Of all the grand beliefs held by American farmers, this one has always stood out: The world, and China in particular, needs American grain.

That may no longer be the case.

Prompted by the Trump trade war launched in 2018 and continued again in his second term, China figured out how to live without our grain. The questions were these: For how long and at what price?

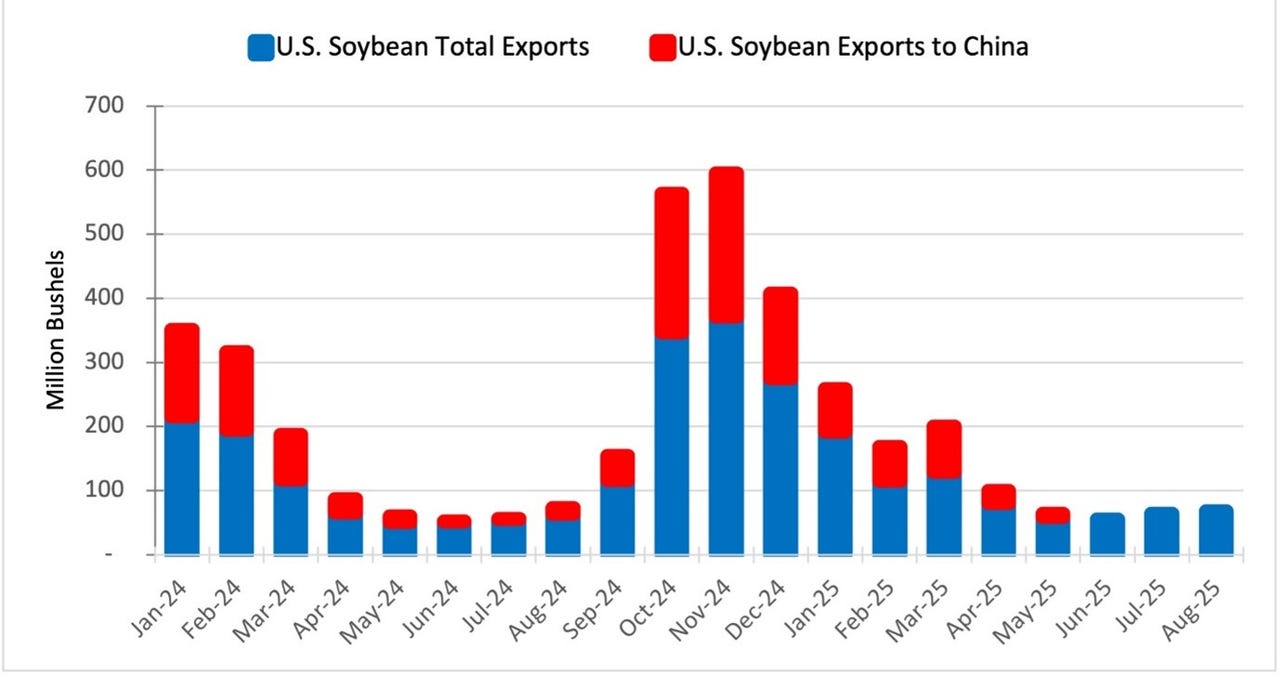

The theory has been that China stockpiled soybeans following the 2024 election in anticipation of the trade war resuming. The unknown is the size of the stockpile, which is critical to understanding how long China could hold out in trade agreement negotiations. For U.S. farmers, the plan was to endure short-term pain for long-term gain.

With China now making a massive soybean purchase from Argentina, adding to significant buys from Brazil and none from the U.S., Iowa farmer Matthew Kruse believes that country’s leaders answered that question: China isn’t relying on its stockpile. It has plenty of sourcing opportunities.

The Argentine deal, Kruse says in an Ag Marketing IQ video, “looks like just another example of China going out of their way to avoid U.S. soybean purchases—or other ag purchases from the United States.”

The painful reality may be that U.S. agriculture becomes the biggest casualty of the trade war. Though Trump is heralding a meeting next month with President Xi, farmers are questioning the tariff strategy and lawmakers are losing hope for a trade deal with China.

With last week’s buy of 7 million metric tons from Argentina—a solid quarter of that country’s soybean and soybean meal production—on top of 12 million bushels from Brazil this calendar year (as of August), chances of China making additional U.S. purchases are falling.

Though that’s concerning for the U.S. economy, there is one notable aspect of how China is buying: When products are on sale.

China made the buy from Argentina in just three days following that country’s move to cut its export tax on soybeans and other agricultural products.

When we look at production cost and commodity grain prices around the world, it’s obvious U.S. farmers aren’t the only ones fighting to make a profit on their production. Kruse points out that China is “waiting in the wings” for those low-price deals.

And that raises a new question: How long can the world continue to cheaply sell ag products to China? That answer could spark new hope.