By Hallie Gu

More than 30 cargoes of U.S. soybeans are bound for China, with almost half expected to arrive after Beijing’s retaliatory tariffs on American farm goods come into effect next month, according to shipping data.

Although the eventual destination of the cargoes could change, most were booked by the state stockpiler Sinograin and are likely to be exempt from the tariffs, said people familiar with the matter, who asked not to be named discussing a sensitive matter.

A fax sent to Sinograin seeking comment didn’t get a response.

The government has imposed a 10% duty on U.S. soybeans, along with levies on a raft of other agricultural products, in its latest response to Washington’s blanket tariffs on Chinese exports. The duty began on March 10, although cargoes shipped before then that land in China by April 12 won’t be affected.

The shipments en route would account for about 2 million tons, according to the data from Kpler, an analytics firm. As of March 6, the U.S. had about 1.36 million tons of outstanding sales to China, the U.S. Department of Agriculture said in its latest assessment.

The market will be looking for evidence — such as cancellations — that U.S. shipments to China have become uneconomical because of the extra cost.

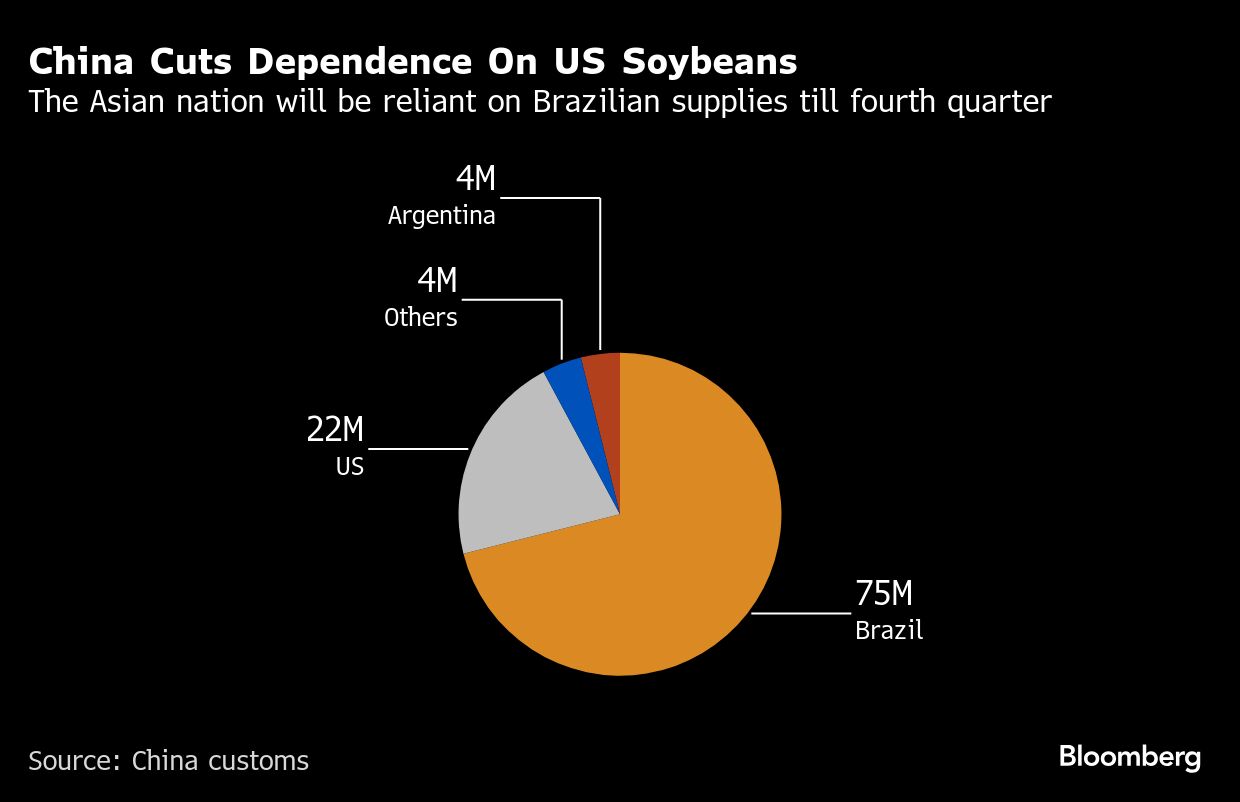

China imported 105 million tons of soybeans in 2024, mostly to feed livestock. The U.S. accounted for about one fifth, a proportion that has shrunk in recent years after Beijing turned to other suppliers like Brazil in the wake of the trade war with the first Trump administration.

“The U.S. is more dependent on Chinese demand than China is on American supply,” said Ishan Bhanu, Kpler’s lead agricultural commodities analyst.

This is also the time of year when American soybean sales are winding down. The impact of the tariffs will be more pronounced if they last until the U.S. export season begins anew in the fourth quarter of the year.

“We are not expecting the trade war to be as drawn out as the first time around, but for now both sides are not budging,” said Richard Buttenshaw, grains analyst at Marex Group.

© 2025 Bloomberg L.P.