The down payment required to purchase a farm is a significant barrier for most producers to overcome, in particular, young and beginning producers. The beginning farmer loans through the USDA are good tools to help overcome this. Many producers look to use these to purchase neighboring farmland. However, they can also be used as a transition tool within families.

Identify goals and priorities

First, you must identify when using these types of programs complement the long-term goals or concerns for a family farm. One of the family farms I recently worked with involved Mom and Dad selling the 160-acre home farm to their son. For Mom and Dad, their priorities were to pay off the remaining debt on equipment while also maintaining the income from the farm to support their living needs.

Their son and his lender were simply trying to figure out how to get him more involved in the operation by buying equipment, leasing land, or perhaps using the beginning farmer loan program to purchase a farm.

Explore FSA beginning farmer loans

FSA has two loan programs that are most readily used.

- In the 5-45-50 program, the young producer provides 5% of the down payment and FSA finances 45% at an interest rate of 1.5%.

- With the 50-50 program, FSA provides 50% of the purchase up to a maximum of $600,000. The interest rate for this option is 2.75% and can be amortized for as long as 40 years. The other 50% typically comes from traditional financing sources, but the seller can also finance it by setting up a private sale contract.

Consider private sale contracts

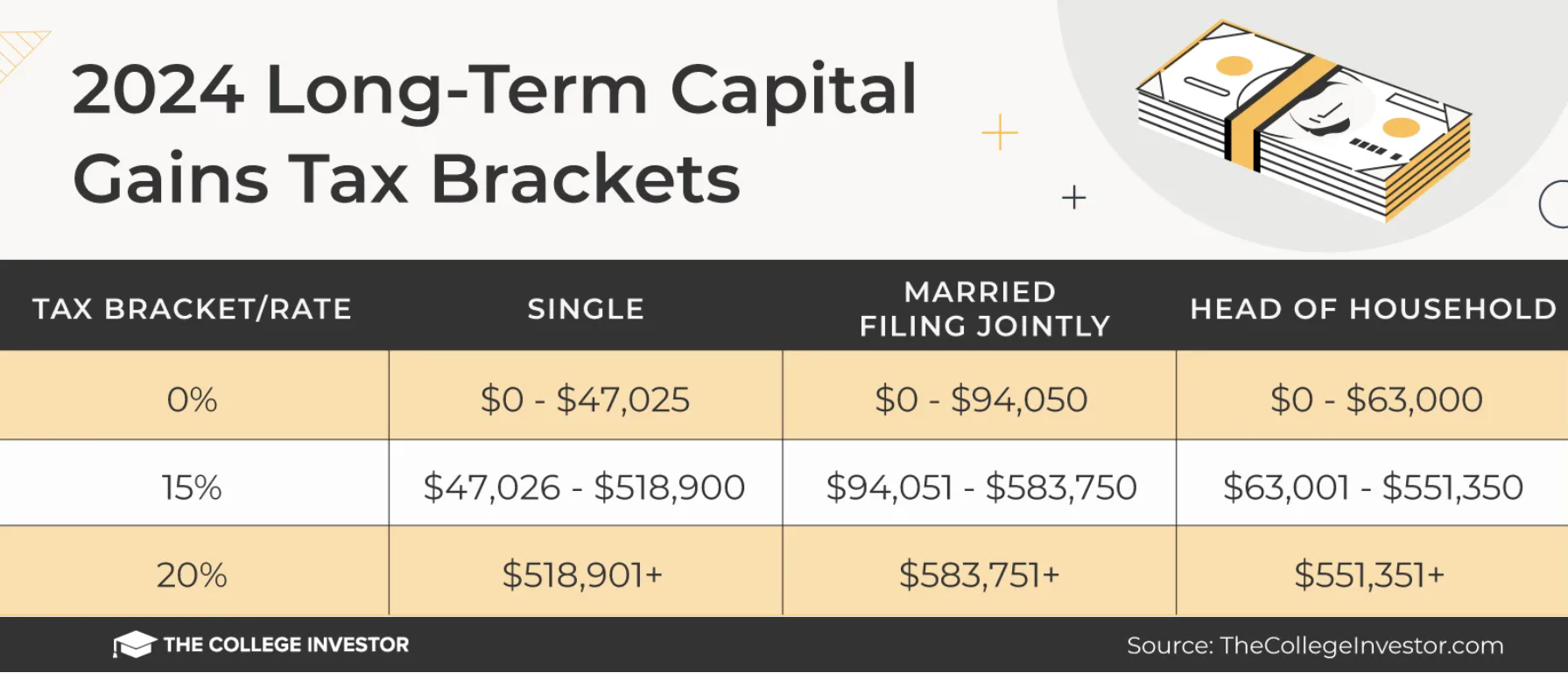

Using a private sale contract gives greater control of the variables of the transaction, a significant one being the purchase price. For this situation, a sale contract will maintain Mom and Dad’s income through the resulting land payments while also allowing them to spread any capital gain over the term of the loan. Capital gain tax rates are preferential over ordinary income. And some people don’t realize the federal capital gain rate is actually zero if you’re filing in the 12% income tax bracket.

Transition 160-acre home farm

Here are how the numbers look for this farm:

One goal was for their son to utilize the full $600,000 available through the FSA beginning farmer loan. Since this represents one-half the purchase using the 50-50 joint financing program, this means the purchase price for the farm will need to be at least $1.2 million, or $7,500 per acre. However, the fair market value of the farm is $12,500 per acre, which initially may cause concern.

