Ever feel like a bobblehead when looking at corn and soybean prices? Maybe a punching bag, or merely a pawn?

Trying to figure out the grain market is difficult in the best of times. But headed into spring 2025, the smoke and mirrors are especially confusing. From Trump tariffs to artificial intelligence, motivations for moves vary by the day, if not the minute.

Only one common denominator cuts through the noise from soybeans and stocks to corn and crude oil: China. China’s fingerprints seem to be everywhere.

Soybeans, of course, are vulnerable to tariff news emanating from Washington or Beijing. But what penalties is China responding to? 10%? 25%? Or more – or less? And are U.S. tariffs aimed at stemming the flow of drugs into the U.S.? Or immigrants? Or steel, aluminum or cars?

How about money? Are China and other U.S. trading partners, like Japan, using their currencies as foot soldiers in this trade war?

Even the time-tested meme of Good Cop/Bad Cop is impossible to decipher without a scorecard. Is China the Good Cop, promoting stability and peace, while the U.S. runs roughshod over the existing world order by promoting friction with Europe over Ukraine? Is Washington in cahoots with Moscow? Or maybe even working secretly with China to promote a new superpower axis at the expense of Western democracies?

And some of the loudest noise comes from bully pulpits: The People’s Congress in China, a joint session of Congress in Washington and meetings of central bankers and leaders in Europe. Here are some of the recently emerged “facts” for traders to decipher.

China likes soybeans

China bought 12% more soybeans last week than the previous year but has taken 6.6% fewer soybeans out of the U.S. for all of the 2024-25 marketing year than a year ago. So, China is buying lots of beans – just not from the U.S.

According to Chinese customs data, imports from all sources rose nearly 14% in the first half of the 2024-25 marketing year, with January-February deliveries up around 4.3%.

China was already pivoting to South America for supplies before the latest dust-up, a shift that seems likely to continue, at least in the official rhetoric. Beijing suspended import licenses of three U.S. companies and added additional tariffs of 10% on new deals.

Still, don’t toss in the towel yet. Despite slowing Chinese demand out of the U.S., total exports still could wind up around 50 million bushels more than USDA currently estimates for the marketing year. That could keep the projected supply of soybeans leftover on Sept. 1, 2025, low enough to promote rallies to the top of the nearby’s trading range over the past two years. After testing $10 last week, such a scenario eventually could bring a return back toward $15 if buyers get spooked, say on weather this summer.

Investors want dollars

Confusing, and possibly contradictory, data gave bulls and bears reason for hope – or fear. Take your pick.

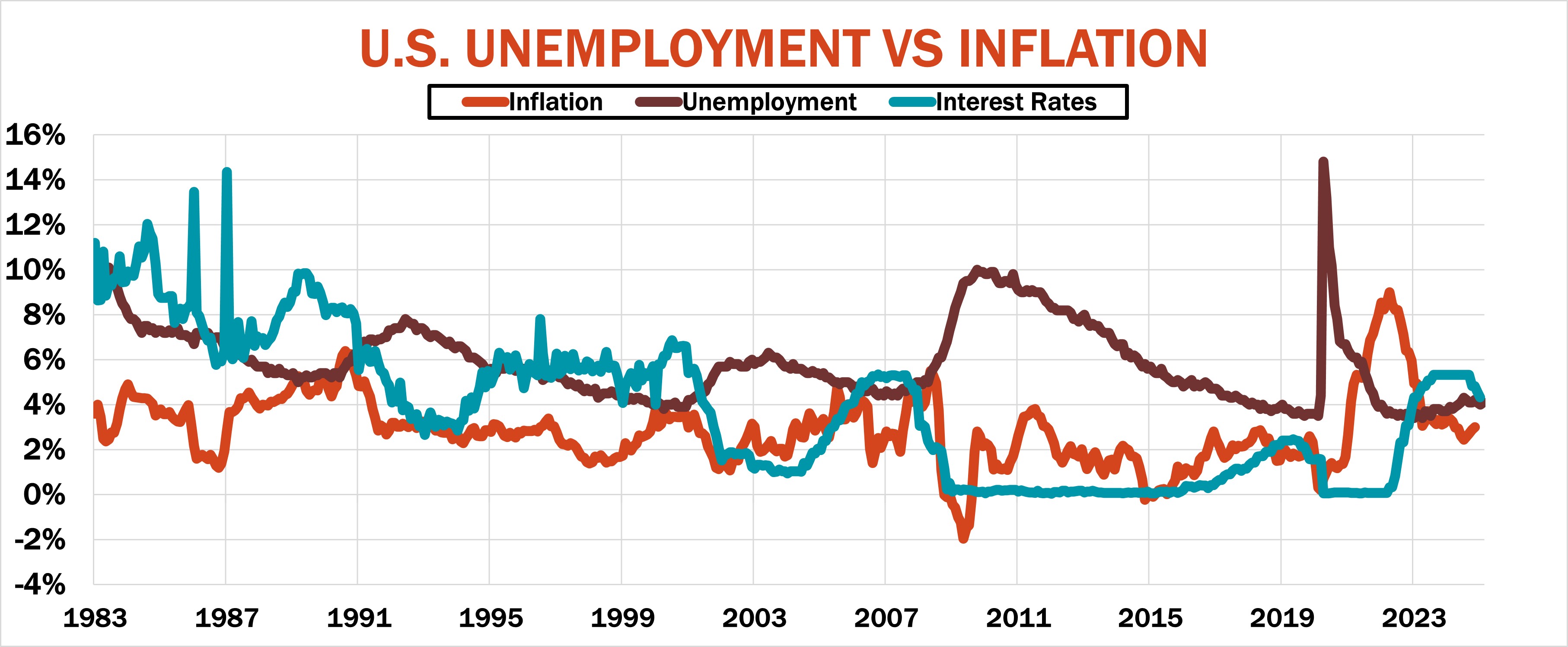

Friday’s jobs report, always an inflection point, sowed the seeds for both. The economy continues to create jobs, but the unemployment rate ticked higher to 4.1% as laid-off workers took longer to find new positions. It’s hard to look at an economy growing at a 5% clip as one beset by “stagflation”, though fears of tariff-fueled inflation remain alive and well.

