The results of the September USDA WASDE report for corn were viewed as neutral versus pre-report expectations. The theme of large U.S. corn production and large carryout continues. However, it was interesting to note that traders shook off the negative sentiment, and corn prices rallied after the report, as suspicion grows regarding actual corn yield.

What’s happened

Let’s take a look at the breakdown of the report. For old crop corn (the 2024-25 crop year) USDA:

- Lowered corn use for ethanol by 35 million bushels.

- Reduced imports by 5 million bushels

- Raised exports by 10 million bushels.

The net result is that old crop ending stocks are now marked at 1.325 billion bushels, up 20 million bushels from the August report.

New crop corn (the 2025-26 crop year) numbers included a few surprising elements. USDA:

- Increased planted acres for corn by an additional 1.4 million acres to 98.7 million acres.

- Raised harvested acres now to 90 million, up 1.3 million acres from last month.

Acknowledging potential pollination issues and complications from Southern rust lurking in fields, USDA did trim yields, but only modestly, as expected. Corn yield is now estimated at 186.7 bushels per acre, down from 188.8 last month.

The combination of higher acres and lower yield overall increased 2025-26 corn production by 72 million bushels, bringing it to an astounding 16.814 billion bushels.

From a marketing perspective

The projected size of the U.S. corn crop has been on an increase since July.

- In July, USDA pegged U.S. corn production at 15.705 billion bushels.

- In August, it raised the production estimate to 16.742 billion bushels.

- The September WASDE again increased production, this time to 16.814 billion bushels.

The good news is demand also increased since July.

- In July, corn total demand was marked at 15.410 billion bushels.

- In August total demand was marked at 15.955 billion bushels

- September’s report brought demand up to a whopping 16.055 billion bushels.

Looking at the specific breakdown on the demand side:

- Total feed and residual use is now projected at 6.1 billion bushels.

- Ethanol use is pegged at 5.6 billion bushels.

- Projected corn exports for the 2025-26 crop came up 100 mb to 2.975 billion bushels.

Ending stocks for the 2025-26 crop are projected at 2.11 billion bushels, down modestly from 2.117 billion in August. If that holds, then U.S. ending stocks still would be the highest in seven years!

And here comes the plot twist. One would suppose that with piles of corn expected at harvest, and record carryout, that the price of corn futures would be well below $4. But it isn’t.

In fact, December 2025 corn futures may have seen an early harvest low back on Aug. 12, the day of the August WASDE report. The price low that day for December 2025 corn futures was $3.92. Prices are now trading near $4.30, despite the bearish carryout printed on paper.

So why the recent price rally? Because the simple truth is that we do not have a clue where corn yield is going to end up until harvest is done. Summer pollination issues, and Southern rust may be taking a toll on yields.

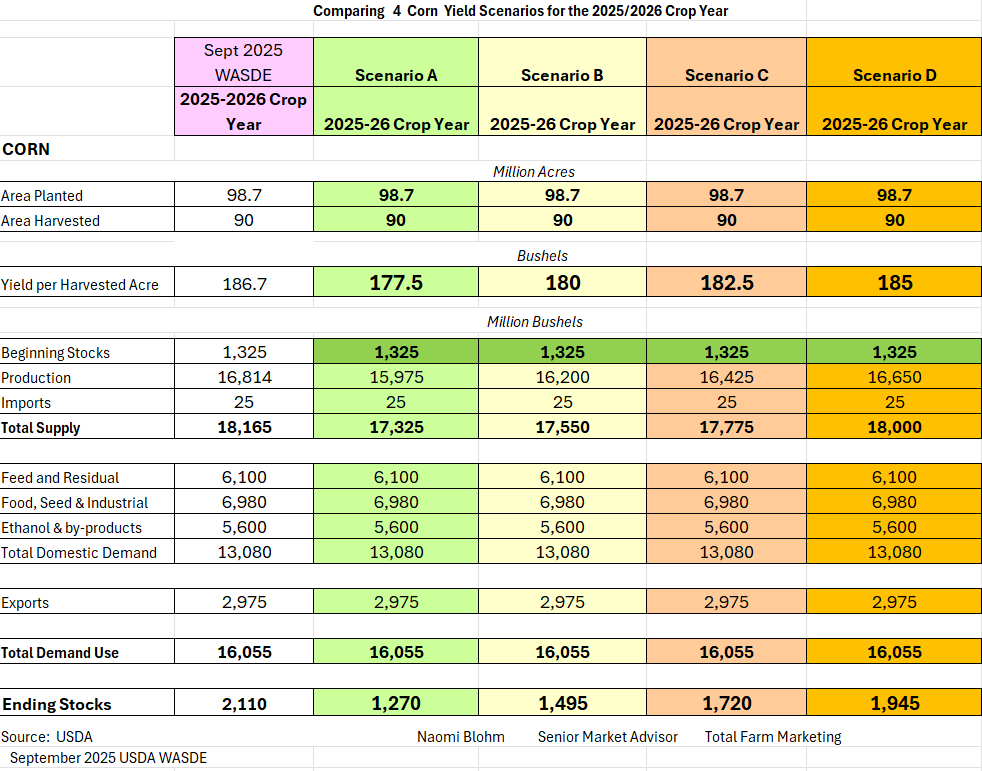

Below is a table that explores four different lower yield scenarios, and how that might affect ending stocks, while using the current demand tables from the September WASDE.

Should yield be perceived to be in the low 180s, that would likely continue to lend to price support. Should yield drop below 180 bushels per acre, that could drastically drop ending stocks and could be a game changer to not only the U.S. balance sheet for corn, but the global balance sheet as well.

The USDA pegged global ending stocks for the 2025-26 crop at 281.4 mmt, down 1.14 mmt from last month. This number has been on a slow decline for the past three years.

Prepare yourself

On paper, it appears the United States has the potential for a record corn crop and record ending stocks, which may keep corn prices from a substantial price rally in the short term.

However, USDA acknowledged the potential yield implications of Southern Rust by lowering yield on the September WASDE.

Based on early harvest results being expressed by clients and farmer chat on social media, the yield potential of this crop could be quite a bit lower than the industry is expecting.

Will the USDA need to further lower yield potential on the October WASDE? Could Southern rust be the “black swan” for the 2025-26 crop year?

Within one month, we will have a better handle on the situation, as farmers begin harvest in earnest. Combines will tell the truth. And this situation must be monitored with the utmost caution and due diligence, as significantly lower yields could dramatically adjust the global balance sheet for corn.

Reach Naomi Blohm at 800-334-9779, on X: @naomiblohm, and at naomi@totalfarmmarketing.com.

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.