Despite rising prices, the prospect of Prime rib for New Year’s Eve dinner continues to appeal to consumers.

Seasonal price increases point to wholesale ribeye prices increasing by 29.9% from the beginning of October through November. By late November, ribeye prices pushed 13.4% higher compared to last year.

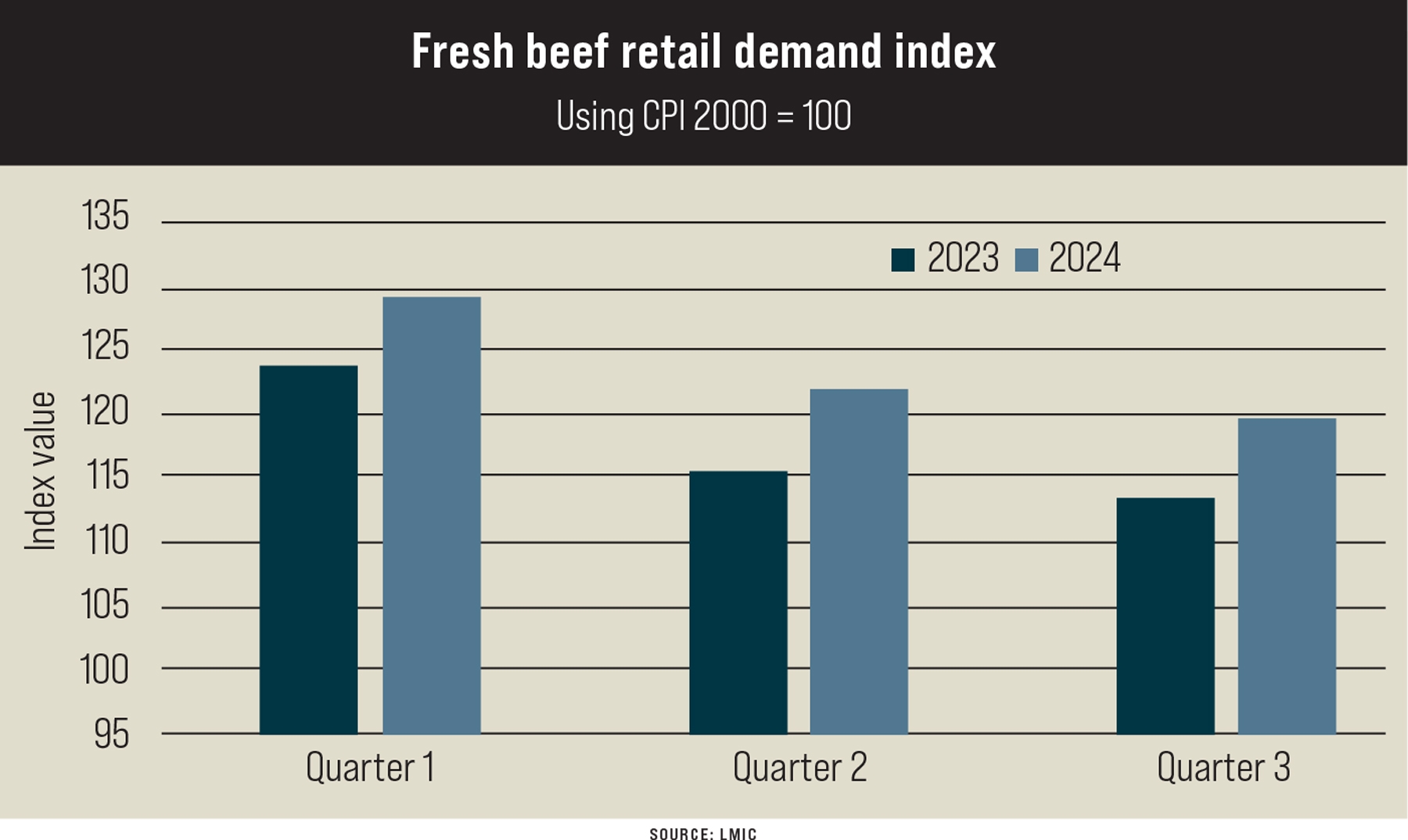

Even with higher costs to consumers, the beef demand index calculated by the Livestock Marketing Information Center confirms that retail beef demand has been stronger year over year in each of the first three quarters of 2024 (see figure).

Shift in consumer eating habits

For much of 2024, the strength in beef demand has been mostly in the end meats rather than the middle meats.

In fact, for the first 47 weeks of the year, the average price of rib and loin primals has been slightly lower year over year, with ribs down 1.4% and loins down 0.6%, while the price of the chuck primal has been higher by 7.4%, and the round primal has been higher by 8.4%.

However, since the middle of October, the price of all the primals has been higher compared to the same time last year.

Choice boxed beef prices have averaged 2.7% higher for the year to date but have been 4.3% higher year over year in November. Higher boxed beef prices have coincided with a 2.2% increase in fed beef production thus far in 2024, which indicates demand is strong.

The value of lean cuts of the carcass, especially from the round, has been supported this year by strong demand from the ground beef market.

Non-fed beef production, from cull cows and bulls, is down 13% year over year through mid-November. This is the result of a sharp year-over-year decrease in cow slaughter, with dairy cow slaughter down 13.1% and beef cow slaughter down 17.9%, as well as bull slaughter down 8.3% compared to last year.

As a result, demand for lean from fed carcasses has been stronger in 2024.

Increased lean demand is also a major driver of increased beef imports, up 21.1% year over year through September.

Total beef production through mid-November was down 0.5% from one year ago, but it is expected to be about equal to 2023 by the end of the year.

Cattle prices finish year strong

Feeder cattle prices increased in November, led by a sharp jump in calf prices and stronger feeder cattle prices.

National auction volumes in October were 6.3% higher year over year due, in part, to worsening drought conditions. In Oklahoma, for example, combined auction volumes in October were up 45.2% from one year ago but were down by 35.6.% in the first half of November.

Improved drought conditions and strong feedlot demand, combined with tight feeder supplies, are pushing feeder prices up in the fourth quarter.

Dry conditions in October contributed to increased feedlot placements, up 5.3% year over year in the November Cattle on Feed report.

October feedlot marketings were up 4.7% over last year, but one extra business day this year makes the daily average marketings equal to one year ago. Nov. 1 feedlot inventories were equal to last year. On average, feedlots have kept feedlot inventories steady with year-earlier levels each of the past 14 months.

Feedlot placements are likely to decrease more in the coming months as tighter feeder supplies become more apparent. At some point, heifer retention is expected to begin, which will squeeze feeder supplies significantly more.