USDA surprised the market by leaving its 2025 corn and soybean harvest estimates for Argentina and Brazil unchanged in its monthly Supply and Demand report today and it also hiked its outlook for U.S. and global wheat stockpiles more than expected.

But USDA’s report as a whole generated only limited market impact, with grain traders shrugging off the data as they monitored global trade tensions and looked ahead to critical acreage forecasts at the end of this month.

“Today’s USDA report was about as expected with very few changes from the previous month,” said Naomi Blohm, Senior Market Advisor at Total Farm Marketing. “This is largely a routine practice for this month, as the USDA tends to wait for the March 31 quarterly Grain Stocks report before making substantial demand adjustments.”

Corn and soybean futures sustained earlier price gains following the USDA report, while wheat futures briefly dropped to a new intraday low after stocks estimates surpassed forecasts. In late trading, May corn rose 1 cent to $4.73 per bushel, May soybeans rose 1 cent to $10.15 and May Chicago wheat fell 3 cents to $5.5950.

The following are brief summaries from today’s USDA Supply and Demand report:

Corn

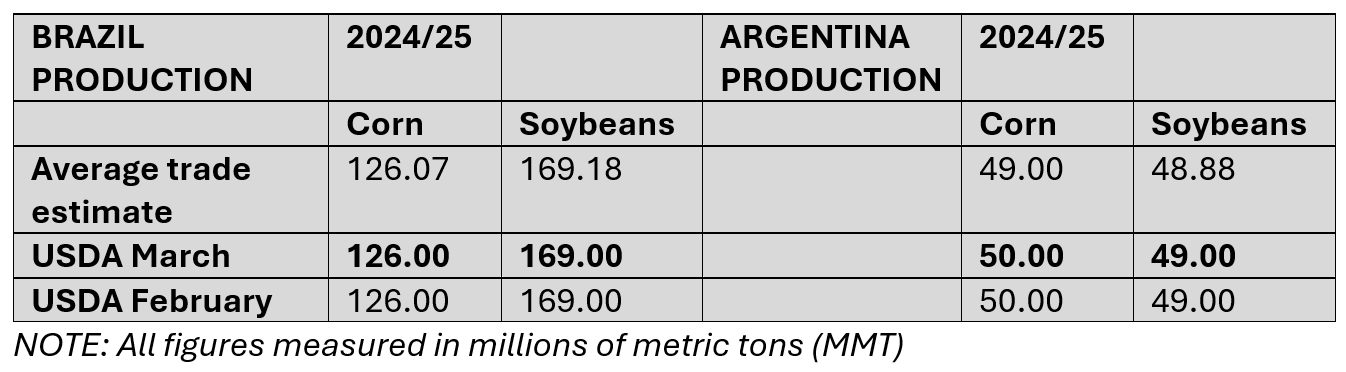

USDA kept its Argentina and Brazil corn production forecasts unchanged at 50 million metric tons (1.97 billion bushels) and 126 MMT (4.96 billion bushels), respectively. Argentina’s crop outlook was expected to shrink about 2% after drought stressed top growing areas earlier this year. Brazil’s crop estimate was expected to increase slightly.

However, USDA did lower its forecast for Brazil’s 2024/25 corn exports by 4.3%, to 44 MMT, reflecting reduced demand from China. USDA now pegs China’s corn imports for the year at 8 MMT, down from 10 MMT in a previous forecast and the smallest in five years. China’s estimated 2024/25 imports would be down 66% from 2023/24.

