Soybean futures currently remind me of an episode of “It’s Always Sunny in Philadelphia” in which Charlie is assigned the role of “wildcard” in a scheme to buy gas and sell it at a markup. In the episode, Charlie cuts the transport vehicle brake line (containing all the gas), causing a crash and loss of all of the gas that was purchased with a bank loan.

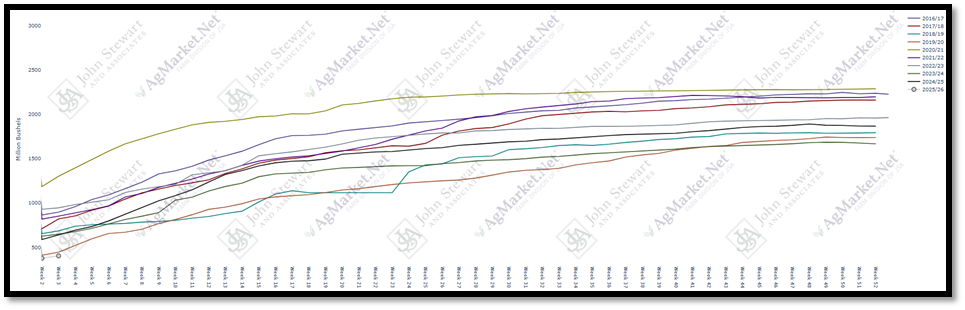

China holds the wildcard for soybeans. Without Chinese business, exports so far have been disappointing.

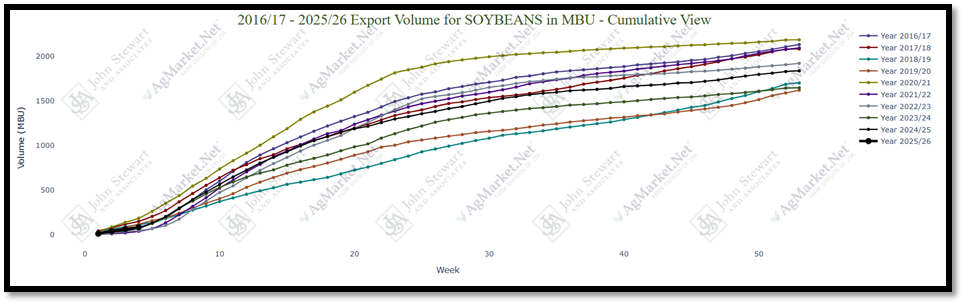

Export inspections for the 2025-26 marketing year are at 82.5 million bushels, a slow pace but still ahead of last year.

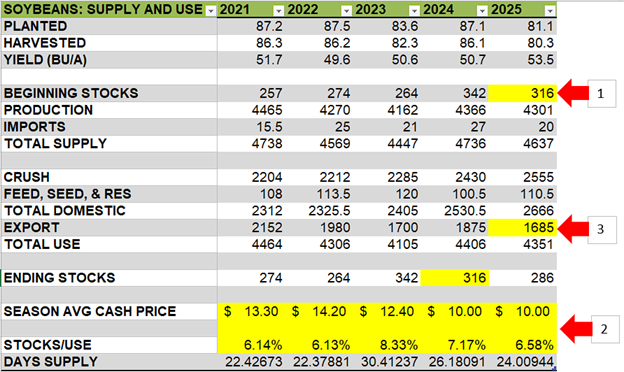

Market key: Stocks-to-use ratio

Currently, stocks-to-use ratio is not high. Prices have been substantially higher in years with greater stocks-to-use ratios (#2 in graph below). However, the export number for the 2025-26 year (#3 in graph below) can change based on China. If China comes in and buys soybeans this export number could increase, leading to tighter stocks. If China can meet its soybean demand with purchases from South America, this export number could drop, leading to a large stocks-to-use and no home for U.S. soybeans.

Will China have no soybean purchases from the United States, in effect cutting the brake line and leading to a U.S. soybean market crash? Or does the line leading from U.S. to China stay intact (somewhat, maybe only for the time being) leading to a supportive market?

To discuss further, please call me directly at 701-401-9600 or give any of the hedging strategists a call at 844-4AG-MRKT. We are here to help.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net® is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through RJO’Brien in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.