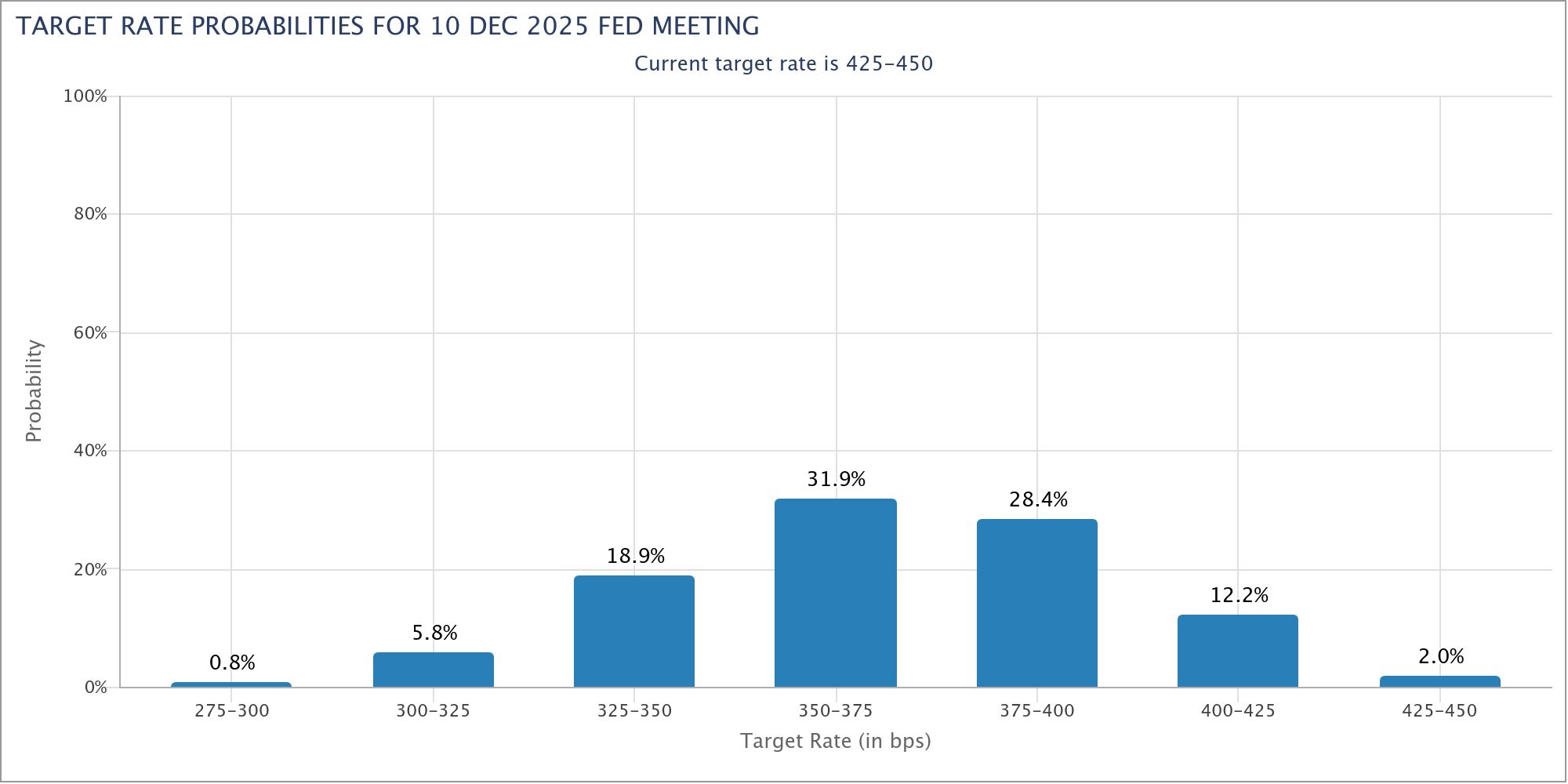

Growth, not inflation, took center stage at central bank meetings. The European Central Bank cut its benchmark interest rate while the Bank of Japan moved in the other direction. Next up is the Federal Reserve, which holds a two-day meeting on monetary policy March 18-19. Those betting on Federal Funds futures don’t see another cut from the Fed coming until June, though three cuts of ¼ of 1% are possible in the second half of the year.

Lower interest rates in a country tend to weaken the value of its underlying currency because investors don’t earn as much from risk-free accounts. The dollar index sank to its lowest reading of the year but held after giving back more than 60% of its rally from fall 2024 lows.

Gold benefits from greenback weakness, but the precious metal may be running out of steam as a safe haven as it nears $3,000 an ounce. Remember when the Hunt Brothers tried to corner the silver market back in the 1970s? Gold was only $200 an ounce back then!