In this case, it’s workable. Mom and Dad used part of their lifetime gift exemption to discount the purchase price for the farm, tax free, to a family price they believed to be fair. Let’s call this their “family market value.” This $5,000 per acre discounted sale represents an $800,000 gift, which reduces the $27 million federal gift and death tax exemption available to Mom and Dad when they file a gift tax return.

For their son, this $800,000 of gifted equity shifts to his balance sheet to help him transition into the farm. It also lowers Mom and Dad’s estate subject to future federal and state estate taxes.

The remaining $7,500 per acre purchase price was split between FSA and a sale contract as follows:

- FSA’s portion of $3,750 per acre represents an annual loan cost of $155 per acre when amortized over 40 years at 2.75%. Mom and Dad used the $600,000 cash from FSA to pay off their remaining equipment debt, which was financed at a much higher rate.

- Mom and Dad’s sale contract of $3,750 per acre represents an annual loan payment of $230 per acre when amortized over 30 years at 4.5%. This maintains their income as if they were renting the farm, while also creating better tax treatment with capital gain versus ordinary income.

- The total annual loan cost for their son is $385 per acre, which in today’s farm economics is the closest he may come to purchasing a farm without any down payment, and not subsidizing the annual land payments from other income sources.

Provision for non-farming heirs

In this case, the sale of the home farm also creates certainty for Mom and Dad whose long-term goal is to transfer this farm with the building site to the son who will carry on the operation. Instead of their son waiting for some uncertain day in the future to buy out his siblings, he can start buying the farm now.

As for capital gains, the cost basis for this farm is near $5,000 per acre which is Mom and Dad’s purchase price from Dad’s siblings. This capital gain can be spread over the 30 years of the contract and the resulting capital gain tax per year will likely be half what they were paying before in property taxes. To boot, if they’re in the 12% income tax filing bracket, their capital gain tax rate will be zero.

As one of my mentors has said, sometimes transition planning is more of an art than a science. Instead of always asking the question why would I do that? Consider instead asking: why not?

Downey has been helping farmers and landowners for the last 24 years with their family farm transition, estate planning, leasing strategies, and general farm advising. He is the co-owner of Next Gen Ag Advocates and founder of Farm Raised Capital. Reach Mike at Downey@farmestate.com.