Grain markets obviously have a lot to do with weather. They even share an old Midwestern joke: If you don’t like it, just wait 15 minutes.

The turnaround after the Sept. 12 World Agricultural Supply and Demand Estimates came much faster than that.

December corn plunged some eight cents in the seconds after the WASDE dropped, while November soybeans nearly doubled that loss. The spikes lower didn’t last. Futures held and were actually higher just three minutes later.

Thanks to high frequency trading programmed to shoot first and ask questions later, this type of whipsaw isn’t unusual.

The trigger for the selloff wasn’t weather. In the long run, causes may be only a footnote to USDA data that also may soon be forgotten. But for now, here’s what the reports said – and didn’t say – about the months ahead.

Lower yield on more acres

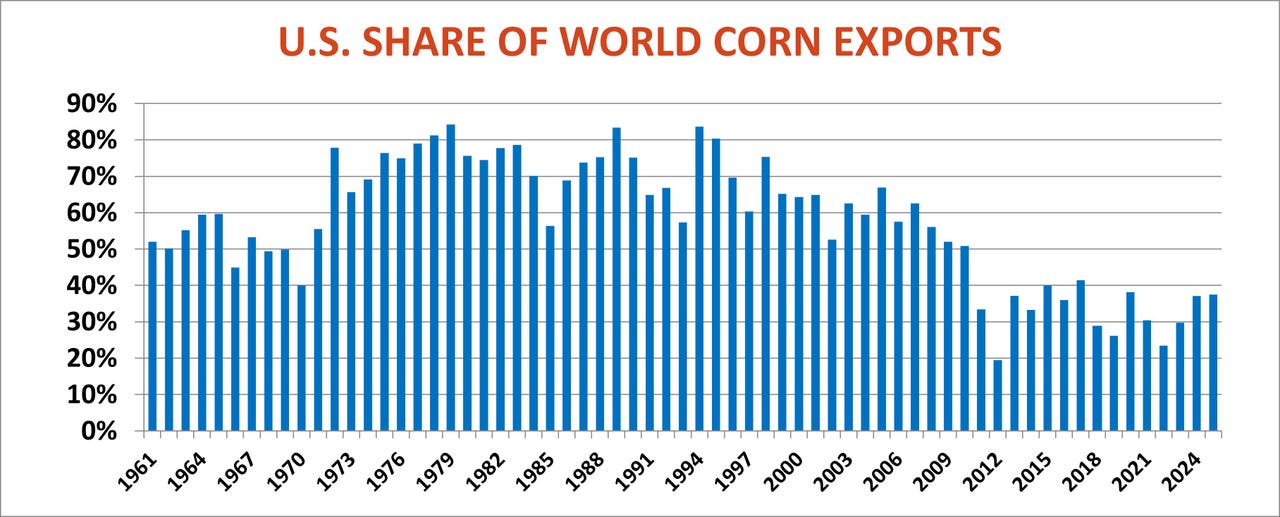

Digging through the weeds of the corn data shows why the trading bots were confused. The agency lowered its estimate of yields by 2.1 bushels per acre but spread the crop across 1.3 million more harvested acres. The result was an increase of 72 million bushels in total production, raising this crop to a record 16.8 billion. Yet a boost in exports could keep a lid on the amount of corn left over a year from now. Ending stocks may not grow much – or at all.

My own models are even more optimistic about exports, but don’t show anywhere near the same robust demand USDA sees for feed and ethanol.

Uncertainty about domestic usage remains high: Will the economy keep growing amid worries about jobs and inflation – not to mention wars, assassinations and headlines even more volatile than the markets? Maybe a nice long road trip through fall colors and steaks on the grill are the antidote for modern troubles? We can all hope it’s that easy!

Bearish for beans?

The fast selloff in soybeans after the USDA release looks like a case of “what’s good for the goose – er, corn – must be good for the gander. Otherwise, the details of the data didn’t scream with overtly bearish signals.

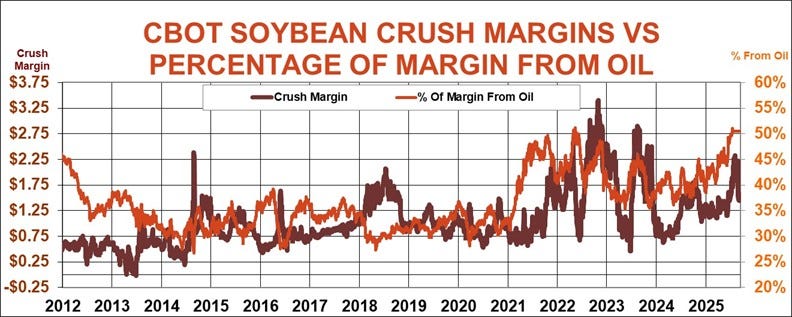

As with corn, USDA dropped its yield estimate and raised harvested acres, though both adjustments for the oilseed were minor. Average national yields were cut a tenth of a bushel to 53.5 bpa, and harvested acres rose by just 200,000 for a gain in total production of a mere 9 million bushels. A small reduction in exports offset an increase in projected crush, while ending stocks rose 10 million bushels. That knocked a dime off average cash prices, dropping them to a projected $10 a bushel.

The same macro-level concerns clouding the corn outlook also hover over soybeans, perhaps even more so. The agency made no change to its forecast for exports to China, which could be the wild card of wild cards, depending on how trade talks play out.

Crush also remains subject to political winds around the world. Margins are in the bottom half of their trading range, supported by soybean oil prices, which account for more than half of processor profits. Maybe cook a lot of fries to go along with those steaks?

Market reaction to rate cut

USDA could adjust some or all of these numbers with the next WASDE, due out Oct. 9. Of course, that assumes a report is coming. Just as uncertain as what USDA will say is whether the agency will say it at all. Talks over a new budget continue and remain bogged down in the Washington swamp. Prospects for another government shutdown seem inevitable, which could postpone or even cancel the next report altogether.

In the meantime, the Federal Reserve begins a two-day meeting on monetary policy that is set to wind up Sept. 17, though who will be sitting at the table remains unknown.

The market believes a cut of ¼ of 1% in benchmark Federal Funds is a done deal, with perhaps even a jumbo cut of ½ of 1% in play. Whether markets take that as a bullish sign or a harbinger of a recession ahead is unclear. In any case the market’s reaction could be like that old joke: If you don’t like the result, just wait 15 minutes.