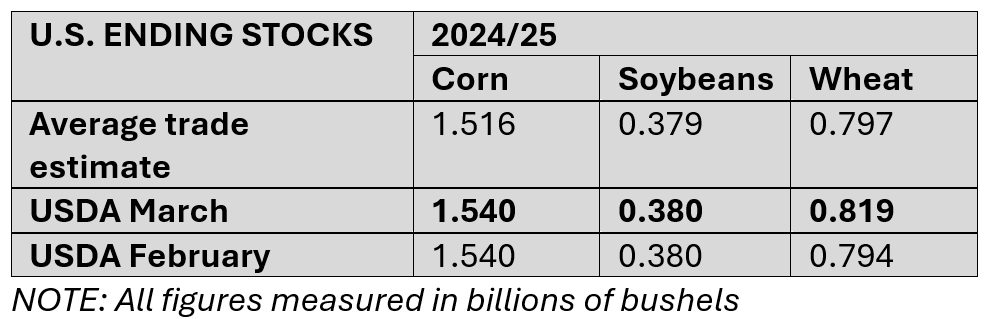

U.S. balance sheet numbers for corn were a mild disappointment for market bulls after USDA left its 2024/25 ending stocks projection unchanged at 1.54 billion bushels, contrary to expectations for a cut of about 24 million bushels. Major demand categories were unchanged, with estimated exports kept at 2.45 billion bushels. The average farm price was steady at $4.35.

Soybeans

USDA kept its forecast for Brazil’s 2025 soybean harvest unchanged at a record 169 MMT (6.21 billion bushels), contrary to analysts’ expectations for a slight increase to about 169.2 MMT.

Argentina’s estimated soybean crop was held at 49 MMT (1.8 billion bushels). Analysts expected a cut of about 0.2% based on beliefs drought in some of the country’s key growing areas may have curbed yields.

“It’s interesting that USDA made no changes to production numbers for Brazil or Argentina,” Blohm said. “Yet, this was not a total surprise, as USDA may wait for additional harvest results before making any larger adjustments. Larger global production adjustments will likely show up on the April report instead.”

USDA has kept its Brazil estimate at 169 MMT since at least September, even as several private consultants released forecasts around 170 MMT or higher. Brazil’s harvest would be up nearly 11% from 2024 if its crop comes in around the USDA forecast.

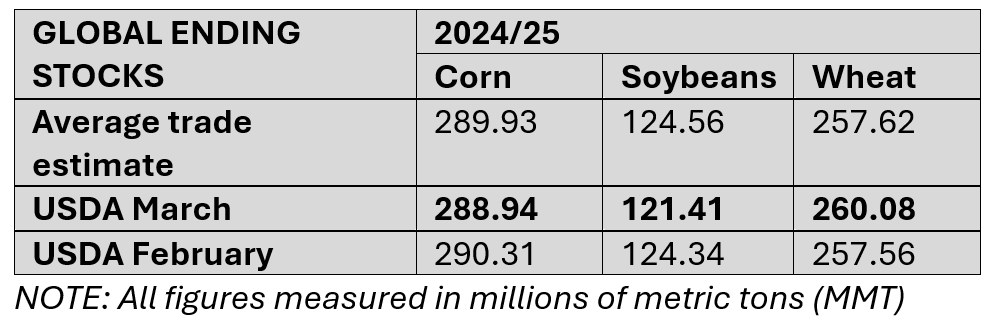

Projected global soybean stocks at the end of the 2024/25 marketing year were cut 2.4% to 121.41 MMT, contrary to expectations for a slight increase but still up almost 8% from 2023/24.

Blohm attributed the stocks reduction to a slight decline in global export demand and an increase in crushing in Argentina and China, which led USDA to hike its global crushing total by just under 1% to 352.84 MMT. The lower soybean stocks figure was “not a market mover, as it’s still a record global carryout,” Blohm said.

USDA largely left the U.S. balance sheet unchanged, with 2024/25 exports and ending stocks held at 1.825 billion bushels and 380 million bushels, respectively. However, USDA lowered its forecast average farm price to $9.95 from $10.10.

Wheat

Wheat futures briefly eroded after USDA said it expected global supplies at the end of 2024/25 to be about 1% higher than previously forecast. USDA pegged ending wheat stockpiles at 260.08 MMT (9.56 billion bushels), up from 257.56 MMT in its February report. Analysts expected only a slight increase.

The higher stocks outlook reflects stronger harvest prospects for Argentina, Australia and Ukraine. Global wheat stocks would still shrink to a 10-year low, based on USDA’s latest forecast.

USDA’s adjustments to the U.S. balance sheet also leaned bearish.

U.S. wheat stockpiles at the end of 2024/25 will reach an estimated 819 million bushels, up from 794 million bushels in a previous forecast, up 18% from 2023/24 and a four-year high. Stocks were expected to be raised by only about 3 million bushels.

USDA also lowered 2024/25 exports by 15 million bushels to 835 million bushels and trimmed the average estimated farm price by 5 cents to $5.50.