s estimated yield by 3 bpa to 219 bpa, still a record. Yields for most other Corn Belt states were also reduced from August forecasts.

Even so, USDA is predicting an even bigger U.S. corn crop, raising its forecast to an unprecedented 16.814 billion bushels, an increase of nearly 2 billion bushels, or about 13%, above last year’s harvest. Higher production reflected another increase in USDA’s estimates for planted and harvested acreage. USDA boosted corn plantings another 1.47 million acres to 98.728 million acres, the highest since 1936.

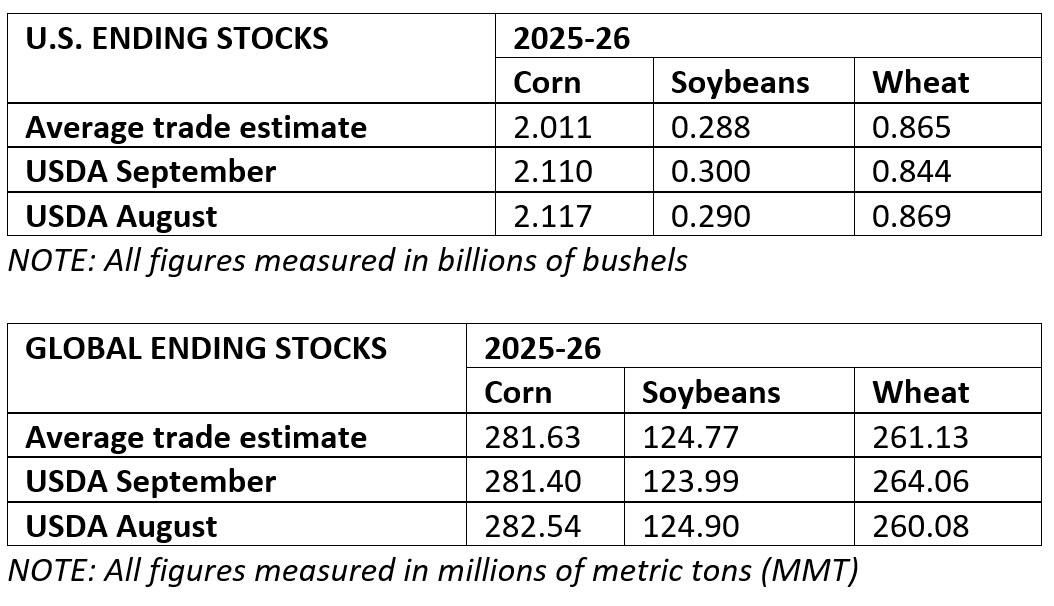

Also in the mix, U.S. corn exports were raised to a record 2.975 billion bushels, up 100 million from last month’s estimate and a record. Ending stocks were trimmed 7 million bushels to 2.11 billion bushels. The expected season-average farm-level price held steady at $3.90 per bushel.

Even with the ending stocks reduction, the corn market faces a burdensome supply outlook for the coming year, limiting price rally prospects and putting any further yield changes under close scrutiny. U.S. corn ending stocks next year would be up 59% from 2024-25 and a seven-year high.

“Further upside potential for corn short-term will now be directly tied to any additional adjustments to the U.S. national average yield,” Basting said.

Global ending corn stocks for 2025-26 were cut 0.4% to 281.4 million metric tons (MMT), down 1% from 2024-25 and the lowest since 2014-15. Increases in South Africa and Ukraine were more than offset by decreases in China and Russia.

Soybeans offer mixed picture on demand

USDA lowered its average nationwide soybean yield estimate to 53.5 bpa from 53.6 bpa, contrary to analysts expectations for a figure closer to 53.5 bpa. Production was raised to 4.301 billion bushels, up 9 million bushels from August but still down 1.5% from 2024’s crop.

Demand numbers were mixed, with estimated U.S. crush raised 15 million bushels to a record 2.555 billion bushels, while exports were reduced by 20 million bushels, to 1.685 billion bushels, a six-year low. Ending 2025-26 stocks were raised 10 million bushels from August to 300 million bushels, down 9% from 2024-25. The season-average price for farmers slipped 10 cents lower to $10.00 per bushel.

On the global front, USDA lowered its estimate for 2025-26 production by 0.1% to 425.9 MMT, which would be up 0.4% from 2024-25. Global stockpiles at the end of the 2025-26 marketing year were trimmed 0.7% to 124 MMT but still seen at an all-time high.

Wheat production keeps increasing globally

USDA upped demand expectations for wheat, increasing projected 2025-26 U.S. exports 25 million bushels to 900 million bushels, citing strong sales and shipments of hard red winter wheat. Estimated U.S. supplies at the close of 2025-26 were tightened by 25 million bushels to 844 million bushels.

However, USDA also lowered its average farm-level wheat price by 20 cents to $5.10 per bushel.

Adjustments to the global balance sheet leaned bearish for wheat prices, with USDA boosting estimated worldwide production for 2025-26 to 816.2 MMT (30 billion bushels), up 1.2% from an August estimate and a seventh consecutive annual increase.

The higher production outlook was driven by expectations for bigger crops from Australia, Canada, Russia and the European Union. USDA raised estimated 2025-26 ending stocks by 1.5% to 264.1 MMT

The following are summaries of key USDA Supply and Demand numbers for the U.S. and world: